The electric vehicle (EV) revolution is transforming the automotive industry, offering an opportunity for investors to capitalize on this growing market. With the world's increasing focus on sustainability and reducing carbon footprints, the demand for electric cars is soaring. This shift presents a unique chance for investors to explore various avenues, such as investing in EV manufacturers, battery technology companies, charging infrastructure developers, and even the renewable energy sector that powers these vehicles. Understanding the market dynamics, technological advancements, and regulatory frameworks is crucial for making informed investment decisions in this rapidly evolving industry.

What You'll Learn

- Market Trends: Track EV sales, policy changes, and industry forecasts to identify investment opportunities

- Key Players: Research leading EV manufacturers, battery tech companies, and charging infrastructure providers

- Sustainable Investing: Explore ESG funds and ETFs focused on clean energy and sustainable transportation

- Regulatory Landscape: Understand government incentives, subsidies, and regulations impacting the EV market

- Innovation and Technology: Monitor advancements in battery technology, autonomous driving, and charging solutions

Market Trends: Track EV sales, policy changes, and industry forecasts to identify investment opportunities

The electric vehicle (EV) market is experiencing rapid growth and transformation, presenting a range of investment opportunities for those who understand the key market trends. Here's a guide on how to track these trends and make informed investment decisions:

Monitor EV Sales and Market Penetration:

- Keep a close eye on global and regional EV sales data. Websites and reports from organizations like the International Energy Agency (IEA), the International Council on Clean Transportation (ICCT), and various market research firms provide valuable insights. Look for trends in sales volume, market share gains by different EV manufacturers, and regional variations. For example, some regions might see a surge in EV adoption due to government incentives, while others might lag due to infrastructure limitations.

- Analyze the sales data to identify leading EV brands and models. Companies like Tesla, Volkswagen, and Chinese manufacturers such as BYD and NIO have made significant strides in the market. Understanding their sales performance and market positioning can help investors pinpoint potential leaders in the industry.

Stay Informed on Policy Changes:

- Government policies play a crucial role in shaping the EV market. Track policy changes related to EV incentives, subsidies, tax benefits, and regulations. Many countries and regions are implementing stricter emissions standards and offering financial incentives to encourage EV adoption. For instance, the European Union's goal of phasing out internal combustion engine vehicles by 2035 will significantly impact the market.

- Keep an eye on trade policies and tariffs as well, as they can affect the cost and availability of EVs and their components. Changes in import/export regulations can impact the supply chain and profitability of EV manufacturers.

Industry Forecasts and Expert Opinions:

- Industry analysts and research firms regularly publish forecasts and reports on the EV market. These reports provide valuable insights into future sales projections, market growth rates, and potential challenges. For instance, a report by BloombergNEF predicts that the global EV market will reach 30 million units by 2030.

- Expert opinions and interviews can also offer a deeper understanding of market dynamics. Following industry analysts, journalists, and thought leaders on social media and news platforms can provide real-time insights and opinions on emerging trends.

Identify Investment Opportunities:

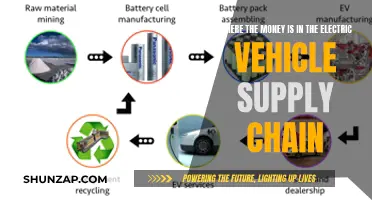

- By tracking sales, policy changes, and industry forecasts, you can identify investment opportunities in various sectors of the EV ecosystem. This includes:

- EV Manufacturers: Direct investments in leading EV companies or exchange-traded funds (ETFs) that track the performance of EV manufacturers.

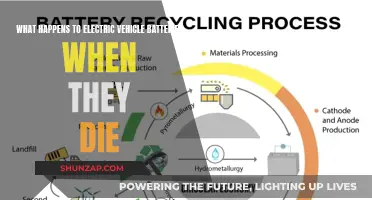

- Battery Technology: The development of advanced battery technology is crucial for the EV industry. Consider investing in companies focused on battery research, production, and recycling.

- Charging Infrastructure: The growth of the EV market will require an expansion of charging stations. Look for companies providing charging solutions, especially those with innovative technologies.

- Autonomous Driving: Self-driving technology is an emerging area within the EV sector. Invest in companies developing autonomous driving systems and related software.

- Diversifying your investments across these sectors can help mitigate risks and maximize potential returns. Regularly reviewing and analyzing market trends will enable you to make timely investment decisions in the dynamic world of electric vehicles.

Sustainable Solutions: Navigating EV Battery Disposal and Recycling

You may want to see also

Key Players: Research leading EV manufacturers, battery tech companies, and charging infrastructure providers

The electric vehicle (EV) revolution is gaining momentum, and it presents a significant investment opportunity for those looking to capitalize on the growing demand for sustainable transportation. Here's a breakdown of key players to research and consider for your investment strategy:

Leading EV Manufacturers:

- Tesla, Inc. (TSLA): Undoubtedly, Tesla is the most well-known and influential player in the EV space. With its innovative designs, advanced technology, and a strong focus on sustainability, Tesla has revolutionized the automotive industry. Their Model 3 and Model Y are popular choices, and the upcoming Cybertruck adds to their appeal. Research Tesla's production capacity, supply chain, and ability to scale production to meet demand.

- Volkswagen Group (VOWG.DE): Volkswagen's commitment to electrification is evident through its ID.3 and ID.4 models. The group's global reach and established brand reputation make it a strong contender. Analyze their battery partnerships, charging network expansion, and the potential for cost synergies within the group.

- Chinese EV Manufacturers: Companies like BYD (Build Your Dreams) and NIO (NIO Inc.) have made significant strides in the EV market. BYD offers a range of electric buses and cars, while NIO focuses on premium electric SUVs. Assess their market share, technological advancements, and the support from the Chinese government's incentives for EV adoption.

Battery Technology Companies:

- Contemporary Amperex Technology (CATL): CATL is a leading global producer of lithium-ion batteries for EVs. Their technology is renowned for its energy density and efficiency. Research CATL's supply agreements with major EV manufacturers, their R&D capabilities, and the potential for vertical integration in the battery supply chain.

- Panasonic Corporation (PANEXY): Panasonic's partnership with Tesla is well-known, and they also supply batteries to other EV brands. Their expertise in battery manufacturing and research should be studied. Evaluate their production capacity, technological innovations, and the potential for expanding their customer base.

- Solid-State Battery Developers: Keep an eye on companies like SolidEnergy Systems and QuantumScape, which are developing solid-state batteries. These next-generation batteries promise higher energy density and faster charging. Assess their technology, partnerships, and the challenges they face in scaling production.

Charging Infrastructure Providers:

- ChargePoint Holdings (CHPT): As the largest network of EV charging stations in North America, ChargePoint plays a crucial role in the EV ecosystem. Their focus on software and hardware solutions for charging stations is essential for a seamless charging experience. Research their partnerships with cities and utilities, and the potential for international expansion.

- Enel X Way: Enel, an Italian multinational, offers a comprehensive charging infrastructure solution. Their FastCharge stations and smart charging platforms are widely adopted. Analyze their global presence, partnerships with EV manufacturers, and the potential for revenue growth as charging becomes a key service in the EV market.

- Tesla's Supercharger Network: While primarily associated with Tesla, the Supercharger network is a significant asset. Research the expansion plans and the potential for revenue generation from non-Tesla EV owners.

When investing in the EV revolution, it's crucial to stay informed about technological advancements, regulatory changes, and market dynamics. Diversifying your research across these key players and their respective industries will provide a comprehensive understanding of the investment landscape. Remember, the EV market is rapidly evolving, so ongoing analysis and adaptability are essential for successful investments.

Georgia EV Tax Credit: A Step-by-Step Guide to Maximizing Your Savings

You may want to see also

Sustainable Investing: Explore ESG funds and ETFs focused on clean energy and sustainable transportation

The electric vehicle (EV) revolution is gaining momentum, and investors are increasingly interested in how they can contribute to this sustainable shift while also generating returns. Sustainable investing, which focuses on environmental, social, and governance (ESG) factors, offers a way to align financial goals with a cleaner, greener future. One of the most accessible ways to invest in the EV revolution is through Exchange-Traded Funds (ETFs) and funds specifically designed to target clean energy and sustainable transportation.

ESG funds and ETFs provide investors with a diversified portfolio of companies that are actively contributing to the development and adoption of electric vehicles, renewable energy sources, and sustainable transportation infrastructure. These funds often screen companies based on their commitment to ESG principles, ensuring that the investments are not only financially sound but also environmentally and socially responsible. For instance, you can find ETFs that focus on the broader clean energy sector, which includes not just EVs but also renewable energy producers, energy efficiency companies, and sustainable infrastructure developers.

When considering these investment options, it's important to look for funds that have a clear mandate and strategy. Some funds might focus on the entire EV supply chain, from battery manufacturers to car manufacturers, while others may concentrate on specific segments like charging infrastructure or sustainable urban mobility. Researching and understanding the fund's holdings and investment approach is crucial to ensure alignment with your personal investment goals and values.

Additionally, investors should pay attention to the fund's fees and expenses, as these can impact overall returns. While ESG investing is a growing trend, it's essential to remember that it doesn't necessarily come without costs. Some funds may have higher expense ratios, so comparing these costs across different funds is a wise practice.

Finally, staying informed about the latest developments in the EV industry and the broader energy transition is key. The EV revolution is an evolving landscape, with new technologies, policies, and market trends constantly emerging. Keeping up with these changes can help investors make more informed decisions and potentially capitalize on emerging opportunities in the sustainable transportation and clean energy sectors.

Mastering the Art of Electric Driving: A Beginner's Guide

You may want to see also

Regulatory Landscape: Understand government incentives, subsidies, and regulations impacting the EV market

The electric vehicle (EV) market is a dynamic and rapidly growing sector, and understanding the regulatory landscape is crucial for investors looking to capitalize on this revolution. Governments around the world are implementing various policies and incentives to promote the adoption of electric cars, which presents both opportunities and challenges for investors. Here's a breakdown of the key considerations:

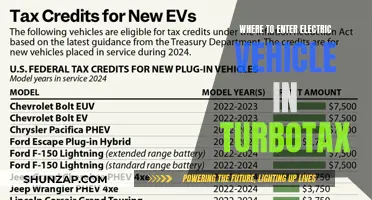

Government Incentives and Subsidies: Many countries have introduced financial incentives to encourage consumers to switch to electric vehicles. These incentives can take the form of direct subsidies, tax credits, or rebates. For instance, in the United States, the Inflation Reduction Act offers a substantial tax credit for EV purchases, making electric cars more affordable for consumers. Similarly, European countries like Norway and Germany provide significant subsidies, often exempting EVs from certain taxes and offering financial support for charging infrastructure. Investors should research and identify these incentives in their target markets, as they can significantly impact consumer behavior and market demand.

Regulatory Frameworks and Standards: Governments are also implementing regulations to standardize and support the EV industry. These regulations may include emission standards, charging infrastructure requirements, and safety norms. For example, the European Union's CO2 standards mandate that car manufacturers achieve specific emission targets, pushing them to invest in electric powertrains. Investors should stay updated on these regulatory frameworks, as they can influence the development of the EV supply chain, including battery production, charging network expansion, and vehicle manufacturing. Understanding these regulations will help investors anticipate market trends and potential investment hotspots.

Policy Support for Charging Infrastructure: The development of a robust charging network is essential for the widespread adoption of EVs. Governments are recognizing this and implementing policies to encourage investment in charging infrastructure. This includes providing grants, tax benefits, or low-interest loans for businesses and individuals setting up charging stations. Investors in the EV space should consider the potential for growth in this sector, as efficient and accessible charging networks are vital for the industry's success.

Long-term Strategies and Goals: It is essential to consider the long-term vision and strategies of governments regarding the EV market. Many countries have set ambitious targets for EV adoption, aiming to reduce their carbon footprint and transition towards sustainable transportation. For instance, the UK has committed to banning new internal combustion engine sales by 2030. Investors should align their strategies with these goals, focusing on companies and projects that contribute to the overall sustainability and growth of the EV ecosystem.

Staying informed about these regulatory developments and their potential impact on the market is crucial for investors. It allows for strategic decision-making, enabling investors to identify the most promising opportunities within the electric vehicle revolution.

Unleashing the Power of EVs: Strategies to Boost Demand and Revolutionize Transportation

You may want to see also

Innovation and Technology: Monitor advancements in battery technology, autonomous driving, and charging solutions

The electric vehicle (EV) revolution is gaining momentum, and staying informed about the latest innovations in battery technology, autonomous driving, and charging infrastructure is crucial for investors looking to capitalize on this growing market. Here's a breakdown of how to monitor these advancements:

Battery Technology:

- Monitor Research and Development: Keep an eye on research institutions, universities, and companies actively investing in battery technology. Websites like ResearchGate, ScienceDirect, and industry-specific publications are excellent resources for staying updated. Look for breakthroughs in lithium-ion battery chemistry, solid-state batteries, and other emerging technologies.

- Follow Company News: Major EV manufacturers and battery producers like Tesla, Panasonic, and Contemporary Amperex Technology (CATL) regularly announce advancements in their battery research and development. Their investor relations websites, press releases, and social media updates can provide valuable insights.

- Industry Reports and Analyses: Reputable market research firms like BloombergNEF, Wood Mackenzie, and S&P Global publish comprehensive reports on battery technology trends. These reports often include detailed analysis of emerging technologies, production capacity, and supply chain developments.

Autonomous Driving:

- Track Regulatory Progress: Autonomous driving regulations are evolving rapidly worldwide. Monitor legislative developments and regulatory body announcements related to self-driving cars. Websites of government transportation departments and organizations like the National Highway Traffic Safety Administration (NHTSA) in the US are valuable sources.

- Follow Company Milestones: Leading autonomous driving companies like Waymo, Cruise (owned by General Motors), and Tesla are constantly pushing the boundaries. Their websites, blog posts, and press releases will highlight testing progress, partnerships, and technological breakthroughs.

- Industry Conferences and Events: Attending or following online events like the Consumer Electronics Show (CES), the International Society of Automotive Engineers (SAE) conferences, and autonomous driving-focused webinars can provide insights into the latest advancements and trends.

Charging Solutions:

- Identify Charging Infrastructure Developers: The growth of EV charging networks is essential for widespread adoption. Investigate companies specializing in charging station construction, management, and technology. Look for innovations in fast-charging technology, wireless charging, and integrated solar charging solutions.

- Monitor Smart Grid Integration: The development of smart grids that can efficiently manage electricity flow and support charging infrastructure is crucial. Keep track of partnerships between utility companies, EV manufacturers, and technology providers working on smart grid solutions.

- Follow Public Charging Network Expansion: Government initiatives and private companies are expanding public charging networks. Monitor announcements regarding new charging station locations, partnerships with retailers, and the deployment of fast-charging corridors.

Additional Tips:

- Stay Informed about Market Trends: Keep abreast of overall market trends in the EV industry by following industry publications, financial news outlets, and analyst reports.

- Network and Connect: Attend industry events, join online forums, and connect with professionals in the EV space to gain insights and stay informed about emerging opportunities.

- Diversify Your Investment Portfolio: Remember that investing in the EV revolution involves risk. Diversify your portfolio across different segments of the industry, including battery manufacturers, EV manufacturers, charging infrastructure providers, and autonomous driving technology companies.

Mastering Electrical Connections: A Guide to Disconnecting Vehicle Connectors

You may want to see also

Frequently asked questions

Investing in the EV revolution can be an exciting opportunity. A common starting point is to research and identify companies that are at the forefront of EV technology, battery development, charging infrastructure, or EV component manufacturing. You can invest in these companies through the stock market by buying their shares. Diversification is key, so consider investing in a range of EV-related stocks to mitigate risk.

One strategy is to focus on the supply chain and component suppliers, as the demand for EV parts is expected to surge. These companies often have strong relationships with major EV manufacturers and can benefit from the industry's growth. Another approach is to invest in renewable energy and energy storage companies, as the transition to EVs goes hand in hand with the development of sustainable energy sources. Additionally, you can explore exchange-traded funds (ETFs) that track the EV industry, providing a diversified exposure to multiple companies.

Yes, like any investment, there are risks. The EV market is still evolving, and regulatory changes or technological advancements could impact the industry. Companies in this sector might also face competition, supply chain disruptions, or production challenges. It's important to stay informed about market trends, keep an eye on company-specific news, and regularly review your investments to manage risk effectively.