Electric vehicles (EVs) are becoming increasingly popular due to their environmental benefits and technological advancements. As the world shifts towards sustainable transportation, many drivers are curious about the financial incentives and tax benefits associated with owning an electric car. Governments and organizations worldwide are offering various tax breaks and subsidies to encourage the adoption of EVs, which can significantly reduce the overall cost of ownership for EV buyers. This paragraph aims to explore these tax advantages, highlighting how they contribute to making electric vehicles a more attractive and affordable choice for environmentally conscious consumers.

What You'll Learn

- Tax Credits: Federal and state tax credits for EV purchases

- Sales Tax Exemption: Some states exempt EV buyers from sales tax

- Property Tax Deductions: EVs may qualify for property tax breaks

- Renewable Energy Credits: Tax benefits for using renewable energy sources

- Business Deductions: Businesses can deduct EV-related expenses from taxes

Tax Credits: Federal and state tax credits for EV purchases

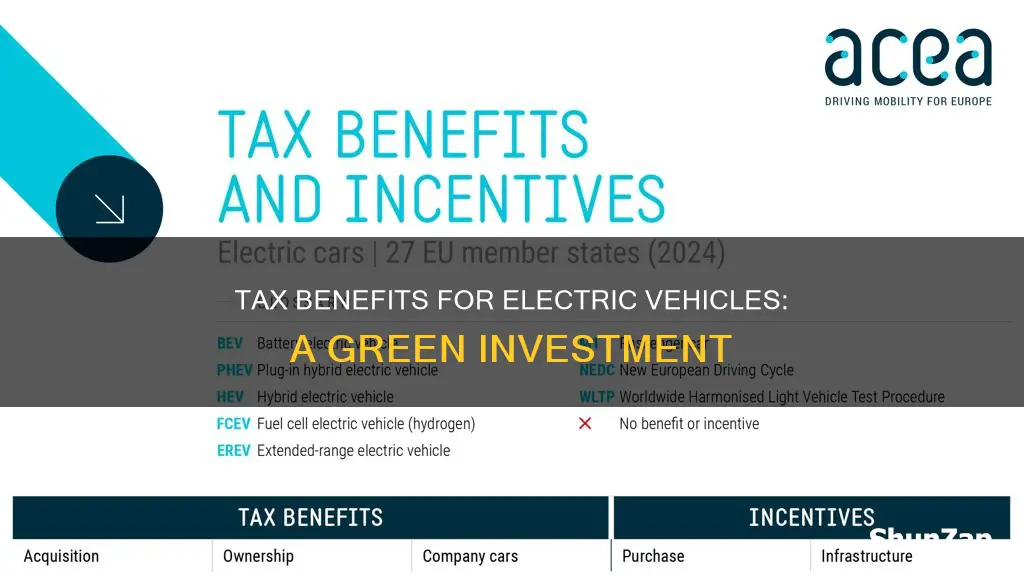

The United States government and many state governments offer tax credits and incentives to encourage the adoption of electric vehicles (EVs). These financial benefits can significantly reduce the overall cost of purchasing an EV, making it more affordable and attractive to consumers. Here's an overview of the tax credits available for EV buyers:

Federal Tax Credits:

The federal government provides a significant tax credit for EV purchases, which has been a driving force in the EV market's growth. As of my cutoff date, the tax credit for electric vehicles is available for new purchases made after December 31, 2020. The credit amount varies depending on the vehicle's battery capacity and the manufacturer's compliance with certain production requirements. Initially, the credit was set at $7,500 per qualified EV, but it was temporarily reduced to $3,750 for vehicles with a battery capacity of less than 40 kWh. However, the full $7,500 credit is available for vehicles with a higher battery capacity. This credit is a direct reduction in the purchase price, making EVs more accessible to buyers. To qualify, the vehicle must be new and purchased from an eligible manufacturer, and it should be used primarily for personal transportation.

State-Level Incentives:

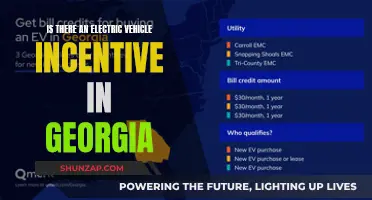

In addition to federal tax credits, many states offer their own incentives to promote EV adoption. These state-level programs can provide additional savings for EV buyers. For example, California's Clean Vehicle Rebate Project offers rebates of up to $2,500 for the purchase or lease of new electric cars and $1,500 for plug-in hybrid vehicles. New York State provides a similar incentive, offering a maximum rebate of $2,000 for new EV purchases. Other states like Oregon, Washington, and Massachusetts also have their own rebate programs with varying credit amounts and eligibility criteria. These state-specific incentives can further reduce the financial burden of buying an EV, making it an even more appealing option for environmentally conscious consumers.

It's important to note that tax credit and incentive programs are subject to change and may have specific requirements and limitations. Therefore, potential EV buyers should research the most up-to-date information from official government sources and consult with tax professionals to understand the full range of benefits available in their respective regions. These tax credits and incentives play a crucial role in making electric vehicles more affordable and accessible to the general public, contributing to a greener and more sustainable transportation future.

Boosting EV Speed: Tips for Faster, More Efficient Driving

You may want to see also

Sales Tax Exemption: Some states exempt EV buyers from sales tax

In the United States, the adoption of electric vehicles (EVs) has been gaining momentum, and with it, the question of tax benefits has become increasingly relevant. One significant advantage that EV owners can take advantage of is the sales tax exemption offered by certain states. This financial incentive is a crucial factor for potential buyers, as it can result in substantial savings on the overall cost of purchasing an EV.

Several states have recognized the environmental benefits of promoting electric vehicles and have implemented policies to encourage their adoption. These policies often include sales tax exemptions, which can vary in terms of eligibility and the specific vehicles covered. For instance, California, a state with a high number of EV owners, offers a sales tax exemption for zero-emission vehicles, including electric cars and motorcycles. This means that EV buyers in California can save a significant amount of money on the purchase, as the state sales tax is typically around 7.25%. By exempting EV buyers from this tax, the state aims to make electric vehicles more affordable and accessible to its residents.

The process of claiming this exemption can vary depending on the state and the specific vehicle. In some cases, buyers may need to provide documentation or proof of the vehicle's zero-emission status to the dealership or seller. This ensures that the tax exemption is applied correctly and that the buyer is not inadvertently charged the full sales tax. It is essential for EV buyers to be aware of these requirements to take full advantage of the exemption.

Additionally, some states offer further incentives beyond the sales tax exemption. For example, New York provides an additional benefit by waiving the vehicle registration fee for electric vehicles, which can further reduce the overall cost of ownership. These combined incentives can make a significant difference in the financial appeal of EVs, especially for those considering a long-term investment in an environmentally friendly mode of transportation.

Understanding the tax benefits associated with electric vehicles is crucial for potential buyers, as it can influence their purchasing decisions. The sales tax exemption, in particular, can result in substantial savings, making EVs more affordable and attractive to a wider range of consumers. As the market for electric vehicles continues to grow, it is expected that more states will introduce similar incentives, further driving the adoption of these environmentally friendly transportation options.

Unveiling the Safety of Electric Vehicles: A Comprehensive Guide

You may want to see also

Property Tax Deductions: EVs may qualify for property tax breaks

The potential tax benefits of owning an electric vehicle (EV) can vary depending on your location and the specific incentives offered by your local government. One such benefit that EV owners in certain regions might be eligible for is property tax deductions. This is a financial incentive designed to encourage the adoption of environmentally friendly vehicles and can provide a significant reduction in property tax liabilities.

In many jurisdictions, governments are actively promoting the use of electric vehicles to reduce carbon emissions and improve air quality. As a result, they often provide tax breaks and incentives to make EVs more affordable and attractive to consumers. Property tax deductions for EV owners fall under this category of incentives. These deductions can be particularly beneficial for individuals and businesses looking to reduce their overall tax burden while contributing to a greener economy.

The process of claiming property tax deductions for EVs typically involves a few key steps. Firstly, EV owners need to ensure that their vehicle meets the eligibility criteria set by the tax authorities. This may include factors such as the vehicle's purchase price, its intended use, and whether it is primarily used for personal or business purposes. Once the vehicle is determined to be eligible, the owner can then file the necessary tax forms to claim the deduction. This often involves providing documentation such as the vehicle's registration, purchase agreement, and any relevant environmental impact assessments.

It is important to note that the availability and specifics of property tax deductions for EVs can vary widely. Some regions might offer a fixed amount as a deduction, while others may provide a percentage of the vehicle's value. Additionally, there may be income limits or other criteria that determine who is eligible for these deductions. Therefore, it is crucial for EV owners to research and understand the tax laws and regulations in their area to ensure they take full advantage of any available benefits.

In summary, property tax deductions for electric vehicles are a significant tax benefit that can help offset the costs of owning an EV. By understanding the eligibility criteria and following the necessary procedures, EV owners can potentially reduce their property tax liabilities while contributing to a more sustainable future. This incentive highlights the government's commitment to supporting the transition to electric transportation and provides a practical advantage for those looking to make environmentally conscious choices.

Ford's Electric Future: Profits and Prospects

You may want to see also

Renewable Energy Credits: Tax benefits for using renewable energy sources

The concept of Renewable Energy Credits (RECs) offers a compelling tax incentive for individuals and businesses embracing renewable energy sources, including electric vehicles (EVs). RECs are a powerful tool to promote the adoption of clean energy and provide financial benefits to those who invest in it. Here's a detailed breakdown of how RECs work and their advantages:

Understanding Renewable Energy Credits:

Renewable Energy Credits represent the environmental attributes of electricity generated from renewable sources. When a renewable energy facility, such as a wind farm or solar panel installation, produces electricity, it earns RECs. These credits can then be sold or transferred to electricity retailers, utilities, or other entities that need to meet their renewable energy targets. RECs essentially quantify the environmental benefits of renewable energy generation.

Tax Benefits for Consumers and Producers:

For Electric Vehicle Owners:

- Personal Income Tax Deductions: In many countries, individuals who own electric vehicles can claim tax deductions or credits for their renewable energy usage. This includes the electricity consumed by EVs, which is often generated from renewable sources. The tax benefit can be substantial, especially for those with higher income tax rates.

- State or Local Incentives: Some regions offer additional incentives, such as state tax credits or rebates, specifically for EV purchases and charging infrastructure. These incentives further reduce the overall cost of ownership for EV owners.

For Renewable Energy Producers:

- Selling RECs: Renewable energy producers can generate additional revenue by selling the RECs associated with their electricity production. This provides a direct financial benefit, especially for small-scale renewable projects that might not have significant economies of scale.

- Business Tax Credits: Businesses investing in renewable energy infrastructure, including EV charging stations, can claim tax credits for the cost of installation. This encourages companies to contribute to the transition to cleaner energy sources.

How RECs Work in Practice:

When a renewable energy source powers an electric vehicle, the electricity provider or retailer can issue RECs to the consumer. These credits can then be reported on tax returns, providing a direct offset against taxable income. For businesses, RECs can be used to meet their sustainability goals and, in some cases, sold to other companies to fulfill their renewable energy requirements.

Renewable Energy Credits provide a tangible way to encourage the use of clean energy sources, including electric vehicles. By offering tax benefits to both consumers and producers, RECs create a positive feedback loop that accelerates the adoption of renewable energy technologies. This system not only benefits the environment but also provides financial incentives, making the transition to a more sustainable future more accessible and rewarding.

Understanding the Electrical Nature of Vehicle Modules

You may want to see also

Business Deductions: Businesses can deduct EV-related expenses from taxes

Businesses can take advantage of various tax deductions and benefits when it comes to electric vehicles (EVs), which can significantly reduce their operational costs and overall tax liability. Here's an overview of the key deductions related to EV ownership and usage:

Vehicle Acquisition and Maintenance: One of the primary tax benefits is the ability to deduct the cost of acquiring an EV. This includes the purchase price, any applicable taxes, and additional fees. For businesses, this deduction can be claimed as a capital expenditure, allowing them to write off the entire cost in the year of purchase. Additionally, businesses can deduct expenses related to maintaining and servicing the EV, such as insurance, registration fees, and charging station costs. These deductions are particularly valuable as they directly offset the ongoing operational expenses associated with EV ownership.

Business Use of EVs: Businesses that use EVs for work-related purposes can claim deductions for the portion of vehicle expenses that is attributable to business use. This is calculated based on the vehicle's total mileage or the number of business days it was used. The deduction covers a percentage of the vehicle's cost, depreciation, and operating expenses. For example, if a business uses an EV 60% of the time for work, they can deduct 60% of the vehicle-related expenses. This deduction encourages businesses to adopt EVs for their fleets, promoting a more sustainable and environmentally friendly approach to transportation.

Charging Station Installation: Installing EV charging stations at business premises can also be a deductible expense. Businesses can claim a deduction for the cost of purchasing and installing the charging equipment, as well as any associated setup or maintenance fees. This deduction is especially relevant for companies with large EV fleets or those operating in areas with high EV ownership. By incentivizing businesses to invest in charging infrastructure, governments aim to support the widespread adoption of electric vehicles.

Alternative Fuel Vehicle Credit: In addition to deductions, businesses can also benefit from the Alternative Motor Vehicle Credit, which provides a tax credit for the purchase of qualified EVs. This credit is designed to encourage the production and sale of electric and fuel-efficient vehicles. The credit amount varies depending on the vehicle's battery capacity and other factors, and it can significantly reduce the overall tax burden for businesses.

By taking advantage of these tax deductions and credits, businesses can not only reduce their taxable income but also contribute to a more sustainable future. The adoption of electric vehicles can lead to long-term cost savings, improved environmental performance, and a positive public image, making it an attractive option for forward-thinking companies.

Upgrading Your Ride: A Guide to Converting Vehicle Axles to Electric Brakes

You may want to see also

Frequently asked questions

Yes, there are several tax benefits associated with electric vehicles (EVs). Many governments worldwide offer incentives to promote the adoption of EVs to reduce environmental impact and encourage sustainable transportation. These incentives often include tax credits, rebates, or deductions for EV purchases. For example, in the United States, the Internal Revenue Service (IRS) provides a tax credit for EV buyers, which can be up to $7,500 per vehicle. This credit is designed to offset the higher upfront cost of EVs compared to traditional gasoline vehicles.

Absolutely! Taxpayers can claim deductions for expenses related to charging their EVs at home. This includes the cost of installing a home charging station and any electricity costs incurred for charging. In the US, the IRS allows a deduction for the cost of charging stations, and the electricity used for charging can be claimed as a business expense if the EV is used for work-related purposes. It's important to keep records of charging expenses, including dates, amounts, and the purpose of the charge.

Yes, many regions offer reduced registration and licensing fees for electric vehicle owners. These benefits are designed to simplify the process of owning an EV and provide financial relief to drivers. For instance, in certain states, EV owners may be exempt from paying annual registration fees or enjoy reduced rates. Additionally, some governments provide tax credits or rebates for the initial registration and licensing of EVs, which can significantly lower the associated costs. It's advisable to check with your local tax authorities or government websites to understand the specific tax benefits available in your area.