Electric vehicles (EVs) have gained significant popularity in recent years due to their environmental benefits and technological advancements. As the world shifts towards more sustainable transportation, many individuals are considering making the switch to EVs. However, before making this decision, it's essential to understand the financial implications, including tax benefits. This paragraph aims to explore the question: Are electric vehicles tax-free? It will delve into the various tax incentives and regulations surrounding EVs, providing valuable insights for those interested in the financial aspects of this emerging technology.

What You'll Learn

- Environmental Benefits: EVs reduce emissions, leading to potential tax incentives

- Purchase Tax Exemption: Many countries offer tax breaks for EV buyers

- Fuel Tax Savings: EVs don't pay fuel taxes, a significant long-term benefit

- Maintenance Tax Relief: Reduced maintenance costs may be tax-deductible

- Resale Tax Advantages: Selling EVs can result in lower tax liabilities

Environmental Benefits: EVs reduce emissions, leading to potential tax incentives

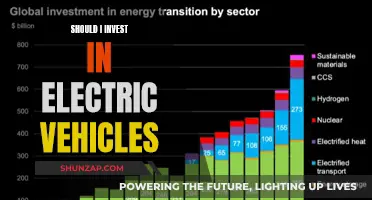

The environmental advantages of electric vehicles (EVs) are well-documented, and these benefits have significant implications for potential tax incentives. One of the most significant advantages of EVs is their ability to reduce emissions, which is a critical factor in combating climate change and improving air quality.

Internal combustion engines in traditional vehicles emit a range of pollutants, including carbon dioxide (CO2), nitrogen oxides (NOx), and particulate matter (PM). These emissions contribute to global warming, smog formation, and various health issues. In contrast, EVs produce zero tailpipe emissions, meaning they do not release harmful pollutants during operation. This is a crucial step towards a cleaner and healthier environment.

The reduction in emissions from EVs is particularly notable in urban areas, where traffic congestion and pollution levels are often at their highest. By adopting electric mobility, cities can significantly improve air quality, leading to better public health outcomes. Studies have shown that the widespread use of EVs can result in substantial reductions in ground-level ozone and fine particulate matter, which are major components of smog and linked to respiratory and cardiovascular diseases.

The environmental benefits of EVs extend beyond the immediate reduction in local emissions. The process of manufacturing and charging EVs also has a lower environmental impact compared to traditional vehicles. The production of EVs often involves fewer and less energy-intensive processes, and the use of renewable energy sources for charging can further reduce the carbon footprint.

As a result of these environmental advantages, governments and tax authorities are increasingly recognizing the potential for tax incentives to promote EV adoption. Many countries offer tax credits, rebates, or exemptions for EV purchases and charging infrastructure. These incentives aim to accelerate the transition to electric mobility, reduce greenhouse gas emissions, and encourage the development of a sustainable transportation ecosystem. For instance, some regions provide tax credits for EV buyers, while others offer tax breaks for businesses investing in EV charging stations, thus fostering a greener economy.

Electric Vehicle Mileage: Understanding the Annual Standard

You may want to see also

Purchase Tax Exemption: Many countries offer tax breaks for EV buyers

In many countries, governments have recognized the environmental benefits of electric vehicles (EVs) and have implemented various incentives to encourage their adoption. One of the most common incentives is the purchase tax exemption, which allows EV buyers to avoid paying sales or value-added tax (VAT) on their vehicles. This financial benefit can significantly reduce the upfront cost of buying an EV, making it more affordable and attractive to potential buyers.

For instance, in several European countries, such as Norway, Sweden, and Germany, the purchase tax for EVs is either reduced or eliminated entirely. Norway, for example, has a zero-percentage tax on electric cars, making it one of the most EV-friendly markets in the world. This exemption not only simplifies the buying process but also encourages consumers to make the switch from traditional gasoline or diesel vehicles to electric ones.

Similarly, in the United States, some states offer tax credits or rebates for EV purchases. These incentives can vary in amount and eligibility criteria, but they generally aim to offset the higher upfront cost of EVs compared to their gasoline counterparts. For instance, California's Clean Vehicle Rebate Project provides rebates of up to $7,000 for the purchase of new electric cars, making it an even more appealing option for consumers.

The tax exemption for EV buyers is a significant advantage, as it directly impacts the overall cost of ownership. By eliminating or reducing the purchase tax, governments are essentially subsidizing the purchase of EVs, which can accelerate the transition to a more sustainable transportation system. This incentive is particularly beneficial for individuals and businesses looking to reduce their carbon footprint and contribute to a greener future.

Moreover, the availability of tax breaks for EV buyers can stimulate the market and drive sales. With the financial burden of sales tax reduced or eliminated, more people are likely to consider purchasing electric vehicles, leading to increased demand and potentially faster technological advancements in the EV industry. This, in turn, can create a positive feedback loop, where improved tax incentives further enhance the appeal of EVs, making them an even more attractive and viable transportation option.

The Future of Electric Vehicles: A Global Revolution

You may want to see also

Fuel Tax Savings: EVs don't pay fuel taxes, a significant long-term benefit

Electric vehicles (EVs) offer a multitude of advantages, and one of the most significant long-term benefits is the elimination of fuel taxes. This is a substantial financial advantage for EV owners, as it directly impacts their daily driving expenses. In many countries, fuel taxes are imposed on gasoline and diesel vehicles, and these taxes can accumulate over time, especially for those who drive frequently or own vehicles with higher mileage.

When you own an EV, you bypass this additional cost. EVs are powered by electricity, and in most regions, electricity is not subject to the same fuel taxes as traditional fossil fuels. This means that charging your EV at home or using public charging stations will not incur the additional fuel tax that gasoline or diesel vehicles would. Over time, these savings can be substantial, especially for those who drive long distances or frequently.

The savings can be calculated by comparing the cost of electricity to the cost of gasoline or diesel. While the initial purchase of an EV might be higher than that of a conventional car, the long-term savings on fuel can be significant. For instance, if you drive 15,000 miles annually and your EV has a fuel efficiency of 100 miles per gallon equivalent (MPGe), you could save thousands of dollars in fuel taxes over a decade. This is a considerable incentive for drivers, as it directly translates to more money in their pockets.

Furthermore, the environmental benefits of EVs are an added advantage. By avoiding fuel taxes, EV owners contribute to a greener economy. The reduction in fuel tax revenue might prompt governments to invest more in renewable energy infrastructure and public transportation, further promoting sustainable practices. This creates a positive feedback loop where the adoption of EVs leads to a more environmentally friendly and cost-effective transportation system.

In summary, the absence of fuel taxes for EVs is a compelling reason for drivers to consider making the switch. It offers a tangible financial benefit and contributes to a more sustainable future. As the world moves towards cleaner energy sources, the long-term savings and environmental advantages of EVs will continue to make them an increasingly attractive option for consumers.

Powering the Future: Unveiling the Key Elements of Electric Vehicles

You may want to see also

Maintenance Tax Relief: Reduced maintenance costs may be tax-deductible

The concept of tax benefits for electric vehicles (EVs) is an important consideration for many drivers, especially as the automotive industry shifts towards more sustainable transportation options. One aspect that often goes overlooked is the potential tax relief associated with reduced maintenance costs for these vehicles. Here's an exploration of this topic:

Electric vehicles have gained popularity due to their environmental benefits and long-term cost savings. One significant advantage is the reduced need for frequent maintenance compared to traditional internal combustion engine (ICE) vehicles. EVs have fewer moving parts, which means less wear and tear, and thus, lower maintenance expenses. This aspect can be particularly appealing to businesses and individuals looking to minimize their vehicle-related costs.

When it comes to tax implications, reduced maintenance costs can be a valuable factor. In many countries, businesses can claim tax deductions for expenses incurred in the normal course of their operations. For EV owners, this could include the reduced costs associated with maintenance, such as fewer oil changes, less frequent tire replacements, and reduced visits to the mechanic. These savings can be substantial over time, especially for those who own multiple vehicles or operate a fleet of cars.

To take advantage of this potential tax relief, EV owners should keep detailed records of their maintenance expenses. This includes receipts for any services or repairs performed on the vehicle, as well as evidence of the reduced frequency of these maintenance tasks compared to traditional vehicles. It is essential to stay organized and maintain proper documentation to ensure compliance with tax regulations.

Additionally, consulting with a tax professional or accountant can provide valuable guidance on how to structure these expenses for tax purposes. They can help determine the most appropriate method for claiming the tax deduction, ensuring that the reduced maintenance costs are accurately reflected and utilized to the owner's advantage.

In summary, the reduced maintenance costs associated with electric vehicles can be a significant financial benefit. By understanding and utilizing this aspect, EV owners can potentially reduce their taxable income and enjoy the environmental advantages of sustainable transportation. Staying informed about tax regulations and seeking professional advice will ensure that individuals and businesses can maximize their savings and contribute to a greener future.

Electric Vehicle Owners: Taxed for a Greener Future?

You may want to see also

Resale Tax Advantages: Selling EVs can result in lower tax liabilities

When it comes to selling electric vehicles (EVs), one of the significant advantages for owners is the potential for lower tax liabilities. This is particularly beneficial for those who have invested in EVs and are now looking to sell them, as it can result in substantial savings. The resale tax advantage is a crucial factor for EV owners to consider, as it can significantly impact their overall financial gains.

In many jurisdictions, the resale of vehicles is subject to a tax, often referred to as a "used car tax" or "sales tax." However, for electric vehicles, there is often a unique tax treatment that can benefit sellers. Many governments and tax authorities recognize the environmental benefits of EVs and, as a result, offer tax incentives or exemptions for their resale. These incentives are designed to encourage the adoption of eco-friendly transportation and can provide a significant advantage to EV owners.

The key to unlocking these tax advantages lies in understanding the specific tax laws and regulations in your region. For instance, some countries or states may offer an exemption from the usual resale tax for electric vehicles, especially if they have been registered and used for a certain period. This means that when you sell your EV, you might not have to pay the standard sales tax, which can be a substantial saving. The tax savings can be substantial, especially for high-end EVs, where the resale value can be considerable.

To take advantage of these tax benefits, it is essential to keep detailed records and documentation. This includes registration papers, service records, and any relevant environmental certificates that prove the vehicle's electric nature. When selling, provide these documents to the buyer and ensure you have the necessary paperwork to support your claim for tax exemption. This process might require additional effort, but it can result in a more favorable selling experience and potentially a higher return on your investment.

In summary, selling electric vehicles can offer a unique tax advantage through reduced resale tax liabilities. This benefit is a strong incentive for EV owners to consider when planning to sell, as it can significantly enhance their financial gains. By understanding and utilizing these tax incentives, EV owners can make informed decisions and potentially save a considerable amount of money during the resale process.

Affordable Electric Cars: Top Choices for Eco-Friendly Driving

You may want to see also

Frequently asked questions

While electric vehicles themselves may not be directly taxed, there are certain tax benefits and incentives associated with their purchase and ownership. Many governments offer tax credits, rebates, or exemptions to encourage the adoption of EVs. These incentives can vary by region and country, so it's essential to check the specific tax laws in your area.

In some cases, yes. Many countries provide tax deductions or credits for EV purchases, especially when the vehicle is used for business purposes. These deductions can help offset the cost of the vehicle and reduce the overall tax liability for individuals or businesses.

Charging infrastructure and electricity consumption for EVs may be subject to different tax regulations. Some regions impose a small fee on electricity bills to fund the development of charging stations. Additionally, there might be taxes on the purchase or installation of charging equipment. However, these fees are typically minimal and designed to support the EV infrastructure.

Personal use of an EV may not directly qualify for tax benefits, but there could be indirect advantages. For instance, if you work from home and use your EV for business-related travel, you might be able to claim expenses related to charging and maintenance. It's best to consult tax professionals to understand the applicable rules in your jurisdiction.