The growing popularity of electric vehicles (EVs) has sparked interest in government incentives, particularly the federal tax credit for EVs. However, there is a common misconception that this credit is permanent. In reality, the EV tax credit is subject to expiration, and understanding its timeline is crucial for potential EV buyers. This paragraph will explore the expiration of the electric vehicle climate credit, shedding light on the factors that determine its longevity and the implications for those considering an EV purchase.

| Characteristics | Values |

|---|---|

| Does the EV Climate Credit Expire? | Yes, the EV Climate Credit, also known as the Clean Vehicle Credit, has an expiration date. The credit was introduced as part of the Inflation Reduction Act (IRA) in 2022 and is set to phase out over time. |

| Phase-out Period | The credit begins to phase out after a certain number of vehicles are sold. The exact number of vehicles and the phase-out schedule can vary depending on the vehicle type and manufacturer. |

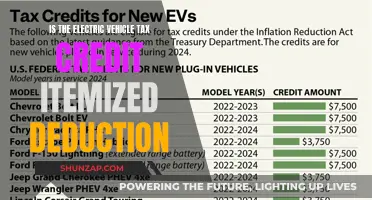

| Credit Amount | The credit amount varies based on the vehicle's price and battery capacity. It ranges from $2,500 to $7,500 for new vehicles and $1,500 to $3,750 for used vehicles. |

| Eligibility | The credit is available to individual buyers and businesses purchasing new or used electric vehicles (EVs) with a battery capacity of at least 4 kWh. |

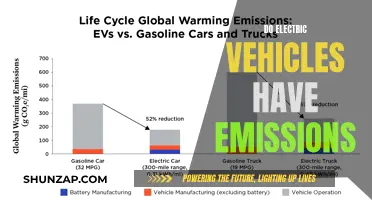

| Taxpayer Funding | The credit is funded by the federal government and is intended to incentivize the adoption of electric vehicles and reduce greenhouse gas emissions. |

| Impact on Market | The expiration of the credit could potentially impact the EV market, as it may affect consumer demand and vehicle prices. |

| Future Changes | The IRS and the government may make changes to the credit program, including modifications to the phase-out schedule or credit amounts, so staying updated is essential. |

What You'll Learn

- Credit Duration: How long do EV climate credits remain valid after purchase

- Renewal Process: What steps are required to renew EV climate credits

- Eligible Vehicles: Which electric vehicles qualify for the credit

- Credit Amount: How much is the maximum EV climate credit value

- Expiration Date: When does the EV climate credit expire for new buyers

Credit Duration: How long do EV climate credits remain valid after purchase?

The validity of electric vehicle (EV) climate credits can vary depending on the specific program and jurisdiction. These credits are often designed to incentivize the purchase of electric vehicles and promote environmental sustainability. Understanding the credit duration is crucial for EV buyers to ensure they maximize the benefits of these financial incentives.

In many countries, EV climate credits are typically valid for a certain period after the purchase of the vehicle. This duration can range from a few months to several years. For instance, in some regions, the credit might be valid for 6 months to 2 years from the date of vehicle registration. It is essential to check the specific regulations and guidelines provided by the relevant government or environmental agencies. These sources will outline the exact timeframe and any conditions associated with the credit's validity.

The credit duration is often tied to the vehicle's registration and compliance with environmental standards. Once the vehicle is registered, the credit is usually activated, and the buyer can claim the incentive. However, it's important to note that some programs may have specific requirements, such as maintaining the vehicle's eligibility for emissions testing or adhering to certain usage criteria. Failing to meet these conditions could result in the credit expiring or being revoked.

To ensure the longevity of the credit, EV owners should stay informed about the vehicle's maintenance and any updates to the environmental regulations. Regular vehicle inspections and keeping records of maintenance activities can help demonstrate compliance. Additionally, staying updated on changes to the credit program will enable buyers to take advantage of any extensions or modifications to the credit duration.

In summary, the duration of EV climate credits varies, but they generally remain valid for a specified period after the vehicle's purchase and registration. Buyers should familiarize themselves with the specific rules and conditions to ensure they receive the full benefit of these incentives. Being proactive in understanding and managing the credit's validity will contribute to a successful and sustainable EV ownership experience.

Powering the Future: Unveiling the Key Component of Electric Vehicles

You may want to see also

Renewal Process: What steps are required to renew EV climate credits?

The process of renewing EV climate credits is an essential aspect of maintaining the environmental benefits of electric vehicles (EVs). These credits, often referred to as 'EV tax credits' or 'clean vehicle credits,' are typically provided by governments to incentivize the adoption of electric cars, thereby reducing greenhouse gas emissions. However, these credits often come with expiration dates, and understanding the renewal process is crucial for EV owners to ensure they continue to benefit from these financial incentives.

The renewal process generally involves several steps, and it is a straightforward procedure designed to ensure that EV owners can continue to claim the tax benefits. Firstly, EV owners need to be aware of the specific requirements and deadlines set by their respective governments. These details can usually be found on official government websites or through environmental agencies responsible for promoting sustainable transportation. It is essential to stay informed about any changes in legislation or regulations that may affect the renewal process.

Once the expiration date of the credit approaches, EV owners will need to initiate the renewal process by submitting an application. This application typically requires providing details about the EV, such as its make, model, and year of manufacture. Additionally, owners may need to verify their vehicle's compliance with the specified environmental standards and provide documentation to support this. The application process might also involve submitting proof of vehicle ownership, such as registration documents or a vehicle history report.

After submitting the application, the relevant authorities will review the provided information. This review ensures that the EV meets the eligibility criteria and that the owner is entitled to the climate credit renewal. The review process may take some time, and during this period, EV owners should ensure that all required documents are in order to avoid any delays. Once approved, the government will issue a renewed credit, allowing the EV owner to continue claiming the tax benefits for the specified period.

It is important to note that the renewal process may vary slightly depending on the country and regional regulations. Therefore, EV owners should consult the relevant government resources or seek professional advice to ensure they follow the correct procedures. Staying informed and proactive in the renewal process is vital to maximize the environmental and financial benefits of owning an electric vehicle.

The Rise of Electric Vehicles: A Growing Trend

You may want to see also

Eligible Vehicles: Which electric vehicles qualify for the credit?

The federal tax credit for electric vehicles (EVs) is a significant incentive for consumers to go green, but it's important to understand which vehicles qualify for this benefit. The credit is designed to promote the adoption of electric cars and trucks, and it can be a substantial financial boost for buyers. However, the rules around eligibility are specific and can vary depending on the vehicle and its manufacturer.

To qualify for the credit, the vehicle must meet certain criteria set by the Internal Revenue Service (IRS). Firstly, the car must be a new, qualified electric vehicle, which includes battery-electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). These vehicles are designed to run primarily on electricity, with the option to use a small amount of gasoline for extended range or in case of an emergency. The credit is not available for traditional hybrid vehicles that rely solely on a combination of gasoline and electric power.

Another key factor is the vehicle's manufacturing process. The IRS has established a complex set of rules to ensure that the credit supports the domestic production of EVs. This includes a requirement that the vehicle's battery components and critical vehicle systems be manufactured or assembled in North America. This rule is designed to encourage the growth of the domestic EV industry and ensure that the credit benefits American workers and the economy.

Additionally, the vehicle's price and the buyer's income can also impact eligibility. The credit is generally available for vehicles with a sticker price of $80,000 or less, and it phases out for vehicles over $55,000. This price cap is adjusted based on the vehicle's battery capacity and the manufacturer's sales volume. Higher-income individuals may also face limitations on the credit amount they can claim.

It's worth noting that the rules and regulations surrounding the EV tax credit are subject to change, and it's essential to stay updated with the latest IRS guidelines. The credit can be a valuable tool for consumers, but understanding the eligibility requirements is crucial to ensure a smooth and successful purchase.

The Future of Driving: Autonomous and Electric, Hand in Hand

You may want to see also

Credit Amount: How much is the maximum EV climate credit value?

The maximum EV climate credit value is a crucial aspect of the financial incentives provided to encourage the adoption of electric vehicles (EVs). This credit is a form of financial support designed to reduce the upfront cost of purchasing an EV, making it more affordable and attractive to consumers. The credit amount varies depending on several factors, including the type of EV, its battery capacity, and the specific regulations in each region.

In the United States, for example, the Inflation Reduction Act (IRA) introduced a significant incentive for EV buyers. The IRA provides a tax credit of up to $7,500 for new qualified EVs and up to $4,500 for used EVs purchased after January 1, 2023. This credit is a substantial financial benefit, especially for those looking to purchase their first EV. However, it's important to note that this credit is not a one-time payment but rather a reduction in the final tax liability for the year the vehicle is purchased.

For new EVs, the credit is generally $7,500, but it can be reduced or phased out for vehicles with a battery capacity above a certain threshold. The exact amount depends on the vehicle's battery range and the manufacturer's compliance with certain production requirements. For used EVs, the credit is generally lower, and there are specific eligibility criteria that must be met.

It's worth mentioning that the credit amount can also be influenced by the timing of the purchase. Some regions or states offer additional incentives or bonuses for early adopters or those who purchase during specific periods. These incentives can further enhance the overall financial benefit of buying an EV.

Understanding the maximum EV climate credit value is essential for potential EV buyers as it directly impacts the financial savings they can achieve. This knowledge can guide individuals in making informed decisions when considering the purchase of an electric vehicle, especially when combined with other factors such as the vehicle's performance, range, and long-term running costs.

Powering the Future: Unveiling the Components of Hybrid Electric Vehicles

You may want to see also

Expiration Date: When does the EV climate credit expire for new buyers?

The EV climate credit, also known as the Clean Vehicle Credit, is a federal tax credit designed to incentivize the purchase of electric vehicles (EVs) in the United States. This credit has been a significant factor in promoting the adoption of EVs and reducing greenhouse gas emissions. However, it's important to understand the expiration date of this credit, especially for new buyers, to make informed decisions when purchasing an EV.

The expiration date for the EV climate credit is set to be a critical factor for prospective EV buyers. The credit was initially introduced as part of the Inflation Reduction Act (IRA) in 2022 and is scheduled to phase out over time. For new buyers, the credit is available for a limited period, and its expiration can significantly impact the overall cost of the vehicle. The credit is designed to encourage the purchase of EVs, and as the market matures, the credit's value may decrease or even disappear, making it a race against time for those looking to take advantage of this incentive.

New buyers should be aware that the EV climate credit has a specific timeline. The credit is typically available for a period of several years, after which it may be reduced or eliminated. For instance, the credit might be available for a certain number of years, after which it could be replaced by a different incentive program. It is crucial to stay updated on the latest legislation and regulations to ensure that the credit is still valid at the time of purchase. The IRS and relevant government agencies provide the most accurate and current information regarding the credit's expiration.

To determine the exact expiration date for the EV climate credit, one should refer to official sources. The IRS website, for example, offers detailed information about the credit, including its eligibility criteria and any changes or updates. Additionally, staying informed about environmental policy changes and updates from the government can provide valuable insights into the credit's future. Prospective buyers should also consider the potential impact of these changes on their purchasing decisions, especially if they are planning to buy an EV in the near future.

In summary, the EV climate credit is a valuable incentive for new buyers, but its expiration date is a critical consideration. Understanding the timeline and staying informed about any changes in legislation will help buyers make the right choices. With the credit's potential reduction or elimination, it is essential to act promptly to ensure that the financial benefits of purchasing an EV are maximized.

Beyond the Electric: Low-Speed Vehicles' Sustainable Future

You may want to see also

Frequently asked questions

The EV climate credit is a financial incentive provided by the government to encourage the adoption of electric vehicles. It is designed to reduce greenhouse gas emissions and promote sustainable transportation.

This credit is typically offered as a tax credit or rebate to EV buyers. It provides a certain amount of money back to the consumer, reducing the overall cost of purchasing an electric vehicle. The credit amount may vary depending on the vehicle's battery capacity, range, and other factors.

Yes, the credit often has an expiration date or a specific timeframe during which it can be claimed. This is to ensure that the funds are allocated efficiently and to encourage timely purchases. The expiration date can vary by region and government policies.

If the credit has expired, you may not be eligible to claim it. It's important to check the current availability and deadlines for the credit in your region. Some governments may also offer alternative incentives or provide information on upcoming programs to ensure you can still benefit from financial support for your EV purchase.

In some cases, yes. Certain jurisdictions allow for a retroactive application of the credit if the purchase was made within a specific period before the expiration date. However, this is not universal, and rules may vary, so it's best to consult the relevant tax authorities or government websites for accurate information.