The electric vehicle (EV) tax credit is a financial incentive designed to encourage the adoption of electric cars, offering a significant benefit to consumers. However, understanding the eligibility criteria for this credit is crucial. One key question that arises is whether there is an income limit for receiving the EV tax credit. This paragraph aims to explore this aspect, providing insights into the potential income thresholds and their implications for individuals looking to take advantage of this financial incentive.

| Characteristics | Values |

|---|---|

| Eligibility | Open to individuals and businesses in the US |

| Tax Credit Amount | Up to $7,500 per vehicle |

| Income Limit | No specific income limit mentioned, but the credit is generally limited to the first 200,000 vehicles sold per manufacturer |

| Vehicle Types | New electric vehicles, including cars, trucks, and SUVs |

| Manufacturers | Applies to vehicles from eligible manufacturers, including Tesla, Ford, and General Motors |

| Sales Date | The credit is available for vehicles sold after December 31, 2020 |

| Resale and Trade-In | The credit can be claimed even if the vehicle is resold or traded in |

| Refundable Credit | Yes, if the credit exceeds the tax liability, a refund may be issued |

| Phase-Out | The credit may phase out for certain vehicle types and income levels, but no specific limits are provided |

| Documentation | Proof of vehicle purchase and eligibility may be required during tax filing |

What You'll Learn

Eligibility Criteria: Who qualifies for the EV tax credit?

The federal tax credit for electric vehicles (EVs) is a significant incentive for consumers to make the switch to electric mobility. However, understanding who qualifies for this credit is essential to ensure you can take full advantage of it. Here's a detailed breakdown of the eligibility criteria:

Income Limits: One of the primary factors determining eligibility is income. The Internal Revenue Service (IRS) has set income limits for EV tax credits. As of the latest updates, the credit is generally available to individuals with adjusted gross income (AGI) of $150,000 or less for single filers and $300,000 or less for joint filers. This means that if your income exceeds these thresholds, you may not be eligible for the full credit amount. However, it's important to note that the credit phases out for income above these limits, allowing some partial credit for those just above the threshold.

Vehicle and Manufacturer Requirements: To qualify for the tax credit, you must purchase or lease a new electric vehicle that meets specific criteria. The vehicle must be new and acquired primarily for personal use. Additionally, the EV must be manufactured in compliance with the IRS's guidelines, ensuring it meets certain production standards and is not a used or pre-owned vehicle. This requirement is in place to encourage the production and sale of new EVs.

Residency and Citizenship: U.S. citizens and permanent residents are eligible for the EV tax credit. Non-resident aliens and their spouses must file a separate return and meet specific requirements to claim the credit. It's important to note that the credit is not available to non-resident aliens unless they meet certain tax-related conditions.

Vehicle Type and Price: The EV tax credit applies to a wide range of electric vehicles, including cars, trucks, SUVs, and motorcycles. However, there are price limitations. The vehicle's price, including any applicable tax, must not exceed $80,000 for new cars and $85,000 for new trucks and SUVs. These price limits ensure that the credit is accessible to a broader range of consumers and encourages the purchase of more affordable EVs.

Lease vs. Purchase: Both individuals who lease and purchase EVs may be eligible for the tax credit. However, the credit is generally claimed by the lessee or purchaser at the time of sale or lease. It's crucial to keep records and ensure that the EV meets all the eligibility criteria to claim the credit accurately.

Understanding these eligibility criteria is vital for anyone considering purchasing or leasing an electric vehicle to maximize their potential tax savings. Always consult the IRS guidelines or seek professional advice to ensure you meet all the requirements and can take full advantage of the EV tax credit.

Powering Up: A Beginner's Guide to Home EV Charging

You may want to see also

Income Thresholds: What are the income limits for the credit?

The federal tax credit for electric vehicles (EVs) is a significant incentive for consumers to go green, but it's important to understand the income limits that apply to this benefit. The credit is designed to promote the adoption of EVs and reduce greenhouse gas emissions, but it is not available to everyone. The income threshold for this credit is a crucial factor in determining eligibility.

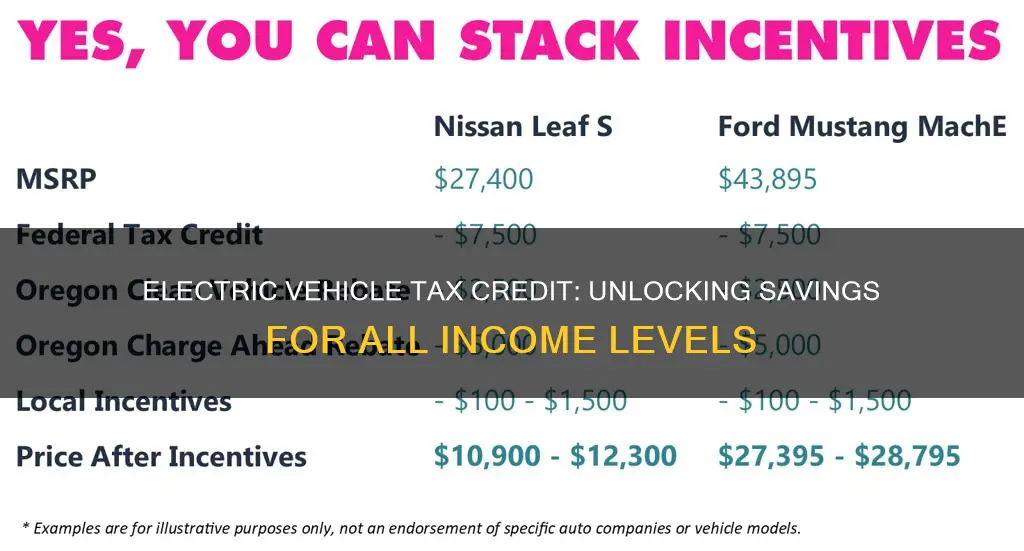

For the 2023 tax year, the income limit for the EV tax credit is set at $300,000 for single filers and $150,000 for married filing jointly. This means that individuals or couples earning above these amounts may not be eligible for the full credit. The credit amount is phased out for those with adjusted gross income (AGI) above these thresholds, meaning the credit value decreases as income increases. For every $100 above the limit, the credit reduces by $1. For instance, a single filer with an AGI of $350,000 would receive a reduced credit of $2,000, while a married couple with an AGI of $175,000 would get a full credit of $7,500.

It's worth noting that these income limits are adjusted annually, and the IRS provides updated figures for each tax year. Therefore, it is essential to check the latest IRS guidelines to ensure you have the most accurate information. The credit is designed to benefit lower- to middle-income earners, providing a substantial incentive for those who may not typically have access to luxury vehicles.

Additionally, the credit has a phase-out rule for vehicles with a manufacturer's suggested retail price (MSRP) above a certain threshold. For the 2023 model year, the phase-out begins at an MSRP of $80,000 for EVs and $55,000 for plug-in hybrids. This rule further restricts the credit's availability, ensuring it primarily supports more affordable EV options.

Understanding these income and vehicle price thresholds is crucial for anyone considering purchasing an electric vehicle and wanting to maximize their tax benefits. It's always advisable to consult a tax professional or use reliable online resources to determine your eligibility and the exact credit amount you may receive.

India's Electric Revolution: Are We Charged and Ready?

You may want to see also

Credit Amount: How much is the tax credit worth?

The federal tax credit for electric vehicles (EVs) is a significant incentive for consumers to make the switch to electric. The credit amount varies depending on several factors, primarily the type and value of the EV purchased. The credit is designed to encourage the adoption of electric vehicles, reduce greenhouse gas emissions, and promote a cleaner environment.

The credit amount for electric vehicles can range from $2,500 to $7,500, depending on the vehicle's price and the manufacturer. For vehicles priced below $80,000, the credit is typically $2,500. However, for vehicles priced between $80,000 and $150,000, the credit increases to $5,500. The highest credit of $7,500 is available for vehicles priced below $80,000 and with a battery capacity of at least 40 kilowatt-hours (kWh). This credit is a substantial amount, especially when considering the potential savings on the overall cost of the vehicle.

It's important to note that the tax credit is generally available for new purchases and not for used EVs. Additionally, the credit is typically applied as a direct reduction in the sales tax owed on the vehicle, which can further reduce the overall cost. The credit amount is also subject to income limits, which are designed to ensure that the benefit is targeted towards middle- and lower-income families. These income limits are adjusted annually and are based on the federal poverty level.

For the 2023 tax year, the income limits for the EV tax credit are $300,000 for single filers and $450,000 for joint filers. This means that individuals or families with an adjusted gross income (AGI) below these limits may be eligible for the full credit amount. However, the credit amount gradually decreases for incomes above these thresholds, with a phase-out starting at $150,000 for single filers and $300,000 for joint filers.

Understanding the credit amount and its eligibility criteria is crucial for potential EV buyers. It allows individuals to make informed decisions about their vehicle purchases and take advantage of this valuable incentive. The tax credit not only reduces the upfront cost of electric vehicles but also provides long-term savings, making EVs more accessible and affordable for a wider range of consumers.

Toyota Prius: Hybrid or Electric? Unveiling the Truth

You may want to see also

Vehicle Types: Which EV models are eligible?

The eligibility for the electric vehicle (EV) tax credit is an important consideration for anyone looking to purchase an EV. The tax credit is a significant incentive, offering a substantial amount of money back on the purchase price of an EV. However, it's crucial to understand that not all EV models are eligible for this credit, and there are specific criteria that must be met.

To begin with, the EV tax credit is primarily available for new, fully assembled vehicles that are purchased and used primarily for personal transportation. This means that custom-built or modified vehicles may not qualify. The credit is designed to encourage the adoption of new, environmentally friendly vehicles, and thus, it is crucial to ensure that the vehicle meets the necessary standards.

When it comes to vehicle types, the Internal Revenue Service (IRS) has outlined specific guidelines. The credit is available for a wide range of EVs, including battery-electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). BEVs are fully electric vehicles that run solely on electricity, while PHEVs have both an electric motor and a conventional engine. Both of these vehicle types are eligible for the tax credit, provided they meet the other eligibility criteria.

Additionally, the vehicle's manufacturer and its assembly location play a significant role in eligibility. The credit is available for vehicles manufactured in the United States, and the assembly must take place in North America. This includes vehicles assembled in the U.S., Canada, or Mexico. It's important to note that the credit is not limited to U.S.-based manufacturers; vehicles assembled in other countries can also be eligible if they meet the specific criteria.

Furthermore, the vehicle's price and the buyer's income level are critical factors. The tax credit is generally available for vehicles with a sticker price of $80,000 or less for new vehicles and $55,000 or less for used vehicles. There is also an income limit for the buyer, with a phase-out of the credit for those earning above a certain threshold. This phase-out is designed to ensure that the credit is targeted towards those who may need it most, promoting a more equitable distribution of the incentive.

Unlocking the Future: Your Guide to Electric Vehicle Investing

You may want to see also

Application Process: How to claim the credit?

The process of claiming the electric vehicle (EV) tax credit involves several steps, and understanding these steps is crucial for eligible individuals to take advantage of this financial incentive. Here's a detailed guide on how to navigate the application process:

- Determine Eligibility: Before initiating the application, ensure you meet the basic eligibility criteria. The EV tax credit is typically available to individuals who purchase or lease new electric vehicles. Research the specific requirements, which may include factors such as vehicle price, battery capacity, and the type of EV (e.g., battery-electric or plug-in hybrid). It's essential to verify if there are any income-based restrictions, as mentioned in the initial prompt.

- Gather Required Documents: Collect all the necessary documents to support your claim. This may include proof of vehicle purchase or lease, such as a sales invoice or lease agreement. You might also need to provide identification documents, such as a driver's license or passport, and proof of income, including tax returns or pay stubs. Having these documents ready will streamline the application process.

- Complete the Application Form: The Internal Revenue Service (IRS) provides the necessary forms for claiming the EV tax credit. Obtain Form 8936, "Expenses for New Energy Efficient Vehicles." This form requires detailed information about the vehicle, including its make, model, and vehicle identification number (VIN). You'll also need to provide your personal details, such as name, address, and Social Security number. Ensure accuracy and completeness when filling out the form.

- Calculate and Claim the Credit: The credit amount you can claim depends on various factors, including the vehicle's battery capacity and the purchase or lease price. The IRS provides guidelines and formulas to calculate the credit. You can use these guidelines to determine the eligible credit amount for your specific EV purchase. When filing your federal tax return, include Form 8936 and the calculated credit amount.

- Submit the Application: After completing the necessary forms and calculations, submit your application to the IRS. This can typically be done through the e-file system or by mailing the forms to the appropriate IRS address. Ensure that you meet the tax return filing requirements and include all supporting documents. The IRS will review your application, and if approved, you will receive the EV tax credit as a refund or reduction in your tax liability.

Remember, staying organized and keeping detailed records throughout the process is essential. If you have any doubts or complex situations, consulting a tax professional can provide valuable guidance to ensure a smooth application process.

Subaru's Electric Revolution: Rumors and Speculations

You may want to see also

Frequently asked questions

No, there is no specific income limit set for the electric vehicle tax credit. This credit is available to all eligible taxpayers, regardless of their income level. The credit is designed to encourage the purchase of electric vehicles and reduce the environmental impact of traditional gasoline-powered cars.

The income eligibility for the electric vehicle tax credit is based on your adjusted gross income (AGI). If your AGI exceeds a certain threshold, you may be subject to a phase-out of the credit. The phase-out begins at $150,000 for individuals and $300,000 for married couples filing jointly. For every $100 above these limits, the credit is reduced by 1%.

Yes, even if you have a high income, you can still claim the electric vehicle tax credit. However, the credit amount may be reduced due to the phase-out rule. The credit is fully available to those with lower incomes, and it gradually decreases as income increases. It's important to note that the credit is not a fixed amount but a percentage of the vehicle's price, so higher-income individuals may still benefit, albeit with a reduced credit value.

Yes, apart from income considerations, there are a few other requirements. The vehicle must be new and purchased primarily for personal use. It should be certified by the manufacturer as an electric vehicle, and the purchase must be made from a dealership or retailer that participates in the program. Additionally, the vehicle's price must not exceed a certain limit, which is adjusted annually.