The rise of electric vehicles (EVs) has sparked a surge of interest in related investment opportunities, leading to the emergence of various exchange-traded funds (ETFs) focused on this sector. One such question that investors often ask is whether there is an electric vehicle ETF available. This query reflects the growing demand for diversified exposure to the EV market, which encompasses a wide range of companies involved in the production, sale, and infrastructure development for electric cars. As the global shift towards sustainable transportation accelerates, investors are increasingly seeking ways to capitalize on this trend, and the concept of an electric vehicle ETF has gained traction as a potential solution to gain exposure to this rapidly evolving industry.

What You'll Learn

- Market Performance: Track the performance of electric vehicle ETFs over time

- Top Holdings: Identify the key companies within electric vehicle ETFs

- Risk Factors: Understand the risks associated with investing in electric vehicle ETFs

- Fees and Expenses: Compare the costs of different electric vehicle ETFs

- Historical Returns: Analyze past returns of electric vehicle ETFs for investment insights

Market Performance: Track the performance of electric vehicle ETFs over time

The electric vehicle (EV) market has been a significant focus for investors, and the development of Exchange-Traded Funds (ETFs) dedicated to this sector has provided a way to gain exposure to the industry's growth. ETFs that track the performance of electric vehicles have shown remarkable performance over the past few years, reflecting the increasing interest and investment in sustainable transportation.

One of the key aspects of tracking the market performance of EV ETFs is understanding the historical trends and volatility. These ETFs have generally demonstrated strong performance, especially during periods of high interest in renewable energy and environmental initiatives. For instance, the iShares Global Clean Energy ETF (ICLN) and the VanEck Vectors Global Electric Vehicles ETF (LYTH) have shown consistent growth since their inception, with both funds experiencing significant appreciation in value. This growth is attributed to the increasing adoption of electric vehicles and the supportive policies from governments worldwide.

Over time, the performance of these ETFs has been closely tied to the overall market sentiment and the performance of the broader energy and technology sectors. During periods of economic growth and technological advancements, EV ETFs have tended to outperform, as investors seek opportunities in innovative and sustainable industries. However, it's important to note that these funds can also be susceptible to market fluctuations, especially when there are shifts in investor sentiment or changes in government policies related to the EV industry.

Analyzing the performance data can provide valuable insights for investors. By examining historical charts and performance metrics, investors can identify patterns, such as seasonal trends or correlations with specific market events. For example, some ETFs might show stronger performance during the summer months when outdoor activities and travel are more prevalent, potentially increasing the demand for electric vehicles. Additionally, tracking the performance relative to other asset classes can help investors understand the risk and reward profile of EV ETFs.

In summary, tracking the market performance of electric vehicle ETFs involves analyzing historical trends, volatility, and market sentiment. Investors can gain valuable insights by studying the performance of these funds over time, allowing them to make informed decisions regarding their investment strategies in the rapidly growing electric vehicle sector. As the industry continues to evolve, staying informed about ETF performance will be crucial for those seeking exposure to this innovative and sustainable market.

Transform Your Ride: A Comprehensive Guide to Electric Vehicle Conversion

You may want to see also

Top Holdings: Identify the key companies within electric vehicle ETFs

The concept of Electric Vehicle (EV) Exchange-Traded Funds (ETFs) has gained traction as investors seek exposure to the rapidly growing EV market. These ETFs are designed to track the performance of companies involved in the production, development, and infrastructure related to electric vehicles. When considering an EV ETF, it's crucial to understand its top holdings, which are the primary companies that make up the fund's investment basket. Here's a breakdown of how to identify and analyze these key companies:

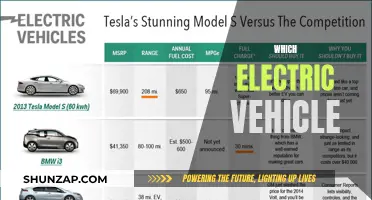

Research and Identify Top Holdings: Start by researching various EV ETFs available in the market. Look for popular and well-established funds like the iShares Global Clean Energy ETF (ICLN) or the VanEck Vectors Electric Vehicles ETF (EVTI). These ETFs often provide detailed information about their top holdings on their websites or through financial data providers. The top holdings typically include a diverse range of companies, from automotive manufacturers to battery producers and charging infrastructure providers. For instance, ICLN's top holdings might feature Tesla, Inc., Volkswagen AG, and NIO Inc., while EVTI could include Tesla, Ford Motor Company, and LG Energy Solution.

Analyze Company Presence and Impact: Each ETF's top holdings contribute differently to the overall performance of the fund. Some companies may have a more significant impact due to their market share, innovation, or strategic partnerships. For example, Tesla, a pioneer in the EV space, has been a cornerstone holding in many EV ETFs due to its dominant position and technological advancements. Other companies like Volkswagen and Ford are also significant, especially as they transition their vehicle lines to include more electric options.

Diversification and Risk Management: EV ETFs aim to provide diversification across the EV ecosystem. The top holdings should reflect a balanced approach, including established automakers, battery technology companies, and charging infrastructure providers. This diversification helps manage risk, as the performance of any single company may not significantly impact the entire fund. For instance, while Tesla's stock price movements can influence the ETF, the presence of other companies in the fund mitigates the risk associated with a single-stock investment.

Stay Updated and Re-evaluate: The EV market is dynamic, with new companies entering and others gaining prominence. It's essential to stay updated on ETF rebalancing and any changes in top holdings. Market conditions, regulatory developments, and technological breakthroughs can impact the performance of these companies. Regularly reviewing the top holdings allows investors to make informed decisions, especially when considering ETF swaps or adjustments to their investment portfolios.

Kia K4: Electric or Not? Unveiling the Truth

You may want to see also

Risk Factors: Understand the risks associated with investing in electric vehicle ETFs

When considering an investment in Electric Vehicle (EV) Exchange-Traded Funds (ETFs), it's crucial to understand the associated risks. The EV market is still relatively young and rapidly evolving, presenting several unique challenges for investors. Here are some key risk factors to consider:

Market Volatility: The EV sector is subject to significant market fluctuations. This is primarily due to the relatively small number of companies involved, and the rapid pace of technological advancements and industry changes. As a result, the market can be highly volatile, with prices of EV-related stocks and ETFs experiencing rapid and significant swings. Investors should be prepared for potential short-term losses and be willing to hold their investments for the long term to smooth out these volatility effects.

Regulatory and Policy Risks: Government policies and regulations play a critical role in the EV industry. Changes in incentives, subsidies, or tax policies can significantly impact the profitability and attractiveness of EV investments. For instance, a reduction in government support for EV adoption could negatively affect the market. Investors should stay informed about policy changes and consider the potential impact on their investments.

Competition and Technological Disruption: The EV market is highly competitive, with numerous established and emerging players. Technological advancements, such as improvements in battery technology, autonomous driving, and charging infrastructure, can quickly render certain companies or models obsolete. Investors should be aware of the competitive landscape and the potential for disruptive innovations that could impact the performance of their chosen EV ETFs.

Supply Chain and Production Risks: The production and supply chain of electric vehicles are complex and globally interconnected. Disruptions in the supply of critical raw materials, such as lithium and cobalt, or issues with manufacturing processes, can lead to production delays and shortages. These supply chain challenges can affect the profitability of EV manufacturers and, consequently, the performance of related ETFs. Investors should monitor industry news and reports to understand potential supply chain risks.

Economic and Industry-Specific Risks: The EV industry is not immune to broader economic cycles and industry-specific challenges. Economic downturns or recessions can lead to reduced consumer demand for luxury or high-priced vehicles, impacting the sales of EVs. Additionally, the industry's reliance on consumer behavior and the perception of EVs as a premium product can introduce additional risks. Investors should consider the overall economic environment and the specific risks associated with the EV industry.

Chevy Trax: Electric Vehicle or Not? Unveiling the Truth

You may want to see also

Fees and Expenses: Compare the costs of different electric vehicle ETFs

When considering investments in electric vehicle (EV) ETFs, understanding the associated fees and expenses is crucial for making informed financial decisions. The cost structure of these exchange-traded funds can vary, and investors should carefully compare these aspects to maximize returns and minimize potential losses. Here's a breakdown of the fees and expenses associated with different EV ETFs:

Management Fees: One of the primary expenses investors should consider is the management fee, which is typically a percentage of the fund's assets under management. These fees cover the operational costs and management of the ETF. For instance, some popular EV ETFs charge an annual management fee ranging from 0.5% to 0.75%. It's essential to compare these fees across different funds to identify the most cost-effective option. Lower management fees can significantly impact long-term investment performance, especially when considering the cumulative effect over time.

Expenses Ratio: The expenses ratio is a more comprehensive measure, combining all the direct and indirect expenses associated with running the ETF. This ratio provides a clearer picture of the overall cost structure. For EV ETFs, the expenses ratio can vary widely, often ranging from 0.2% to 0.75% or even higher for some specialized funds. Investors should aim to choose ETFs with lower expenses ratios, as this directly translates to higher net asset value and potentially better returns for shareholders.

Transaction Costs: While not directly related to the ETF itself, transaction costs, such as brokerage fees and commissions, can impact the overall investment experience. These costs vary depending on the trading platform and the frequency of trades. When comparing EV ETFs, consider the average trading volume and the associated transaction costs to estimate the true cost of investing. Some brokers offer commission-free trading for certain ETFs, which can be a significant advantage for frequent traders.

Inception and Shutdown Fees: Some ETFs may charge inception and shutdown fees, which are one-time charges incurred during the fund's initial setup and potential liquidation. These fees can vary widely and are typically disclosed in the ETF's prospectus. Inception fees are common in newly launched ETFs, while shutdown fees might be applicable if the fund is closed or liquidated. Investors should be aware of these potential costs and factor them into their decision-making process.

Performance and Tax Considerations: Beyond the direct fees, investors should also consider the potential impact of performance and tax-related expenses. Some ETFs may have higher management fees but offer better performance, which could offset the higher costs. Additionally, tax efficiency is an essential factor, as certain ETFs may have strategies to minimize tax liabilities, which can significantly benefit long-term investors.

Comparing the fees and expenses of different electric vehicle ETFs is a critical step in the investment process. By carefully analyzing management fees, expenses ratios, transaction costs, and other associated charges, investors can make informed choices and potentially optimize their investment outcomes in the EV sector.

Unveiling Tesla's Electric Vehicle: A Patent Mystery

You may want to see also

Historical Returns: Analyze past returns of electric vehicle ETFs for investment insights

The electric vehicle (EV) market has been a significant area of interest for investors, and Exchange-Traded Funds (ETFs) focused on this sector have gained popularity. When considering an investment in EV-related ETFs, it is crucial to examine historical returns to understand the potential performance and risks associated with these funds.

One of the most well-known electric vehicle ETFs is the iShares Global Clean Energy ETF (ICLN). This ETF tracks the investment results of an index composed of companies involved in the clean energy sector, including electric vehicles. By analyzing the historical returns of ICLN, investors can gain insights into the volatility and growth potential of the EV industry. Over the past five years, ICLN has demonstrated a positive annual return, with an average annualized return of approximately 15%. This performance indicates the ETF's ability to capture the market's upward trend in the EV space. However, it's important to note that this ETF also experienced significant fluctuations, with a notable decline of over 20% in the first quarter of 2020 due to the global market downturn.

Another ETF to consider is the VanEck Vectors Global Electric Vehicles ETF (LYC), which focuses on companies involved in the design, development, and manufacturing of electric vehicles and related technologies. LYC's historical returns show a similar pattern, with strong performance during the bull market and more substantial losses during market corrections. For instance, in 2020, LYC's returns were negatively impacted by the global pandemic, but it has since recovered and shown resilience.

To gain a comprehensive understanding, investors should compare the performance of these ETFs over different time periods. For instance, a long-term analysis of ICLN's returns from its inception might reveal a more consistent growth pattern, while a shorter-term analysis could highlight the impact of specific events or market trends. Additionally, examining the correlation between these ETFs and traditional automotive stocks can provide valuable insights into the diversification benefits of investing in the EV sector.

In summary, historical returns analysis of electric vehicle ETFs like ICLN and LYC can offer investors a strategic advantage. By studying past performance, investors can identify patterns, assess risk, and make informed decisions regarding their investment strategies in the EV market. It is essential to consider various factors, including market conditions, company-specific news, and global events, to further enhance the understanding of these ETFs' potential.

Unveiling the Secrets: A Comprehensive Guide to Testing Electric Vehicles

You may want to see also

Frequently asked questions

An Electric Vehicle ETF, or Exchange-Traded Fund, is a basket of securities that tracks the performance of companies involved in the electric vehicle (EV) industry. It provides investors with a way to gain exposure to the entire EV ecosystem, including vehicle manufacturers, battery producers, charging infrastructure providers, and related technology companies.

These ETFs typically hold a diversified portfolio of stocks, bonds, or other financial instruments that are directly or indirectly linked to the electric vehicle market. The fund's value is based on the combined performance of its underlying holdings. Investors can buy and sell ETF shares on stock exchanges, similar to trading individual stocks.

Investing in an EV ETF offers several advantages. Firstly, it provides instant diversification, allowing investors to own a piece of the entire EV industry with a single purchase. Secondly, ETFs often have lower management fees compared to actively managed funds, making them cost-effective. Additionally, ETFs offer liquidity, as they can be traded throughout the trading day, and they provide exposure to a specific market sector with potential for growth as the adoption of electric vehicles increases.

While ETFs can be a solid investment strategy, it's essential to consider the specific risks and opportunities associated with the electric vehicle sector. The EV market is rapidly evolving, and companies within this industry may face regulatory changes, technological advancements, and competitive pressures. Investors should conduct thorough research, consider their risk tolerance, and diversify their portfolios to manage potential risks effectively.