I recently received a substantial refund of $7,500 for my electric vehicle, and I'm excited to share my experience. It all started when I decided to purchase an electric car, driven by my commitment to sustainability and the desire for a more efficient mode of transportation. After thorough research, I found a local dealership offering a range of eco-friendly vehicles. The sales team was incredibly knowledgeable and helped me choose the perfect model that suited my needs and budget. During the purchase process, I was pleasantly surprised to learn that the government provides incentives and tax credits for electric vehicle buyers, significantly reducing the overall cost. This, coupled with the dealership's excellent financing options, made the purchase feasible. I completed the transaction, and a few months later, I received the refund, which was a welcome surprise. This experience not only saved me money but also made me feel proud of my contribution to a greener future.

What You'll Learn

- Tax Incentives: Government programs offering refunds for electric vehicle purchases

- Vehicle Registration: Special registration fees for electric vehicles can be refunded

- Energy Efficiency: Rebates for energy-efficient electric vehicle upgrades

- Environmental Impact: Tax credits for reducing carbon emissions with electric vehicles

- Dealer Incentives: Dealers may offer refunds for electric vehicle sales

Tax Incentives: Government programs offering refunds for electric vehicle purchases

The process of obtaining a refund of up to $7,500 for an electric vehicle (EV) purchase is made possible through various government tax incentives. These programs are designed to encourage the adoption of electric vehicles, reduce environmental impact, and stimulate the economy. Here's an overview of how these tax incentives work and how you can take advantage of them:

Federal Tax Credit for Electric Vehicles: One of the most well-known incentives is the Federal Tax Credit, which provides a substantial benefit to EV buyers. This credit is available for new and used electric vehicles, including plug-in hybrids. The amount of the credit varies depending on the vehicle's battery capacity and the manufacturer's compliance with certain production requirements. For the 2023 tax year, the credit can be up to $7,500, making it a significant incentive for EV buyers. To claim this credit, you need to file your federal tax return and provide the necessary documentation, such as the vehicle's purchase agreement and proof of ownership.

State-Specific Incentives: In addition to federal programs, many states offer their own tax incentives and rebates for electric vehicle purchases. These state-specific programs can provide additional financial benefits, often in the form of rebates or tax credits. For instance, some states may offer a flat-rate rebate for EV purchases, while others might provide a percentage-based credit. Researching your state's incentives is crucial, as the eligibility criteria and maximum benefits can vary widely. State-level incentives often have their own application processes, and you may need to submit additional documentation to the relevant state agency.

Local and Regional Programs: Beyond federal and state incentives, local governments and regional authorities sometimes introduce their own EV purchase programs. These initiatives can include partnerships with EV manufacturers, offering additional discounts or rebates. For example, a city might provide a rebate for residents purchasing electric vehicles, especially if they meet certain income criteria. Keep an eye on local government websites and community resources to discover any such programs in your area.

To maximize your chances of obtaining a $7,500 refund, it's essential to understand the specific requirements and limitations of each incentive program. Consulting with a tax professional or financial advisor can be beneficial, as they can guide you through the application process and ensure you meet all the necessary criteria. Additionally, staying informed about the latest updates and changes to these incentives is crucial, as government policies can evolve over time.

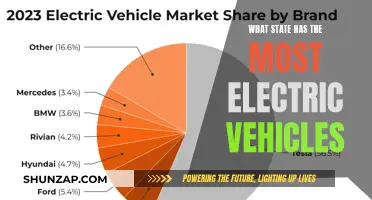

The Electric Vehicle Leader: Unveiling the Top State's EV Revolution

You may want to see also

Vehicle Registration: Special registration fees for electric vehicles can be refunded

Vehicle registration fees for electric vehicles can often be a significant expense, but many governments and authorities offer refunds or incentives to promote the adoption of eco-friendly transportation. If you've recently purchased an electric vehicle and are eligible for a refund on the special registration fees, here's a step-by-step guide on how to navigate the process:

- Research and Confirm Eligibility: Begin by researching your region's specific policies regarding electric vehicle registration fees. Different areas may have varying refund criteria, such as vehicle type, purchase date, or environmental impact. Check official government websites, transportation departments, or relevant agencies to gather accurate and up-to-date information. Understanding the eligibility requirements is crucial to ensure you meet the necessary conditions for a refund.

- Gather Required Documents: Once you've established your eligibility, collect all the necessary documents. This may include proof of purchase, vehicle registration documents, environmental certificates, and any other supporting materials. Ensure that these documents are in order and easily accessible to streamline the refund process.

- Contact the Relevant Authority: Reach out to the appropriate government department or agency responsible for vehicle registration and refunds. You can typically find contact information on official websites. Clearly explain your situation and provide the required documents. Be prepared to answer questions regarding your vehicle, purchase details, and the specific reasons for seeking a refund.

- Follow the Refund Process: The authority will guide you through the refund procedure. This might involve filling out forms, providing additional information, or submitting supporting documents digitally or in person. Stay organized and keep track of submission deadlines to avoid any delays. Be proactive in following up with the relevant officials to ensure your application is processed smoothly.

- Track the Refund: After submitting your application, monitor the progress of your refund. Keep records of any correspondence and maintain communication with the authorities. If there are any issues or additional requirements, address them promptly to ensure a successful outcome.

Remember, the process may vary depending on your location and the specific policies in place. It's essential to stay informed and be proactive in seeking the refund you are entitled to. With the right information and documentation, you can navigate the vehicle registration fees refund process efficiently and potentially receive a significant financial boost for your electric vehicle purchase.

Uncover the Top EV Tax Rebate Destinations

You may want to see also

Energy Efficiency: Rebates for energy-efficient electric vehicle upgrades

Energy efficiency upgrades for electric vehicles (EVs) can significantly enhance performance and reduce long-term costs. Many governments and utility companies offer rebates and incentives to encourage these improvements, which can sometimes result in substantial refunds. Here's a guide on how to navigate the process and potentially secure a refund of up to $7,500 for energy-efficient EV upgrades:

Understanding the Rebate Programs:

Start by researching the rebate programs available in your region. These programs often target specific EV upgrades, such as battery replacements, efficient charging systems, or the installation of solar panels for home charging. Government websites, local utility companies, and environmental organizations are excellent resources for finding these programs. Look for initiatives that align with your desired upgrades and ensure you understand the eligibility criteria and application process.

Identifying Eligible Upgrades:

Not all EV upgrades qualify for rebates. Focus on improvements that directly impact energy efficiency. This could include:

- Advanced Battery Technology: Upgrading to a more efficient battery system can increase range and reduce energy consumption.

- Smart Charging Systems: Installing a smart charger that optimizes charging times and reduces energy waste.

- Regenerative Braking: Upgrading to a regenerative braking system captures and stores energy that would otherwise be lost during braking.

- Aerodynamic Enhancements: Modifying the vehicle's design to reduce drag and improve aerodynamics.

Finding Reputable Installers:

Rebate programs often require installations by certified professionals. Research and choose reputable installers who specialize in EV upgrades. Ensure they are familiar with the specific requirements of your vehicle and the rebate program. A good installer will also provide detailed documentation and certificates to support your rebate application.

Application Process:

The rebate application process varies by program. Typically, you'll need to:

- Complete an application form, providing details of the upgrade, installer, and expected energy savings.

- Gather supporting documents, such as invoices, installation certificates, and energy efficiency reports.

- Submit your application to the relevant authority, often your local utility company or environmental agency.

Maximizing Your Refund:

To increase your chances of a substantial refund, consider the following:

- Research and Compare: Compare different rebate programs to find the one offering the highest refund for your specific upgrade.

- Combine Incentives: Some programs may stack rebates, allowing you to claim multiple incentives for a single upgrade.

- Long-Term Savings: Focus on upgrades that provide significant long-term energy savings, as these will be more attractive to rebate providers.

By strategically approaching energy efficiency upgrades and rebate programs, you can potentially secure a substantial refund, making your EV ownership more affordable and environmentally friendly. Remember to stay informed about the latest rebate opportunities and keep detailed records of your upgrades and applications.

Toyota Crown: Electric Future or Traditional Icon?

You may want to see also

Environmental Impact: Tax credits for reducing carbon emissions with electric vehicles

The environmental benefits of electric vehicles (EVs) are well-documented, and governments worldwide are incentivizing the switch to cleaner transportation. One such incentive is the tax credit system, which provides financial benefits to EV owners, encouraging the reduction of carbon emissions. This strategy not only promotes a greener future but also offers a practical solution to those looking to make a positive environmental impact while potentially saving money.

Tax credits for electric vehicles are designed to offset the higher upfront cost of EVs compared to traditional gasoline vehicles. These credits can significantly reduce the overall purchase price, making electric cars more affordable and accessible to a wider range of consumers. By doing so, governments aim to accelerate the adoption of EVs, which, in turn, leads to a substantial decrease in greenhouse gas emissions and air pollutants. The environmental impact is twofold: first, the direct reduction in carbon emissions from the vehicles themselves, and second, the potential for a broader shift towards sustainable transportation infrastructure.

To qualify for these tax credits, individuals typically need to purchase or lease a new electric vehicle that meets specific environmental standards. These standards often include criteria for the vehicle's battery capacity, range, and the source of its electricity generation. Once the EV is purchased, the tax credit can be claimed as a deduction on one's income tax return, providing a financial boost to the environment and the consumer. The amount of the credit can vary depending on the country and the specific vehicle model, but it often covers a significant portion of the vehicle's cost, sometimes even reaching up to $7,500, as you mentioned.

The process of obtaining a tax credit for an electric vehicle is relatively straightforward. It usually involves the vehicle manufacturer or dealer submitting the necessary documentation to the relevant tax authorities. This documentation includes details about the vehicle, its environmental performance, and the buyer's eligibility. After a successful claim, the tax credit is directly applied to the buyer's tax liability, reducing the amount owed or increasing the refund. This not only benefits the individual financially but also contributes to a collective effort to combat climate change.

In summary, tax credits for electric vehicles are a powerful tool to encourage the adoption of environmentally friendly transportation. By providing financial incentives, governments can motivate citizens to make greener choices, ultimately leading to a more sustainable future. This strategy not only reduces carbon emissions but also educates the public about the benefits of electric mobility, fostering a culture of environmental responsibility. With the potential to save thousands of dollars, as evidenced by your research, individuals can make a significant impact on both their personal finances and the environment.

Ford's Electric Future: Partnering with Rivian for a Green Revolution

You may want to see also

Dealer Incentives: Dealers may offer refunds for electric vehicle sales

Dealers often play a crucial role in promoting and selling electric vehicles (EVs) to customers, and they have the power to incentivize purchases through various means. One such incentive is the offer of refunds, which can significantly benefit both the dealer and the customer. These refunds are typically provided as a financial reward to customers who purchase electric vehicles, and they can be a powerful tool to encourage EV adoption.

The process usually begins with the dealer establishing a relationship with the manufacturer or the brand. Many automotive brands offer incentives to their dealers to boost sales, and these incentives can be in the form of direct refunds or rebates. Dealers can then pass on these benefits to their customers, making EV purchases more affordable. For instance, a dealer might offer a $7,500 refund on a specific electric vehicle model, which could be a substantial discount for potential buyers. This strategy not only attracts customers but also helps dealers clear inventory and meet sales targets.

When a customer expresses interest in an electric vehicle, the dealer can present the refund offer as a unique opportunity. This approach can create a sense of urgency and encourage customers to make a purchase decision. The refund amount can be a significant factor in a customer's decision-making process, especially when considering the potential savings over the vehicle's lifetime. For example, a customer might be more inclined to buy an EV with a $7,500 refund, knowing they will receive a substantial amount back, effectively reducing the overall cost.

It is essential for customers to understand the terms and conditions of these dealer incentives. Refunds might be subject to specific criteria, such as meeting certain sales targets or providing proof of residency in a particular area. Dealers should be transparent about these conditions to ensure customers are aware of any requirements. Additionally, customers should be encouraged to ask questions and seek clarification to ensure they fully comprehend the incentive structure.

In summary, dealer incentives, including refunds, are powerful tools to promote electric vehicle sales. These incentives provide an opportunity for dealers to attract customers and offer substantial savings. By understanding the terms and conditions, customers can make informed decisions and potentially benefit from these dealer-offered refunds, making the transition to electric vehicles more accessible and appealing.

Explore Chrysler's Electric Vehicle Lineup: From SUVs to Sedans

You may want to see also

Frequently asked questions

The process for obtaining a refund can vary depending on your location and the specific circumstances of your purchase. Typically, you would need to contact the dealership or manufacturer and provide them with the necessary documentation, such as proof of purchase, vehicle details, and any relevant tax or rebate information. They may guide you through the refund process, which could involve filling out forms, submitting supporting documents, and following their instructions.

Eligibility criteria can vary widely, and it's essential to check with your local government or the relevant authorities. Generally, you may be eligible if you meet certain income thresholds, reside in specific regions, or have purchased an electric vehicle that meets certain environmental standards. Some programs also require you to be a resident of the state or region offering the refund.

Yes, in many cases, you can still be eligible for a refund even if you've received a tax credit. Tax credits and refunds often serve different purposes and are designed to incentivize different aspects of electric vehicle ownership. For example, a tax credit might reduce your taxable income, while a refund could be a direct payment to cover the cost of the vehicle. It's best to consult with a tax professional or the relevant authorities to understand the specific rules in your jurisdiction.

The refund process duration can vary significantly depending on various factors, including the complexity of your case, the efficiency of the dealership or manufacturer's refund system, and the workload of the relevant authorities. Some refunds might be processed within a few weeks, while others could take several months. It's advisable to inquire about the estimated timeline when initiating the refund process.

Typically, there are no fees associated with the refund process for electric vehicle purchases. However, it's always a good idea to review the terms and conditions of any financial assistance or incentives you are applying for. Some programs might have specific rules regarding fees, penalties, or administrative costs that you should be aware of.