The first electric vehicle (EV) tax credit in the United States was introduced in 2009 as part of the American Recovery and Reinvestment Act. This legislation aimed to stimulate the economy and promote the adoption of cleaner, more efficient transportation options. The tax credit provided a significant financial incentive for consumers to purchase electric vehicles, helping to accelerate the growth of the EV market in the country. This initial credit played a crucial role in the development of the EV industry in the US, encouraging manufacturers to invest in electric vehicle technology and contributing to the country's transition towards a more sustainable transportation future.

| Characteristics | Values |

|---|---|

| Introduction of the Tax Credit | The first electric vehicle (EV) tax credit in the United States was introduced in 2009 as part of the American Recovery and Reinvestment Act (ARRA). |

| Initial Amount | The initial tax credit was $7,500 per qualified EV. |

| Eligibility Criteria | To qualify, the vehicle must have a battery capacity of at least 4 kWh and be manufactured in the United States or in a country with a free trade agreement with the US. |

| Sunset Clause | The tax credit was initially set to expire after 200,000 credits were claimed, but this limit was increased to 200,000 vehicles in 2015. |

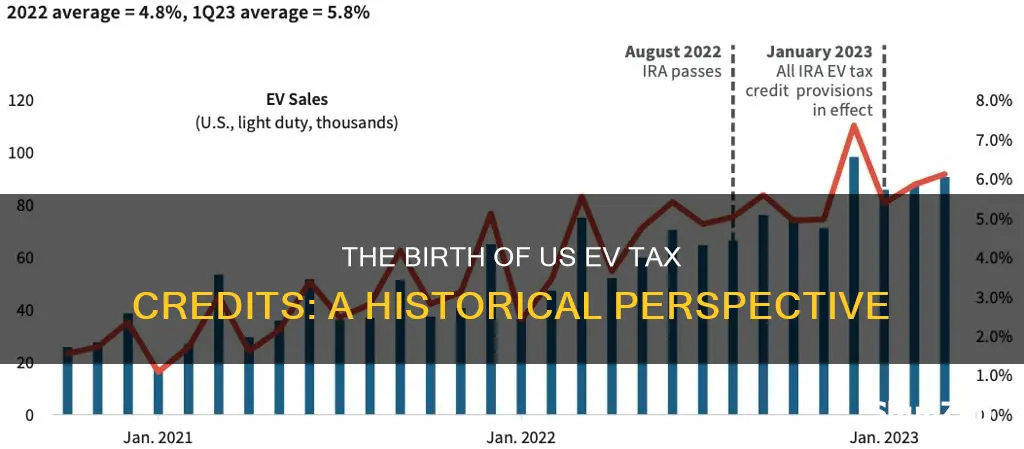

| Recent Changes | In 2022, the tax credit was extended and expanded as part of the Inflation Reduction Act (IRA). The new credit is $7,500 for vehicles with a battery capacity of at least 4 kWh, and up to $4,500 for vehicles with a battery capacity of at least 5 kWh. |

| Phase-Out | The credit is phased out for vehicles with a manufacturer's suggested retail price (MSRP) above $80,000 for individuals and $100,000 for joint filers. |

| Effective Dates | The 2022 changes took effect on January 1, 2023, and the previous credit structure is no longer available. |

What You'll Learn

- Historical Context: The first electric vehicle tax credit in the US was introduced in 2009 as part of the American Recovery and Reinvestment Act

- Initial Amount: The initial tax credit was $7,500 per vehicle, later increased to $10,000 in 2010

- Eligibility Criteria: Tax credits were available for new electric vehicles purchased after December 19, 2009

- Sunset Clause: The credit expired in 2017, but was temporarily revived in 2022 due to supply chain issues

- Impact: The tax credit significantly boosted the electric vehicle market, leading to increased sales and reduced environmental impact

Historical Context: The first electric vehicle tax credit in the US was introduced in 2009 as part of the American Recovery and Reinvestment Act

The introduction of the first electric vehicle (EV) tax credit in the United States marked a significant milestone in the country's efforts to promote sustainable transportation and reduce its carbon footprint. This pivotal moment occurred in 2009 when the American Recovery and Reinvestment Act was enacted, a comprehensive economic stimulus bill aimed at revitalizing the nation's economy during the global financial crisis.

The historical context of this tax credit is rooted in the growing environmental concerns and the recognition of the potential of electric vehicles as a cleaner and more efficient alternative to traditional internal combustion engines. As the world grappled with the impacts of climate change, policymakers sought to incentivize the adoption of electric cars to reduce greenhouse gas emissions and promote energy independence.

The 2009 Act included a provision that offered a tax credit of up to $7,500 for the purchase of qualified electric vehicles. This credit was designed to encourage consumers to make the switch from conventional gasoline-powered cars to electric ones. By providing a financial incentive, the government aimed to accelerate the market adoption of EVs, stimulate economic growth, and foster innovation in the automotive industry.

This initiative was a response to the increasing awareness of the environmental benefits of electric vehicles, including reduced air pollution and lower carbon emissions. The tax credit not only made EVs more affordable but also signaled a commitment to a greener future. It played a crucial role in attracting attention to the emerging EV market and encouraging manufacturers to invest in electric car technology.

The historical significance of this tax credit lies in its ability to catalyze the growth of the electric vehicle industry in the US. It sparked a wave of interest and investment, leading to the development of new EV models, improved battery technologies, and the establishment of charging infrastructure. This initial push ultimately contributed to the country's growing reputation as a leader in the global transition to sustainable transportation.

Exploring the Range of Electric Conveyance Vehicle Sizes

You may want to see also

Initial Amount: The initial tax credit was $7,500 per vehicle, later increased to $10,000 in 2010

The first electric vehicle (EV) tax credit in the United States was introduced as part of the Energy Policy Act of 2005, which aimed to promote the production and use of alternative fuel vehicles. This initial credit was a significant step towards encouraging consumers to adopt electric cars and reduce their carbon footprint.

Under this legislation, the Internal Revenue Service (IRS) offered a tax credit of $7,500 per qualified electric vehicle. This credit was designed to be a one-time benefit for individual taxpayers who purchased or leased a new electric car. The purpose was to make electric vehicles more affordable and attractive to consumers, especially during the early stages of the EV market's development.

The $7,500 credit was a substantial amount at the time, providing a significant financial incentive for buyers. It helped offset the higher upfront costs associated with electric vehicles, which were often more expensive than their gasoline-powered counterparts. This initial credit played a crucial role in generating interest and demand for electric cars, especially among environmentally conscious consumers.

In 2010, the tax credit amount was increased to $10,000, further boosting the appeal of electric vehicles. This increase was part of a broader effort to accelerate the transition to cleaner transportation options. The higher credit amount allowed consumers to save even more on their vehicle purchases, making electric cars more accessible and competitive in the market.

This tax credit program had a positive impact on the EV market, leading to increased sales and a growing number of electric vehicle owners. It encouraged manufacturers to invest in EV technology and infrastructure, ultimately contributing to the advancement of sustainable transportation. The initial $7,500 credit, followed by the increased $10,000 credit, played a vital role in shaping the early days of the electric vehicle industry in the United States.

Unveiling Electro-Hydraulic Power: The Heart of Modern Vehicle Systems

You may want to see also

Eligibility Criteria: Tax credits were available for new electric vehicles purchased after December 19, 2009

The first electric vehicle (EV) tax credit in the United States was introduced as part of the Energy Policy Act of 2005. However, the eligibility criteria for this credit were quite specific and limited. The credit was initially set at $4,000 per qualified electric vehicle and was available for vehicles purchased after December 19, 2009. This date is crucial as it marks the beginning of the period during which EV buyers could take advantage of this financial incentive.

To be eligible for the tax credit, the vehicle had to meet certain requirements. Firstly, it needed to be a new electric vehicle, meaning it was not a used car or a pre-owned vehicle. Secondly, the vehicle had to be purchased from a dealership or manufacturer that offered the credit. This ensured that the credit was directly tied to the sale of new EVs. Additionally, the vehicle had to be equipped with a qualified battery or fuel cell that powered the vehicle and was designed to be used primarily as a passenger car or light-duty truck.

The tax credit was designed to encourage the adoption of electric vehicles and reduce the environmental impact of the transportation sector. By providing a financial incentive, the government aimed to make EVs more affordable and attractive to consumers. This credit played a significant role in the early stages of the EV market, helping to establish a consumer base for electric vehicles.

It's important to note that the eligibility criteria also included restrictions on the vehicle's manufacturer and the location of the purchase. The vehicle had to be manufactured in the United States or in a country that has a free trade agreement with the US. Furthermore, the purchase had to be made from a dealership or manufacturer that participated in the tax credit program. These criteria ensured that the credit was directed towards supporting domestic EV production and sales.

In summary, the first electric vehicle tax credit in the US was available for new EVs purchased after December 19, 2009, and met specific eligibility requirements. This credit was a significant step in promoting the use of electric vehicles and shaping the early EV market in the United States. Understanding these criteria is essential for anyone interested in the historical context of EV incentives and their impact on the automotive industry.

Electric Vehicles: Unlocking the True Cost of Green Driving

You may want to see also

Sunset Clause: The credit expired in 2017, but was temporarily revived in 2022 due to supply chain issues

The concept of a tax credit for electric vehicles (EVs) in the United States has a fascinating history, with one of its key milestones being the sunset clause. This clause, a common feature in legislation, refers to the automatic expiration of a provision unless explicitly extended. In the context of the EV tax credit, the sunset clause meant that the credit would remain in effect until it was specifically repealed or extended by Congress.

The initial electric vehicle tax credit was introduced as part of the Energy Policy Act of 2005. This act provided a tax credit of up to $10,000 for the purchase or lease of qualified plug-in electric vehicles. This credit was designed to encourage the adoption of EVs and reduce the environmental impact of the transportation sector. The credit was a significant incentive for consumers, as it directly reduced the cost of purchasing these vehicles, making them more affordable and attractive to potential buyers.

However, the credit had a sunset clause, which meant it would expire unless Congress acted to extend it. This clause was a strategic move to ensure that the government's support for EV adoption was not indefinite, allowing for a gradual phase-out as the market matured. The credit expired on December 31, 2017, which led to a significant drop in EV sales as the incentive was no longer available. This event highlighted the importance of long-term policy planning in the automotive industry.

In 2022, the electric vehicle tax credit experienced a surprising revival. The Inflation Reduction Act (IRA) reintroduced the credit, but with a twist. The IRA extended the credit and made it more generous, offering a credit of up to $7,500 for new purchases and up to $4,500 for used vehicles. This revival was primarily due to the global supply chain issues that had disrupted the EV market. The credit was temporarily revived to address the challenges faced by consumers in purchasing EVs, ensuring a more stable market and continued support for sustainable transportation.

The sunset clause, in this context, played a crucial role in demonstrating the dynamic nature of government incentives. It allowed for a temporary extension to address immediate market concerns, showcasing the flexibility of policy-making in response to real-world challenges. This approach has the potential to significantly impact the EV industry and accelerate the transition to more sustainable transportation methods.

India's Electric Revolution: Are We Ready for the EV Shift?

You may want to see also

Impact: The tax credit significantly boosted the electric vehicle market, leading to increased sales and reduced environmental impact

The introduction of the federal tax credit for electric vehicles (EVs) in the United States has had a profound impact on the automotive industry and the environment. This incentive, which has been in place since 2009, has played a pivotal role in accelerating the adoption of electric cars and reducing the environmental footprint of the transportation sector.

One of the most significant impacts of this tax credit is the boost it provided to the electric vehicle market. By offering a substantial tax credit of up to $7,500 per vehicle, the government incentivized consumers to make the switch from traditional gasoline-powered cars to electric alternatives. This financial incentive made electric vehicles more affordable and attractive to a broader range of buyers, leading to a surge in sales. As a result, the market for EVs experienced rapid growth, with numerous manufacturers expanding their electric car lineups to meet the rising demand. This shift in consumer behavior has not only benefited the automotive industry but has also encouraged innovation and investment in EV technology.

The increased sales of electric vehicles have had a direct and positive environmental impact. With more EVs on the road, there has been a noticeable reduction in greenhouse gas emissions and air pollutants. Electric cars produce zero tailpipe emissions, which means they do not contribute to smog formation or air pollution, especially in densely populated urban areas. This shift towards cleaner transportation has helped cities improve air quality, benefiting public health and reducing the environmental impact of urban transportation.

Furthermore, the tax credit has contributed to a more sustainable future by promoting the development of a robust EV charging infrastructure. As the demand for electric vehicles grew, so did the need for convenient and accessible charging stations. This led to significant investments in charging networks, ensuring that EV owners have the necessary infrastructure to support their vehicles. The expansion of charging infrastructure not only makes electric vehicle ownership more convenient but also encourages more people to consider making the switch.

In summary, the federal tax credit for electric vehicles has been a powerful catalyst for change. It has not only boosted the electric vehicle market and sales but has also played a crucial role in reducing the environmental impact of transportation. By making electric cars more affordable and desirable, the credit has contributed to a cleaner, greener future, where sustainable mobility is within reach for a growing number of consumers. This success story highlights the potential for government incentives to drive positive environmental change and shape the future of the automotive industry.

Debunking Myths: Are Electric Vehicles' Range Claims Reliable?

You may want to see also

Frequently asked questions

The first electric vehicle tax credit was introduced in 2009 as part of the American Recovery and Reinvestment Act (ARRA). This act provided a tax credit of up to $7,500 for the purchase of new electric vehicles, with certain income limits applied.

The 2009 tax credit had income thresholds, limiting eligibility to individuals with adjusted gross income (AGI) of $200,000 or less for single filers and $400,000 or less for joint filers. These limits were adjusted in subsequent years, but the initial credit was available to a wide range of taxpayers.

The 2009 tax credit played a significant role in boosting the electric vehicle market in the US. It encouraged consumers to purchase electric cars, leading to increased sales and the introduction of more electric vehicle models. This credit helped establish the market and promote the adoption of electric mobility.

Yes, the tax credit has undergone several modifications over the years. In 2015, the credit was extended and expanded, increasing the maximum credit to $7,500 and making it available for a broader range of vehicles. However, the credit has also faced expiration concerns, and there have been discussions about its future.

The current electric vehicle tax credit in the US is part of the Inflation Reduction Act (IRA) of 2022. This act provides a tax credit of up to $7,500 for new electric vehicles, with certain requirements and limitations. The credit is available for vehicles purchased after November 16, 2021, and there are specific guidelines for vehicle pricing and manufacturer requirements.