In the state of Connecticut, property taxes are a significant source of revenue for local governments, but they do not directly apply to electric vehicles (EVs). Connecticut does not have a specific property tax for EVs, as these vehicles are considered personal property and are typically taxed based on their value, similar to other personal vehicles. However, the state does have a unique registration fee for EVs, which is designed to support the development and infrastructure of electric vehicle technology. This fee is an additional cost for EV owners, but it is distinct from the property tax structure that applies to real estate and other personal property. Understanding these tax considerations is essential for EV owners in Connecticut to manage their financial obligations effectively.

What You'll Learn

- CT Property Tax Rules: Understanding EV-specific tax regulations in Connecticut

- Electric Vehicle Incentives: Exploring state incentives to reduce property tax burden

- Tax Exemption Eligibility: Criteria for EV owners to claim property tax exemptions

- Local Tax Variations: Differences in property taxes for EVs across Connecticut towns

- EV Ownership Benefits: Advantages of owning an EV in Connecticut regarding property taxes

CT Property Tax Rules: Understanding EV-specific tax regulations in Connecticut

Connecticut, like many states, imposes property taxes on various assets, including real estate and personal property. When it comes to electric vehicles (EVs), there are specific tax regulations that EV owners in Connecticut should be aware of. Understanding these rules is crucial to ensure compliance and avoid any potential penalties.

In Connecticut, the state's Department of Revenue Services (DRS) is responsible for administering property tax laws. For EVs, the tax assessment process can vary depending on the type of vehicle and its classification. Generally, EVs are considered personal property and are subject to the same tax rules as other personal vehicles. However, there are some unique considerations.

One important aspect to note is that Connecticut does not have a specific property tax on EVs based solely on their electric nature. The tax is primarily based on the vehicle's value, similar to traditional gasoline-powered cars. The assessment is made by the local assessors, who determine the market value of the vehicle. This value is then used to calculate the property tax liability. It's essential for EV owners to have their vehicles properly assessed to ensure an accurate tax amount.

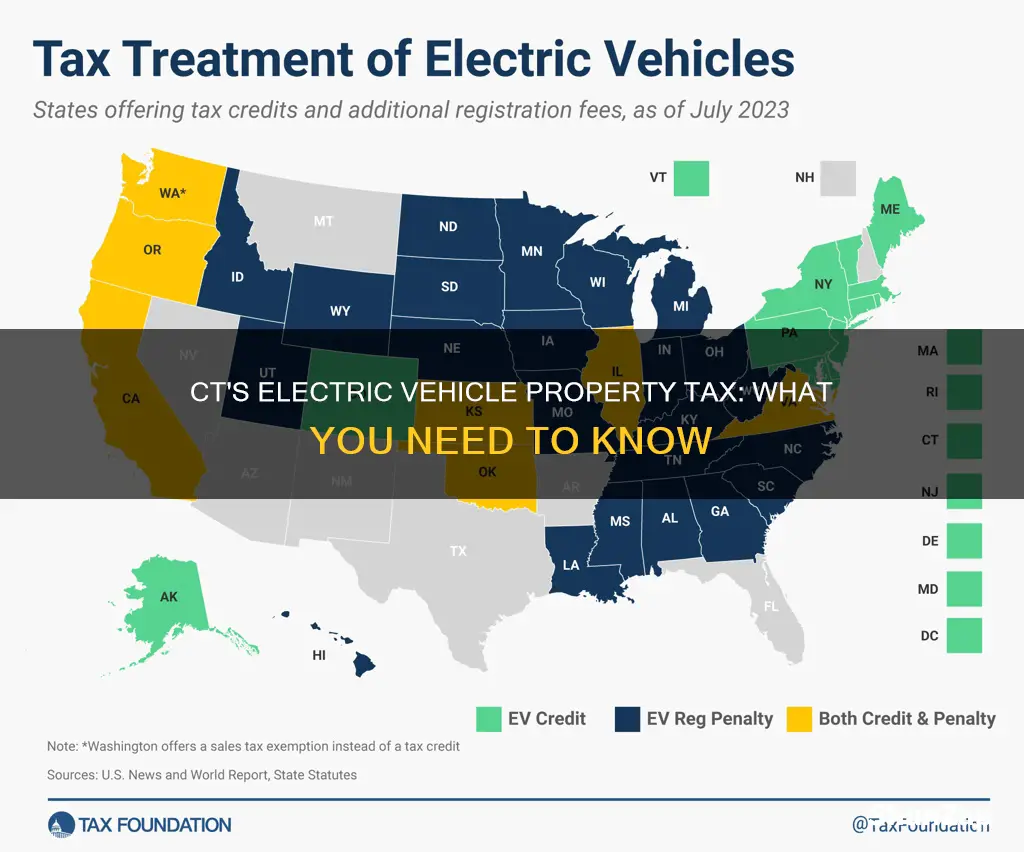

Additionally, Connecticut offers certain incentives and benefits for EV owners. The state provides a property tax credit for electric vehicles, which can help reduce the overall tax burden. This credit is designed to encourage the adoption of EVs and promote environmental sustainability. To qualify, EV owners must meet specific criteria, such as purchasing or leasing the vehicle from an authorized dealer and meeting certain environmental standards. The DRS provides guidelines and forms to assist EV owners in claiming this credit.

Understanding the tax regulations and incentives related to EVs is essential for Connecticut residents. By staying informed, EV owners can ensure they are in compliance with the law and take advantage of any available benefits. It is recommended to consult the DRS website or seek professional advice to stay updated on the latest property tax rules and requirements for electric vehicles in Connecticut.

Government Incentives: Are They Enough to Go Electric?

You may want to see also

Electric Vehicle Incentives: Exploring state incentives to reduce property tax burden

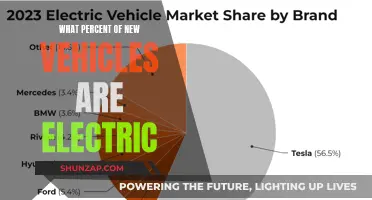

The growing popularity of electric vehicles (EVs) has sparked interest in understanding the associated financial benefits and potential drawbacks, including property taxes. Many states offer incentives to promote the adoption of EVs, aiming to reduce environmental impact and encourage sustainable transportation. One aspect to consider is whether these incentives extend to property tax benefits, which could significantly impact EV owners' financial obligations.

In certain states, such as Connecticut, property tax laws for EVs are worth examining. Connecticut, known for its commitment to environmental initiatives, has implemented various incentives to support EV owners. One of the key incentives is the exemption from personal property tax for EVs. This means that EV owners in Connecticut do not have to pay an additional property tax on their vehicles, which can be a substantial savings over time. The state's initiative aims to encourage residents to make eco-friendly choices while also providing financial relief.

To explore further, one can delve into the specific details of Connecticut's EV incentives. The state's Department of Revenue Services provides guidelines and regulations regarding personal property tax exemptions for EVs. These guidelines often include criteria for eligibility, such as the vehicle's value, model year, and whether it is used for personal or commercial purposes. Understanding these criteria is essential for EV owners to ensure they qualify for the tax exemption and can effectively plan their finances.

Additionally, other states may offer similar incentives, and researching these can provide a comprehensive understanding of the potential property tax benefits for EV owners. Some states provide tax credits or rebates, which can directly reduce the purchase price of EVs, indirectly impacting property tax obligations. These incentives are designed to make EVs more affordable and attractive to consumers, fostering a shift towards sustainable transportation.

In summary, exploring state incentives for electric vehicles can reveal valuable information about potential property tax advantages. Connecticut's example highlights the importance of understanding local regulations and the financial benefits that can arise from adopting eco-friendly transportation options. By staying informed about these incentives, EV owners can make well-informed decisions and potentially reduce their overall tax burden.

NMC vs. NCA: Unlocking EV Battery Potential

You may want to see also

Tax Exemption Eligibility: Criteria for EV owners to claim property tax exemptions

To be eligible for property tax exemptions on electric vehicles (EVs) in Connecticut, EV owners must meet specific criteria set by the state's tax authorities. Firstly, the vehicle must be powered exclusively by an electric motor and not have any internal combustion engine. This is a crucial requirement, as it ensures that the vehicle is indeed an EV and not a hybrid or a vehicle with a secondary fuel source. Secondly, the vehicle must be registered in Connecticut, and the owner must be a resident of the state. This registration and residency requirement is standard for many tax exemptions and ensures that the benefits are provided to Connecticut residents.

The vehicle's value also plays a significant role in determining eligibility. Connecticut's tax laws typically exempt vehicles with a value below a certain threshold from property taxes. This threshold can vary, but it often includes a cap on the vehicle's market value or a specific amount. For instance, if the threshold is set at $50,000, any EV with a value below this amount may be exempt from property taxes. It's important for EV owners to check the current threshold to ensure their vehicle qualifies.

Another critical criterion is the vehicle's use. The EV must be primarily used for personal transportation, and the owner should provide documentation to support this. This could include vehicle registration records, insurance documents, or any other relevant paperwork that demonstrates the vehicle's primary use. The purpose of this requirement is to ensure that the exemption is applied to vehicles that are genuinely used for personal, non-commercial purposes.

Additionally, EV owners might need to provide proof of the vehicle's environmental benefits. Connecticut, like many other states, offers tax incentives for EVs to promote eco-friendly transportation. This could involve submitting documentation that verifies the vehicle's low or zero emissions, such as environmental reports or certificates. By meeting these criteria, EV owners can effectively claim property tax exemptions and potentially save on their vehicle's annual tax liability.

In summary, to claim property tax exemptions for EVs in Connecticut, owners must ensure their vehicle meets the state's definition of an EV, is registered and used primarily for personal transportation, and falls within the specified value threshold. Providing the necessary documentation and meeting these criteria will enable EV owners to take advantage of the available tax benefits, making electric vehicle ownership more financially advantageous.

Unlocking EV Tax Credits: A Guide to Maximizing Your Federal Benefits

You may want to see also

Local Tax Variations: Differences in property taxes for EVs across Connecticut towns

The state of Connecticut does not impose a specific property tax on electric vehicles (EVs), but local towns and cities have the authority to implement their own tax policies. This means that the tax implications for EV owners can vary significantly depending on their residence. Understanding these local variations is crucial for EV owners to manage their finances effectively.

In some Connecticut towns, EVs are exempt from property taxes, recognizing the environmental benefits of these vehicles. For instance, the town of Greenwich has a policy that exempts EVs from local property taxes, which can result in substantial savings for EV owners. This exemption is often extended to other zero-emission vehicles, such as hybrid cars, to encourage the adoption of cleaner transportation options. On the other hand, towns like Bridgeport and New Haven may have different approaches, where EVs are taxed at a reduced rate compared to traditional gasoline vehicles. These reduced rates can be a significant incentive for residents to opt for electric transportation.

The tax rates and policies can also depend on the age and value of the EV. Some towns might offer tax exemptions or reduced rates for newer models, while others may have different criteria. For example, a town might exempt EVs that were manufactured within the last five years, or those with a specific range or battery capacity. These criteria ensure that the tax benefits are targeted at the most environmentally friendly and advanced vehicles.

It is essential for EV owners to research and understand the specific tax laws in their respective towns. This information can often be found on the town's official website or by contacting local tax authorities. Being aware of these local variations can help EV owners plan their finances, especially when considering the long-term cost implications of owning an EV.

In summary, while Connecticut does not have a statewide property tax specifically for EVs, local towns have the flexibility to implement their own policies. These variations can result in significant differences in tax liabilities for EV owners, making it crucial to stay informed about the specific regulations in their area.

Powering Your EV: A Guide to Choosing the Right Battery

You may want to see also

EV Ownership Benefits: Advantages of owning an EV in Connecticut regarding property taxes

The state of Connecticut offers a unique advantage to electric vehicle (EV) owners when it comes to property taxes. Connecticut has implemented a specific property tax exemption for EVs, which can significantly benefit EV owners in the state. This exemption is a significant advantage and can lead to substantial savings for EV owners over time.

When you purchase an EV, you are eligible for a property tax exemption on the vehicle's assessed value. This means that instead of paying property taxes on the full value of your car, you only pay taxes on the value of the vehicle after a certain threshold. The specific amount of the exemption varies, but it typically covers a significant portion of the vehicle's value, often around 75%. For example, if your EV is valued at $30,000, you might only pay property taxes on $22,500, resulting in a substantial reduction in annual tax liability.

This property tax advantage is a significant incentive for EV owners, as it directly impacts their financial savings. Over the lifetime of the vehicle, this exemption can result in thousands of dollars in savings, making EV ownership more affordable and cost-effective. It also encourages the adoption of environmentally friendly vehicles, as the tax benefits are directly tied to the vehicle's environmental impact.

Furthermore, this tax exemption is a long-term benefit. As EVs are known for their durability and low maintenance costs, the savings can extend over many years. This makes EV ownership an attractive option for those seeking to minimize their transportation costs while also contributing to a greener environment. Connecticut's property tax structure for EVs is a unique and appealing feature, providing financial relief and promoting sustainable transportation choices.

In summary, owning an EV in Connecticut offers a valuable property tax advantage. This exemption can lead to significant financial savings, making EV ownership more accessible and environmentally friendly. It is a unique benefit that EV owners in Connecticut can take advantage of, ensuring a greener and more cost-effective transportation choice.

Ford's Electric Future: Shifting Focus or Staying Committed?

You may want to see also

Frequently asked questions

No, there is no specific property tax in Connecticut for electric vehicles. The state does not impose a separate tax on electric vehicles based on their value or ownership.

No, the purchase and registration of electric vehicles in Connecticut are subject to the same tax laws as traditional gasoline vehicles. You will pay a sales tax on the purchase price and a registration fee when you register the vehicle.

Connecticut offers a few incentives and exemptions for electric vehicle owners. The state provides a tax credit for the purchase or lease of electric vehicles, which can be claimed on your state income tax return. Additionally, electric vehicle owners may be eligible for a reduced registration fee, and some counties and municipalities offer exemptions from certain local taxes.

Property taxes for a charging station are typically assessed based on the value of the improvement or structure where the station is installed. Since it is an electric vehicle-related infrastructure, it may be considered a fixture or improvement to your property. The assessment would be part of your overall property tax, and the specific rate can vary depending on the local tax laws and regulations in your jurisdiction.