The federal electric vehicle (EV) credit is a significant incentive for consumers to purchase electric cars, offering a substantial tax credit of up to $7,500 per vehicle. However, understanding the refundability of this credit is crucial for EV buyers. This paragraph will explore the intricacies of the federal EV credit, focusing on whether it is refundable and how it impacts the overall financial benefits for EV owners.

| Characteristics | Values |

|---|---|

| Refundability | Non-refundable |

| Eligibility | Available to individuals and businesses purchasing new electric vehicles (EVs) |

| Credit Amount | Up to $7,500 per vehicle |

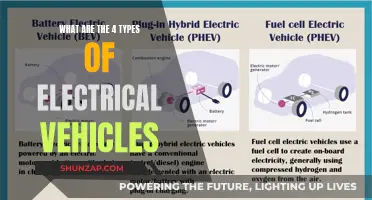

| Vehicle Types | Battery electric vehicles (BEVs) and fuel cell electric vehicles (FCEVs) |

| Income Limit | Not specified, but may be subject to phase-out for high-income earners |

| Tax Year | Claimable in the tax year the vehicle is placed in service |

| Documentation | Requires proof of purchase, vehicle specifications, and other relevant documents |

| Refund Process | Claimed as a credit against federal income tax liability |

| Recent Changes | The credit was temporarily suspended in 2023 but is expected to resume in 2024 |

| Alternative Incentives | Some states offer additional incentives and rebates for EV purchases |

What You'll Learn

Eligibility: Who qualifies for the federal EV tax credit?

The federal EV tax credit is a financial incentive designed to encourage the purchase of electric vehicles (EVs) in the United States. This credit is a significant benefit for EV buyers, as it can provide a substantial refund on their federal income taxes. However, eligibility for this credit is not open to everyone; it is specifically targeted at individuals who meet certain criteria.

To qualify for the federal EV tax credit, you must be a U.S. citizen or resident alien. This means that non-residents, including permanent residents and green card holders, are generally not eligible. Additionally, the vehicle must be purchased from a dealership or retailer that is authorized to sell EVs and has a valid federal tax identification number. This ensures that the business is legitimate and can provide the necessary documentation for the credit.

Another important eligibility factor is the type of vehicle. The credit applies to the purchase of new electric vehicles, including battery-electric cars, plug-in hybrid electric vehicles, and fuel cell electric vehicles. However, it does not cover used EVs, and the vehicle must be acquired primarily for personal use. The credit amount also depends on the vehicle's price and the taxpayer's income level. Generally, the credit is available for vehicles with a manufacturer's suggested retail price (MSRP) of $80,000 or less, and the credit amount decreases for vehicles above this price point.

Furthermore, the credit is generally available to individuals who file a federal income tax return and have a modified adjusted gross income (AGI) below a certain threshold. For tax years 2022 and 2023, the income limit for individuals is $150,000, and for married filing jointly, it is $300,000. The credit is phased out for taxpayers with AGI above these limits, and the phase-out begins at $150,000 for individuals and $300,000 for joint filers.

It is essential to note that the federal EV tax credit has specific rules and limitations, and understanding these eligibility criteria is crucial for those considering purchasing an electric vehicle. The credit can significantly impact the overall cost of the vehicle, making it more affordable for eligible buyers.

The Electric Revolution: Are Americans Ready to Go Green?

You may want to see also

Refund Process: How is the credit refunded to taxpayers?

The process of refunding the federal electric vehicle credit to taxpayers involves a specific mechanism designed to ensure that eligible individuals and businesses receive the financial incentive for purchasing electric vehicles. When a taxpayer qualifies for this credit, they can claim it as a refund on their tax return, which can be particularly beneficial for those who have already paid taxes for the year. Here's an overview of how the refund process works:

Claiming the Credit: Taxpayers can claim the federal electric vehicle credit when filing their annual tax return. This credit is typically available for individuals who have purchased or leased a qualified electric vehicle. The credit amount varies depending on the vehicle's battery capacity and the taxpayer's income level. To claim this credit, individuals must provide detailed information about the vehicle purchase or lease, including the vehicle's make, model, and battery specifications.

Refund Calculation: Once the tax return is filed, the Internal Revenue Service (IRS) calculates the refund amount based on the claimed credit. The refund is essentially the credit amount that the taxpayer is entitled to, considering their tax liability for the year. For instance, if a taxpayer has a federal income tax liability of $5,000 and is eligible for a $7,500 electric vehicle credit, they will receive a refund of $2,500. This refund is processed directly to the taxpayer's bank account or in the form of a check, depending on their preferred payment method.

Processing Time: The time it takes for the refund to be processed and received by the taxpayer can vary. Typically, the IRS aims to process tax returns and issue refunds within a specific timeframe. However, during peak tax seasons, there may be delays. Taxpayers can use the IRS's online tools or the 'Where's My Refund?' feature to track the status of their refund and estimate when it will be received.

Documentation and Verification: To ensure the accuracy of the refund process, taxpayers may be required to provide additional documentation. This could include proof of vehicle purchase or lease, such as sales invoices or lease agreements. The IRS verifies the claimed credit to ensure compliance with the program's regulations, and any discrepancies or errors may result in adjustments to the refund amount.

It is important for taxpayers to stay informed about the latest guidelines and requirements for claiming the federal electric vehicle credit, as the rules may change over time. Seeking professional tax advice can also ensure that taxpayers maximize their benefits and navigate the refund process smoothly.

Cadillac's Electric Revolution: The Future of Luxury EVs

You may want to see also

Timing: When is the refund typically issued?

The timing of the refund for the federal electric vehicle credit can vary depending on several factors, and understanding these factors is crucial for those seeking financial relief for their electric vehicle purchases. Typically, the Internal Revenue Service (IRS) processes these refunds within a standard timeframe, ensuring that eligible taxpayers receive their credits promptly.

Once a tax return is filed and the credit is claimed, the IRS usually processes the refund within a few weeks. This processing period allows the IRS to verify the accuracy of the information provided and ensure compliance with the tax laws. After a successful review, the refund is issued, and the funds are typically deposited into the taxpayer's bank account or issued as a check, depending on the preferred payment method.

In some cases, the IRS may require additional documentation or clarification, which can extend the processing time. This additional scrutiny is a standard procedure to prevent fraud and ensure the integrity of the tax system. Taxpayers should be prepared to provide any necessary supporting documents, such as proof of vehicle purchase and ownership, to expedite the refund process.

It is important to note that the IRS provides regular updates and guidelines on their website regarding the status of refunds. Taxpayers can use these resources to track their refund and understand any potential delays. Additionally, contacting the IRS directly can provide further insights into the expected timeline for receiving the refund, especially if there are specific circumstances or issues with the tax return.

For those who have already filed their tax return and claimed the credit, the anticipation of the refund can be a significant financial boost, especially for those who have invested in electric vehicles. Understanding the typical processing time and being aware of potential factors that may influence the refund's issuance can help manage expectations and provide a more accurate timeline for receiving the financial benefit.

Unleash India's EV Potential: A Guide to Starting Your Green Venture

You may want to see also

Documentation: What paperwork is required for a refund?

When it comes to the federal electric vehicle (EV) tax credit, understanding the refund process and the required documentation is crucial for eligible taxpayers. The credit is designed to incentivize the purchase of electric vehicles, and knowing the refund procedure ensures you can access the financial benefits effectively. Here's an overview of the paperwork you'll need:

- Sales or Lease Agreement: The primary document is the sales or lease agreement for the electric vehicle. This agreement should clearly state the purchase or lease details, including the vehicle's make, model, and specifications. It should also mention the date of purchase or lease and the price or lease amount. Keep in mind that the agreement must be from a qualified dealer or manufacturer, as specified by the IRS.

- IRS Form 8936: This is a crucial form for claiming the federal EV tax credit. It is used to report the amount of the credit you are claiming and provides details about the vehicle purchase. You'll need to fill out Form 8936, including information such as your name, address, Social Security number, and the vehicle's identification number (VIN). The form also requires details about the dealer or manufacturer and the specific vehicle model.

- Supporting Documents: Along with the sales or lease agreement and Form 8936, you may need additional supporting documents. These could include a copy of the vehicle's title, registration, or any other official documentation that verifies the vehicle's ownership and compliance with the credit requirements. In some cases, you might also need to provide proof of the vehicle's environmental attributes, such as its carbon dioxide emissions or fuel efficiency.

- Timely Submission: It's essential to submit the required documentation promptly to ensure a smooth refund process. The IRS has specific deadlines for claiming the EV tax credit, and late submission may result in delays or even the loss of the credit. Keep copies of all submitted documents for your records, and ensure you have the necessary information readily available to support your refund claim.

Understanding the refund process and gathering the required paperwork in advance can help ensure a seamless experience when claiming the federal electric vehicle credit. It is always advisable to consult the IRS guidelines or seek professional advice to ensure compliance with the latest regulations and requirements.

Powering Up: A Beginner's Guide to Home EV Charging

You may want to see also

Limitations: Are there any restrictions on refundability?

The Federal Electric Vehicle Credit, a significant incentive for the adoption of electric vehicles (EVs), has sparked interest among consumers and manufacturers alike. However, understanding the nuances of this credit, particularly regarding its refundability, is essential for maximizing its benefits. While the credit itself is designed to promote the purchase of EVs, the process of claiming and refunding it comes with certain limitations and restrictions that individuals should be aware of.

One of the primary limitations is the eligibility criteria for the credit. The credit is typically available to individuals who purchase or lease a new electric vehicle, but there are specific requirements that must be met. For instance, the vehicle must be purchased or leased from a dealership or manufacturer that participates in the federal credit program. Additionally, the vehicle must meet certain environmental and performance standards set by the Internal Revenue Service (IRS). These standards ensure that the vehicle contributes significantly to reducing greenhouse gas emissions and improving fuel efficiency.

Refundability is a critical aspect of this credit, and there are restrictions in place to prevent abuse and ensure the program's integrity. Firstly, the credit is generally non-refundable, meaning that if the purchase price of the EV exceeds the credit amount, the excess cannot be refunded to the taxpayer. This limitation ensures that the credit is used to offset the cost of the vehicle itself rather than being claimed as a refund. Secondly, the credit has a cap on the amount that can be claimed in a single year, which is currently set at $7,500 for new EVs and $4,500 for used EVs. This cap prevents individuals from claiming the full credit in a single transaction, encouraging a more gradual and sustainable approach to EV adoption.

Furthermore, there are restrictions on the types of vehicles eligible for the credit. The IRS has defined specific categories of EVs, including battery-electric vehicles, plug-in hybrid electric vehicles, and fuel cell vehicles. Each category has its own set of requirements and limitations. For instance, the credit for used EVs is limited to vehicles that have been owned and used primarily in the United States for at least the previous six consecutive months. These restrictions ensure that the credit is targeted towards vehicles that meet specific criteria and contribute to the environmental benefits intended by the program.

In summary, while the Federal Electric Vehicle Credit offers a valuable incentive for EV adoption, it is important to understand the limitations and restrictions associated with its refundability. The eligibility criteria, non-refundable nature, and caps on credit amounts are designed to ensure the program's effectiveness and prevent misuse. By being aware of these limitations, individuals can make informed decisions when purchasing an electric vehicle and maximize the benefits of this federal initiative.

Unleash Savings: Your Guide to Federal EV Credit Claims

You may want to see also

Frequently asked questions

The Federal EV Credit, also known as the Clean Vehicle Credit, is a financial incentive provided by the U.S. government to encourage the purchase of new electric vehicles. This credit is designed to promote the adoption of electric cars and reduce greenhouse gas emissions.

The credit amount varies depending on the vehicle's battery capacity and the manufacturer's compliance with certain production requirements. For model year 2023, the credit ranges from $2,500 to $7,500 per vehicle, with specific eligibility criteria.

Yes, the credit is generally refundable. If the credit exceeds the taxpayer's tax liability, the excess amount can be refunded to the vehicle buyer. This refund process allows individuals to receive a cash payment if the credit they are entitled to is more than what they owe in taxes.

Yes, there are income limits in place for this credit. The credit is generally available to individuals with adjusted gross income (AGI) of up to $150,000 for single filers and $300,000 for joint filers. However, the credit phases out for income above these thresholds.

No, the Federal EV Credit is specifically designed for buyers of electric vehicles, not lessees. To qualify, the vehicle must be purchased and registered in the buyer's name.