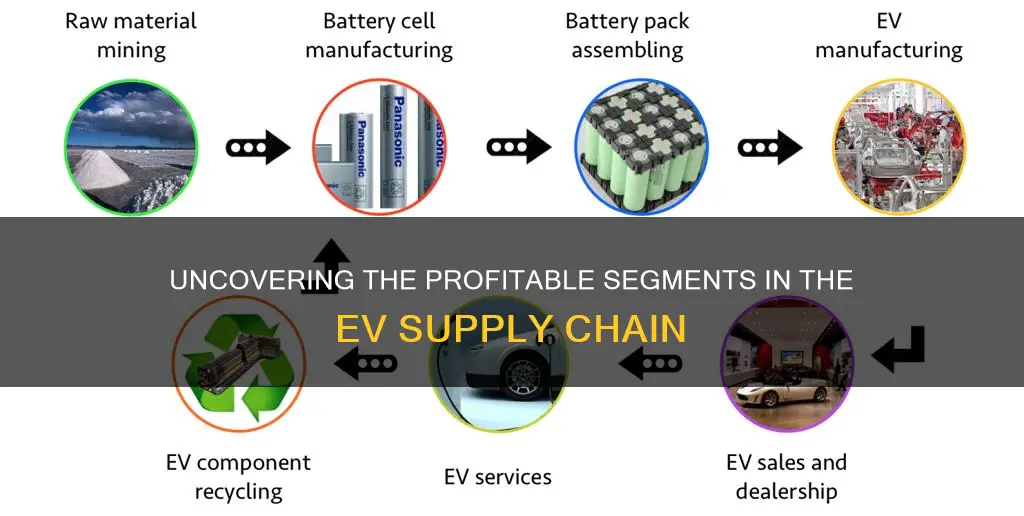

The electric vehicle (EV) market is experiencing rapid growth, and with it, a complex supply chain that spans multiple industries and geographic regions. As the demand for EVs continues to rise, understanding the financial dynamics within this supply chain becomes increasingly crucial. This paragraph delves into the financial landscape of the EV supply chain, exploring the revenue streams and cost structures that shape the industry. From raw material extraction to battery manufacturing, vehicle assembly, and the distribution of finished products, each stage of the supply chain presents unique opportunities and challenges. By examining these aspects, we can gain insights into the profitability and investment potential across various segments of the EV industry.

What You'll Learn

- Battery Manufacturing: Focus on lithium-ion cell production and supply chain optimization

- Charging Infrastructure: Development of charging stations and the associated financial models

- Recycling and Circular Economy: Strategies for end-of-life battery recycling and resource recovery

- Raw Material Sourcing: Exploration of sustainable mining practices and supply chain transparency

- Market Dynamics: Analysis of EV market growth and its impact on supply chain profitability

Battery Manufacturing: Focus on lithium-ion cell production and supply chain optimization

The electric vehicle (EV) market is experiencing rapid growth, and at the heart of this revolution is the lithium-ion battery. These batteries are the power source for EVs, and their production and supply chain optimization are critical to the industry's success. Here's an overview of the financial opportunities in lithium-ion cell manufacturing and supply chain management:

Battery Manufacturing: A Profitable Venture

The production of lithium-ion cells is a complex process that involves multiple stages, from raw material extraction to cell assembly. This industry has become a significant focus for investors due to the high demand for EVs and the subsequent need for advanced battery technology. Lithium-ion cell manufacturers are in a unique position to capitalize on this growing market. The key to profitability lies in scaling production efficiently while maintaining high-quality standards. Companies that can streamline manufacturing processes, reduce costs, and ensure consistent performance will gain a competitive edge. Advanced manufacturing techniques, such as automation and AI-driven quality control, are essential to achieving this.

Supply Chain Optimization: Securing Raw Materials

The supply chain for lithium-ion batteries is intricate and globally interconnected. It begins with the extraction of raw materials, primarily lithium, cobalt, and nickel. These materials are sourced from various regions worldwide, and their availability and pricing can significantly impact production costs. Optimizing the supply chain involves securing stable and sustainable sources of these raw materials. This includes negotiating long-term contracts with suppliers, implementing recycling programs to reduce reliance on virgin resources, and exploring innovative extraction methods. By ensuring a consistent supply of high-quality raw materials, battery manufacturers can maintain production efficiency and reduce the risk of supply chain disruptions.

Vertical Integration: A Strategic Move

Many battery manufacturers are adopting a vertical integration strategy to gain control over the entire supply chain. This approach involves investing in or acquiring businesses at different stages of the supply chain, from raw material processing to component manufacturing. By doing so, companies can reduce costs, improve product quality, and ensure a steady supply of critical components. For instance, a battery manufacturer might establish its own lithium mine, process the raw material, and then build the cells in-house. This level of control allows for better cost management and faster response to market demands.

Innovation and Research: Staying Ahead

The EV battery market is highly competitive, and innovation is key to staying ahead. Battery manufacturers are investing in research and development to create more efficient, longer-lasting, and safer lithium-ion cells. This includes exploring solid-state batteries, improving energy density, and developing advanced cooling systems. Companies that can introduce groundbreaking technologies and improve battery performance will attract more customers and secure a larger market share. Additionally, staying updated with the latest industry trends and regulations is essential to ensure compliance and maintain a competitive advantage.

In summary, battery manufacturing and supply chain optimization are critical aspects of the electric vehicle industry, offering significant financial opportunities. By focusing on efficient production, raw material sourcing, vertical integration, and innovation, companies can thrive in this rapidly evolving market. As the demand for EVs continues to rise, the players who master these aspects will be well-positioned to capture a substantial share of the lucrative EV battery supply chain.

Powering the Future: Essential Resources for Electric Vehicles

You may want to see also

Charging Infrastructure: Development of charging stations and the associated financial models

The development of charging infrastructure is a critical component of the electric vehicle (EV) supply chain, and it presents a significant opportunity for investment and revenue generation. As the adoption of EVs continues to grow, the demand for convenient and efficient charging stations will skyrocket. This creates a lucrative market for businesses and investors looking to capitalize on the EV revolution.

The financial models associated with charging infrastructure development are multifaceted and can be broken down into several key areas. Firstly, the initial capital expenditure (capex) required to build and install charging stations is substantial. This includes the cost of land acquisition, station construction, equipment purchase, and installation. The capex can vary depending on factors such as location, station type, and the number of chargers. For instance, fast-charging stations in urban areas might require higher investments due to land costs and the need for specialized equipment.

Once the charging stations are operational, the revenue model comes into play. There are several ways to generate income from these stations:

- Subscription and Membership: Offering monthly or annual subscription plans for unlimited charging can attract EV owners. This model provides a steady revenue stream and encourages long-term customer loyalty.

- Pay-as-You-Go: Customers can pay per session or per minute, providing flexibility but potentially lower revenue per user.

- Dynamic Pricing: Adjusting prices based on demand, time of day, or other factors can optimize revenue. For example, charging during off-peak hours might be cheaper, encouraging usage when demand is lower.

- Corporate Partnerships: Businesses can invest in or sponsor charging stations, especially in commercial areas, and offer exclusive services or discounts to their customers.

The financial viability of charging infrastructure projects often relies on a combination of these revenue streams and strategic partnerships. For instance, a partnership between a charging station operator and an energy company could provide an integrated solution, where customers can not only charge their vehicles but also purchase renewable energy at the station. This integrated approach can enhance the customer experience and provide additional revenue opportunities.

In summary, the development of charging stations offers a range of financial prospects. It requires significant upfront investment, but the potential for revenue generation through various pricing models and partnerships is substantial. As the EV market expands, the charging infrastructure will become a vital part of the ecosystem, driving innovation and creating new business opportunities. Understanding the financial dynamics of this sector is essential for investors and entrepreneurs looking to tap into the lucrative world of electric vehicle charging.

Unveiling the Materials: Inside Electric Vehicle Construction

You may want to see also

Recycling and Circular Economy: Strategies for end-of-life battery recycling and resource recovery

The electric vehicle (EV) market is experiencing rapid growth, and with it, the demand for sustainable practices in the supply chain is becoming increasingly important. One of the critical aspects of this sustainability focus is the end-of-life (EOL) management of EV batteries, which presents both challenges and opportunities for the industry. The recycling and circular economy strategies for EOL battery recycling and resource recovery are essential to ensure a sustainable future for the EV industry.

EOL batteries from EVs contain valuable materials such as lithium, cobalt, nickel, and rare earth elements, which can be recovered and reused. The process of recycling these batteries is complex and requires specialized techniques. One common method is hydrometallurgy, which involves dissolving the battery materials in a chemical solution to separate and recover the metals. This process can be optimized to minimize environmental impact and maximize resource recovery. For instance, lithium can be extracted through a process called lithium extraction, where it is dissolved and then precipitated, allowing for its reuse in new batteries.

Another strategy is pyrometallurgy, which uses high-temperature processes to melt and separate the battery components. This method is more energy-intensive but can be effective for certain types of batteries. The key is to develop efficient and environmentally friendly recycling processes that can handle the diverse range of battery chemistries used in EVs. Advanced recycling techniques, such as direct recycling, aim to recover materials directly from spent batteries without extensive preprocessing, making the process more cost-effective and sustainable.

Implementing a circular economy model for EV batteries involves more than just recycling. It requires a holistic approach to design, production, and end-of-life management. Manufacturers can design batteries with recyclability in mind, using materials that are easier to separate and recover. This includes developing batteries with modular designs, allowing for individual component replacement instead of entire battery packs being discarded. Additionally, creating a closed-loop system where recovered materials are fed back into the production process can significantly reduce costs and environmental impact.

In summary, the financial opportunities in the electric vehicle supply chain are closely tied to the implementation of effective recycling and circular economy strategies. By focusing on EOL battery recycling and resource recovery, the industry can ensure a sustainable future. This includes adopting advanced recycling technologies, optimizing processes to minimize environmental harm, and embracing a circular economy model that promotes the reuse and recycling of valuable materials. With these strategies, the EV industry can not only meet the growing demand for electric transportation but also contribute to a more sustainable and profitable supply chain.

Uncover the Top EV Tax Rebate Destinations

You may want to see also

Raw Material Sourcing: Exploration of sustainable mining practices and supply chain transparency

The electric vehicle (EV) market is experiencing rapid growth, and with it, a heightened focus on the sustainability and transparency of its supply chain. At the heart of this industry are the raw materials that power EVs, from lithium and cobalt to rare earth elements. As the demand for these materials soars, there is an urgent need to explore and implement sustainable mining practices to ensure a responsible and ethical supply.

Sustainable mining practices aim to minimize environmental impact, protect local communities, and promote economic development. This involves adopting cleaner extraction methods, such as using renewable energy sources for mining operations and implementing water recycling systems to reduce the strain on local resources. For instance, lithium mining, a critical process for EV batteries, can be optimized by employing in-situ leaching techniques, which extract lithium from underground reserves without the need for extensive open-pit mining. This method significantly reduces land disturbance and water usage compared to traditional mining.

Transparency in the supply chain is another crucial aspect of responsible raw material sourcing. EV manufacturers and suppliers must ensure that their supply chains are free from conflict minerals, which are often associated with human rights abuses and environmental degradation. By implementing robust due diligence processes, companies can trace the origin of their materials, verify their sustainability, and ensure fair labor practices throughout the supply chain. This level of transparency allows consumers to make informed choices, supporting brands that prioritize ethical sourcing.

Furthermore, the financial incentives for adopting sustainable practices are compelling. Investors are increasingly considering environmental, social, and governance (ESG) factors when making investment decisions. Companies that demonstrate a commitment to sustainable mining and supply chain transparency can attract positive attention from investors, leading to improved access to capital and a stronger market position. This financial motivation, coupled with the growing consumer demand for eco-friendly products, creates a powerful incentive for the EV industry to prioritize sustainable raw material sourcing.

In conclusion, the electric vehicle supply chain presents a unique opportunity to revolutionize raw material sourcing. By embracing sustainable mining practices and supply chain transparency, the industry can ensure a responsible and ethical approach to extracting the materials needed for EV production. This not only benefits the environment and local communities but also positions the EV sector as a leader in sustainable innovation, attracting investors and consumers alike. As the market continues to evolve, the focus on sustainability will only intensify, making it imperative for companies to adopt these practices to stay competitive and contribute to a greener future.

Electric Vehicle Owners: Taxed for a Greener Future?

You may want to see also

Market Dynamics: Analysis of EV market growth and its impact on supply chain profitability

The electric vehicle (EV) market has experienced remarkable growth in recent years, driven by increasing environmental concerns, government incentives, and consumer demand for sustainable transportation. This rapid expansion has had a profound impact on the automotive supply chain, presenting both opportunities and challenges for various stakeholders. Understanding the market dynamics and the evolving landscape of the EV supply chain is crucial for businesses to capitalize on the growing demand for electric vehicles.

One of the key factors contributing to the market growth is the rising awareness of climate change and the need for sustainable alternatives. Governments worldwide have implemented policies and incentives to encourage the adoption of EVs, such as tax credits, subsidies, and the development of charging infrastructure. These initiatives have successfully driven consumer interest, leading to a surge in EV sales. As a result, the supply chain for electric vehicles has become increasingly complex, requiring a diverse range of components and specialized manufacturing processes.

The growth of the EV market has led to a shift in the focus of the automotive industry towards electric powertrains, batteries, and associated technologies. This transition has created new revenue streams for suppliers and manufacturers. For instance, the demand for lithium-ion batteries, a critical component in EVs, has skyrocketed. Companies specializing in battery production and technology have seen significant growth, as they cater to the needs of EV manufacturers. Additionally, the development of advanced charging systems and power electronics has opened up opportunities for innovation and market expansion.

However, the rapid growth also presents challenges for the supply chain. The increased demand for raw materials, such as lithium, cobalt, and nickel, has led to concerns about resource scarcity and ethical sourcing. As a result, supply chain managers must navigate complex logistics and ensure a stable supply of these critical materials. Moreover, the specialized nature of EV components requires manufacturers to invest in new production facilities and adapt their supply chains to meet the specific demands of electric vehicles.

In terms of profitability, the EV market dynamics have created a unique landscape. While the initial investment in EV technology and infrastructure may be substantial, the long-term benefits are promising. The growing market share of EVs is expected to lead to economies of scale, reducing production costs and increasing profitability for manufacturers. Additionally, the development of a robust charging network will further stimulate market growth and provide opportunities for revenue generation through service offerings.

In summary, the EV market's growth has significantly influenced the supply chain, presenting both opportunities and challenges. The demand for electric vehicles has spurred innovation, created new revenue streams, and driven the development of specialized components. However, supply chain managers must address resource constraints and adapt to the unique requirements of EV manufacturing. By understanding these market dynamics, businesses can strategically position themselves to thrive in the evolving electric vehicle supply chain.

Electric Vehicles: Green Revolution or Environmental Trade-Off?

You may want to see also

Frequently asked questions

The cost of raw materials, such as lithium, cobalt, and nickel, is a significant expense in the EV battery supply chain. These materials are sourced from various regions globally, and their prices can fluctuate based on market demand and geopolitical factors. The distribution often involves mining operations, followed by processing and refining, which are then supplied to battery manufacturers.

Financial incentives play a crucial role in promoting EV adoption. Governments and organizations worldwide offer subsidies, tax credits, and grants to consumers and businesses purchasing electric vehicles. These incentives aim to reduce the upfront cost barrier and encourage the transition to electric mobility. The benefits are directly passed on to consumers, making EVs more affordable and attractive to potential buyers.

Yes, dedicated funding sources have been established to support the expansion of charging infrastructure for electric vehicles. Governments and private investors provide grants, loans, and tax benefits to companies and organizations building charging stations. These funds are essential to ensure the availability of convenient charging options, which is critical for widespread EV adoption.

The revenue from EV sales is distributed across various stakeholders in the supply chain. This includes manufacturers, suppliers of components (such as batteries, motors, and electronics), and dealers or retailers. A significant portion of the revenue goes to the manufacturer, but suppliers and retailers also earn a share based on their contributions to the overall production and distribution process.

The EV supply chain can have diverse economic impacts on various regions. Manufacturing hubs for EVs and their components can create jobs and stimulate local economies. Regions with abundant natural resources for battery production may experience increased economic activity. However, areas heavily reliant on traditional automotive industries might face challenges during the transition, requiring strategic planning and support to ensure a just and sustainable shift.