Navigating the complexities of tax credits for electric vehicles can be a daunting task, but Turbotax offers a comprehensive solution to simplify the process. This guide will provide a step-by-step breakdown of how to claim your electric vehicle tax credit efficiently, ensuring you maximize your tax benefits and contribute to a greener future.

What You'll Learn

- Eligibility: Determine if you qualify for the EV tax credit based on vehicle and income criteria

- Documentation: Gather necessary documents like purchase agreements and vehicle information for the tax credit claim

- Filing Process: Understand the steps to file for the credit on your tax return using Turbotax

- Claiming Methods: Learn how to claim the credit, either as a refund or a reduction in tax liability

- Deadlines: Be aware of the tax filing deadlines to ensure timely submission of the EV tax credit

Eligibility: Determine if you qualify for the EV tax credit based on vehicle and income criteria

To determine your eligibility for the electric vehicle (EV) tax credit, you need to consider both vehicle and income criteria. Here's a detailed breakdown:

Vehicle Criteria:

- New or Used: The EV tax credit applies to both new and used EVs purchased or leased after December 31, 2009. However, there are some nuances:

- New EVs: You must purchase the vehicle directly from a dealership or manufacturer. This means you can't claim the credit if you buy it from a private seller.

- Used EVs: You can claim the credit for a used EV if it was originally purchased or leased by someone else and you acquire it through a private sale or lease.

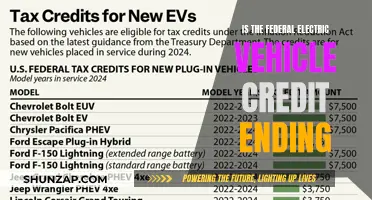

- Make and Model: The IRS has a list of qualified EVs. You can find this list on the IRS website. The list includes specific makes and models of EVs that meet certain performance and emission standards.

- Price: There are income limits based on the vehicle's price. The credit is generally limited to vehicles with a manufacturer's suggested retail price (MSRP) of $80,000 or less. If the vehicle exceeds this price, the credit amount decreases proportionally.

Income Criteria:

- Adjusted Gross Income (AGI): Your AGI is a key factor. The EV tax credit phases out for individuals with AGI above certain thresholds. For the 2023 tax year, the phase-out begins at $150,000 for single filers and $225,000 for joint filers.

- Marital Status: Your marital status also plays a role. The phase-out thresholds are higher for married couples filing jointly compared to single filers.

Determining Eligibility:

To determine if you qualify, carefully review the vehicle's MSRP and your AGI. You can use online tools or consult a tax professional to help with these calculations. Remember, the EV tax credit is designed to incentivize the purchase of environmentally friendly vehicles. Make sure you understand the rules and limitations to ensure you receive the credit you're entitled to.

Electric Vehicles: Unveiling the Mystery of Their Extra Weight

You may want to see also

Documentation: Gather necessary documents like purchase agreements and vehicle information for the tax credit claim

When it comes to claiming the electric vehicle tax credit, proper documentation is key. Here's a step-by-step guide on what you need to gather:

Purchase Agreement: Start by obtaining a copy of your vehicle purchase agreement. This document is crucial as it provides essential details about your electric vehicle purchase. Make sure it includes information such as the vehicle's make, model, year, and VIN (Vehicle Identification Number). The purchase agreement should also specify the date of purchase, the price paid, and any applicable discounts or incentives. Keep in mind that the tax credit is typically tied to the original purchase price, so having this information readily available is vital.

Vehicle Information: Along with the purchase agreement, collect all relevant vehicle details. This includes the vehicle's battery capacity (in kilowatt-hours, kWh) and the range it can achieve on a single charge. These specifications are often found in the vehicle's owner's manual or on the manufacturer's website. Additionally, gather any other documentation related to the vehicle's performance, such as EPA fuel economy estimates or manufacturer-provided specifications.

Additional Supporting Documents: Depending on your specific situation, there might be other documents to consider. For instance, if you purchased the vehicle from a dealership, you may need a bill of sale or a dealer-issued certificate of purchase. In some cases, you might also need to provide proof of residency, such as a utility bill or a driver's license, to verify your eligibility for the tax credit.

Organize and Store: Once you've gathered all these documents, organize them in a structured manner. Create a folder or a digital file named "Electric Vehicle Tax Credit" and store all the relevant papers within it. Ensure that each document is clearly labeled and easily accessible. This organized approach will make the tax credit claim process smoother and more efficient when you're ready to file your taxes.

Remember, the IRS (Internal Revenue Service) has specific guidelines for electric vehicle tax credits, and providing accurate and complete documentation is essential to ensure a smooth claiming process. By gathering these documents in advance, you'll be well-prepared to take advantage of the tax benefits associated with your electric vehicle purchase.

India's Electric Vehicle Revolution: Ready for the Future?

You may want to see also

Filing Process: Understand the steps to file for the credit on your tax return using Turbotax

To claim the electric vehicle (EV) tax credit through Turbotax, you'll need to follow a series of steps to ensure you maximize your benefits and comply with the IRS regulations. Here's a breakdown of the process:

- Gather Required Information: Before you begin, have all the necessary documents and information readily available. This includes proof of your EV purchase, such as the sales invoice or a statement from the dealership. You'll also need your vehicle identification number (VIN), which is typically found on the vehicle's title or registration. Additionally, gather your personal financial information, such as income, deductions, and any other relevant tax details.

- Determine Eligibility: The EV tax credit is available to individuals who purchase or lease qualified electric vehicles. Ensure your vehicle meets the IRS criteria for EV credits. This includes factors like battery capacity, vehicle weight, and the use of a qualified battery component. Turbotax can guide you through the eligibility process, helping you understand if your vehicle qualifies for the credit.

- Calculate the Credit: Turbotax will assist you in calculating the amount of the EV tax credit you're entitled to. This calculation considers factors such as the vehicle's battery capacity, the percentage of domestically produced battery components, and the vehicle's weight. The software will provide a clear breakdown of the credit amount based on your vehicle's specifications.

- File Your Tax Return: When filing your tax return using Turbotax, navigate to the section related to credits and deductions. Locate the electric vehicle tax credit section and input the calculated credit amount. Turbotax will guide you through the process, ensuring you select the correct credit type and provide all necessary details. Double-check all information to avoid any errors.

- Review and Submit: Before finalizing your tax return, review the entire filing process. Turbotax often provides a summary of the credits claimed, allowing you to verify the accuracy of the information. If everything looks correct, submit your tax return. You may choose to e-file or print and mail your return, depending on your preference and Turbotax's options.

Remember, Turbotax is designed to simplify the tax filing process, and their software can provide real-time assistance throughout the journey. It's essential to keep accurate records and consult the IRS guidelines for any specific requirements or changes in regulations.

Unraveling the Power of Electric Vehicle Technology: A Comprehensive Guide

You may want to see also

Claiming Methods: Learn how to claim the credit, either as a refund or a reduction in tax liability

To claim the electric vehicle (EV) tax credit through Turbotax, you'll need to follow a structured process to ensure you maximize your benefits and comply with the IRS regulations. Here's a step-by-step guide on how to claim the credit, either as a refund or a reduction in your tax liability:

- Gather Required Information: Before you begin, ensure you have all the necessary documentation and information at hand. This includes proof of purchase for your electric vehicle, such as the sales invoice or bill of sale. You'll also need to provide details about the vehicle's battery capacity and the make and model of the car. These details are crucial for calculating the credit amount.

- Determine Your Credit Amount: The EV tax credit is calculated based on the vehicle's battery capacity and the make and model. You can find the specific credit amount for your vehicle by referring to the IRS's EV tax credit tables or using online resources. Turbotax provides tools to help you calculate this, ensuring you get the correct credit amount.

- File Your Tax Return: When filing your tax return with Turbotax, you have the option to claim the credit as a refund or as a reduction in your tax liability. If you choose to receive a refund, Turbotax will automatically calculate the credit and adjust your refund amount accordingly. Alternatively, you can apply the credit to reduce your tax liability, which means you'll pay less in taxes owed.

- Complete the Necessary Forms: Turbotax will guide you through the process of filling out the appropriate forms to claim the EV tax credit. You'll need to provide details about your vehicle purchase, including the date of purchase, the vehicle's specifications, and the amount paid. The software will ensure that you select the correct credit type (refund or reduction) and calculate the applicable amount.

- Review and Submit: Before submitting your tax return, review the calculations and adjustments made by Turbotax. Ensure that all the information provided is accurate and up-to-date. Once you're satisfied, submit your return. If you've chosen to receive a refund, you'll receive the credit amount as part of your refund. If you've opted for a reduction in tax liability, the credit will be applied to your tax bill.

Remember, it's essential to stay updated with the latest IRS guidelines and regulations regarding EV tax credits, as they may change over time. Turbotax provides resources and support to help you navigate these changes, ensuring you claim your credit accurately and efficiently.

Unleash Savings: Tax Incentives for Your Electric Vehicle Journey

You may want to see also

Deadlines: Be aware of the tax filing deadlines to ensure timely submission of the EV tax credit

Understanding the tax filing deadlines is crucial when it comes to claiming the electric vehicle (EV) tax credit. This is a significant incentive for EV buyers, and missing the deadline could result in losing out on this valuable benefit. The Internal Revenue Service (IRS) sets specific dates for tax returns, and it's essential to be aware of these deadlines to ensure you don't miss out on your well-deserved EV tax credit.

For the current tax year, the deadline for filing federal income tax returns is typically April 15. However, if this date falls on a weekend or holiday, the deadline is extended to the following Monday. It's important to mark this date on your calendar to avoid any surprises. When it comes to the EV tax credit, the IRS has a separate process, and the deadline for claiming this credit is generally the same as the federal tax filing deadline. This means that if you purchased your EV before the end of the tax year, you should file your tax return by the deadline to claim the credit.

In addition to the federal deadline, some states may have their own tax filing requirements and deadlines. It's essential to check with your state's tax authority to ensure compliance with state-specific regulations. State tax returns often have different due dates, and failing to meet these deadlines could result in penalties. Therefore, it's crucial to be well-informed about both federal and state tax obligations.

To ensure a smooth and timely process, consider the following steps: Firstly, keep track of the purchase date of your EV and the tax year in which the purchase was made. This information is vital for determining the correct tax filing period. Secondly, familiarize yourself with the IRS guidelines for EV tax credits, as they provide detailed instructions on how and when to claim the credit. Lastly, if you're using tax preparation software like TurboTax, ensure that you input the necessary information accurately and on time to avoid any processing delays.

In summary, being mindful of tax filing deadlines is essential to successfully claiming the EV tax credit. By understanding the federal and, if applicable, state tax deadlines, you can take the necessary steps to ensure a timely submission. Remember, proper planning and attention to detail will help you maximize this financial incentive for your EV purchase.

Jeep's Electric Future: A Green Revolution?

You may want to see also

Frequently asked questions

The electric vehicle (EV) tax credit is a financial incentive offered by the U.S. government to encourage the purchase of qualified electric vehicles. The credit can significantly reduce the cost of buying an EV, making it more affordable for consumers. To claim this credit, you must meet specific criteria and follow the necessary steps, which can be facilitated through tax preparation software like TurboTax.

To qualify, you must purchase a new electric vehicle that meets the IRS's criteria, which includes factors like battery capacity and vehicle weight. TurboTax guides you through the process, ensuring you provide the required information. You'll need to fill out Form 8936, "Qualified Electric Vehicle Tax Credit," and provide details about your vehicle purchase. TurboTax's step-by-step process simplifies this, ensuring you don't miss any crucial details.

Yes, there are certain limitations. The credit is generally limited to the amount of the vehicle's sale price, and it cannot exceed $7,500. Additionally, the vehicle must be new and acquired primarily for personal use. TurboTax provides clear instructions on how to calculate and claim the credit, ensuring you understand the limitations and can maximize your benefits.