Electric vehicles (EVs) have gained significant popularity in recent years, and as the market for EVs expands, so does the need for clear tax policies. One question that often arises among EV buyers and enthusiasts is whether sales tax applies to electric vehicles. This paragraph aims to shed light on this topic, providing an overview of the tax considerations for electric vehicle purchases and helping consumers understand their financial obligations when buying an EV.

What You'll Learn

- State-by-State Variations: Sales tax on EVs varies by state, with some exempting them entirely

- Local Tax Rates: City or county taxes may apply in addition to state sales tax

- Environmental Incentives: Some states offer tax breaks for electric vehicles to promote sustainability

- Used EV Sales: Sales tax rules differ for new and used electric vehicles

- Online Purchases: Out-of-state online purchases may be subject to sales tax

State-by-State Variations: Sales tax on EVs varies by state, with some exempting them entirely

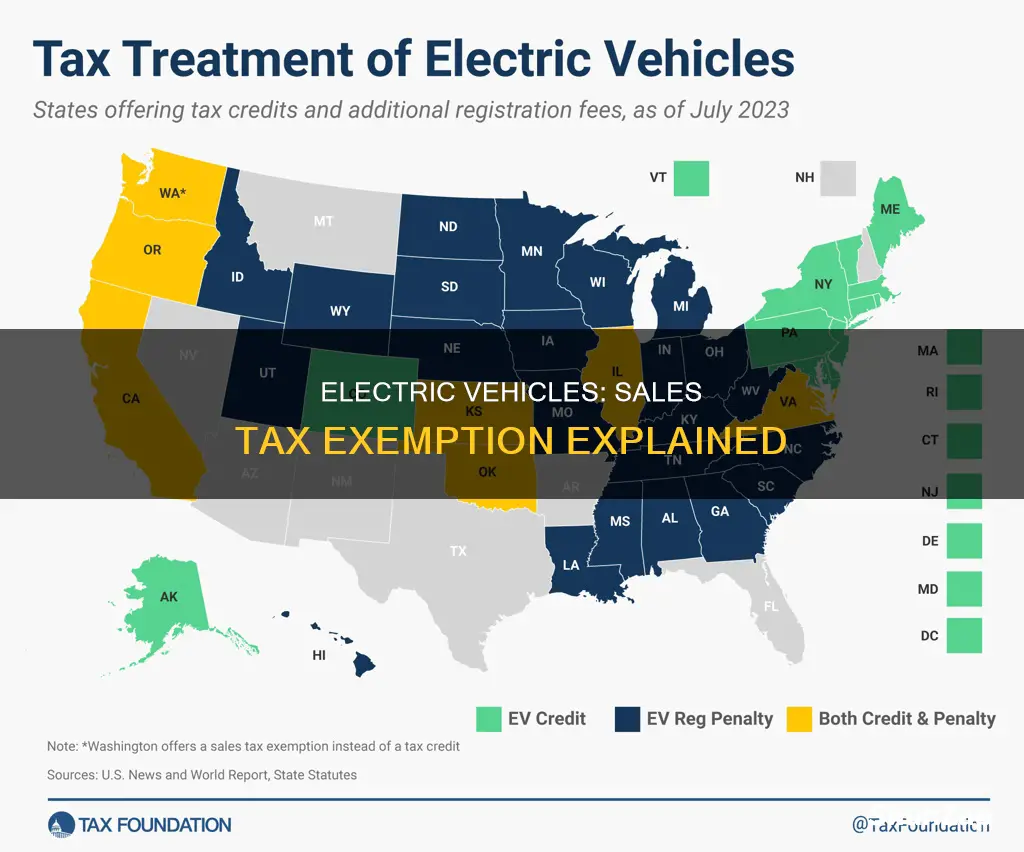

The sales tax on electric vehicles (EVs) can vary significantly from one state to another, and this variation can be a crucial factor for EV buyers and enthusiasts. Some states have chosen to exempt EVs from sales tax entirely, while others apply the standard sales tax rate. This difference in taxation policies can have a substantial impact on the overall cost of purchasing an EV.

For instance, California, one of the leading markets for EVs, has been a pioneer in promoting electric mobility. The state has historically been sales-tax-free for EVs, encouraging residents to make the switch. This exemption has been a significant incentive for EV buyers, as it directly reduces the upfront cost of the vehicle. Similarly, states like New York, New Jersey, and Massachusetts have also waived sales tax on EVs, making them more affordable for consumers. These states recognize the environmental benefits of electric vehicles and aim to accelerate the transition to a cleaner transportation system.

On the other hand, states like Texas, Florida, and Pennsylvania have not exempt EVs from sales tax. In these states, the standard sales tax rate applies to the purchase of electric vehicles, which can be a substantial additional cost. For example, in Texas, the state's general sales tax rate is 6.25%, and this applies to EVs as well. This can make the purchase of an EV more expensive compared to states with no sales tax.

The variation in sales tax policies is not just limited to the presence or absence of an exemption but also includes different tax rates. Some states with no sales tax on EVs may have other forms of taxation, such as a per-mile usage fee or a registration tax, which can impact the overall cost of ownership. It is essential for potential EV buyers to research and understand the specific tax implications in their state to make an informed decision.

In summary, the sales tax on EVs is not a uniform policy across the United States. Some states have embraced the idea of exempting EVs from sales tax, while others have not. This state-by-state variation can significantly influence the financial considerations of EV buyers, making it a critical aspect to consider when purchasing an electric vehicle. Understanding these differences is key to navigating the EV market and making the right choice for individual needs.

Sustainable Power: Recycling EV Batteries for a Greener Future

You may want to see also

Local Tax Rates: City or county taxes may apply in addition to state sales tax

When purchasing an electric vehicle, it's important to consider the tax implications, as local tax rates can vary significantly depending on your location. In addition to the state sales tax, cities and counties often impose their own taxes, which can add up to a substantial amount. This is especially true in metropolitan areas where the cost of living and doing business is typically higher. For instance, a city might levy a higher tax rate to fund local services and infrastructure, which can directly impact the final price of your vehicle. Understanding these local tax rates is crucial for budgeting and ensuring you're prepared for the total cost of your electric car.

The tax rate for electric vehicles can vary widely, even within the same state. This is because local governments have the authority to set their own tax rates, which can be influenced by factors such as the local economy, population density, and the need for public services. For example, a densely populated city might have a higher tax rate to support its extensive public transportation system, while a rural county might have a lower rate to encourage business and development. These variations in tax rates can significantly affect the overall cost of your vehicle, making it essential to research the specific tax rates in your area.

To navigate these local tax rates, it's advisable to check with your local government or tax authorities. They can provide you with the most up-to-date and accurate information regarding the taxes applicable to your region. Additionally, many states provide online resources or tools that allow you to calculate the total sales tax based on your address and the vehicle's price. These resources can help you estimate the additional cost accurately and plan your budget accordingly.

For those who are considering purchasing an electric vehicle, it's a good idea to factor in these local tax rates when making your decision. While the state sales tax is a significant consideration, the local tax can also be substantial and should not be overlooked. By being aware of these additional costs, you can make a more informed choice and potentially negotiate with dealers or sellers to account for these local taxes in the final price.

In summary, local tax rates play a significant role in the total cost of an electric vehicle. Understanding the tax rates in your city or county, in addition to the state sales tax, is essential for budgeting and making an informed purchase. Researching local tax authorities and utilizing online tools can help you navigate these variations and ensure you're prepared for the financial commitment of owning an electric car.

NMC vs. NCA: Unlocking EV Battery Potential

You may want to see also

Environmental Incentives: Some states offer tax breaks for electric vehicles to promote sustainability

In an effort to encourage the adoption of electric vehicles (EVs) and reduce the environmental impact of traditional gasoline-powered cars, several states in the United States have implemented environmental incentives in the form of tax breaks for electric vehicle purchases. These incentives are designed to make EVs more affordable and attractive to consumers, ultimately contributing to a greener and more sustainable future.

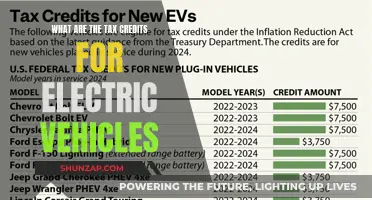

One of the primary environmental incentives is the reduction or elimination of sales tax on electric vehicles. Typically, the sales tax on a vehicle purchase is a significant expense for buyers. However, many states have recognized the potential of EVs to lower carbon emissions and have taken steps to alleviate the financial burden associated with purchasing these vehicles. For instance, California, a state known for its stringent environmental regulations, offers a zero-emission vehicle (ZEV) credit that can be used to offset the purchase price of an EV. This credit can be substantial, sometimes covering a significant portion of the vehicle's cost, making EVs more accessible to a wider range of consumers.

In addition to sales tax breaks, some states provide other financial incentives to promote EV ownership. These may include reduced registration fees, exemption from certain road taxes, and even rebates or grants. For example, New York State offers a $2,000 tax credit for the purchase or lease of an electric vehicle, which can be particularly beneficial for residents looking to make the switch from conventional cars. These incentives not only make EVs more affordable but also help to accelerate the transition to a more sustainable transportation system.

The environmental benefits of these tax breaks are twofold. Firstly, they directly contribute to reducing the overall carbon footprint of the transportation sector, which is a major contributor to greenhouse gas emissions. By making EVs more affordable, these incentives encourage consumers to choose cleaner, more efficient vehicles, leading to a gradual shift in the automotive market. Secondly, the increased popularity of EVs can stimulate the development of supporting infrastructure, such as charging stations, which are essential for the widespread adoption of electric vehicles.

Furthermore, these state-level incentives play a crucial role in aligning local policies with national and international sustainability goals. Many countries and regions have committed to reducing carbon emissions and transitioning to renewable energy sources. By offering tax breaks for electric vehicles, states are actively participating in this global effort, fostering a culture of environmental responsibility and innovation. This not only benefits the environment but also positions states at the forefront of the green economy, potentially attracting businesses and investors who prioritize sustainability.

Mastering EV Battery Sizing: A Comprehensive Guide to Powering Your Ride

You may want to see also

Used EV Sales: Sales tax rules differ for new and used electric vehicles

The rules regarding sales tax on electric vehicles (EVs) can be complex, especially when it comes to used EVs. When purchasing a new electric vehicle, the sales tax is typically applied to the full purchase price, just like any other vehicle. However, the situation changes when you're buying a used EV.

For used electric vehicles, the sales tax rules can vary significantly depending on your location and the specific circumstances of the sale. In some states, the sales tax is calculated based on the original purchase price of the vehicle when it was new. This means that if you're buying a used EV that was originally sold with a certain tax amount, you'll be taxed on that original amount. For instance, if a used EV was bought for $20,000 and was originally taxed at 5%, the sales tax on the used vehicle would be $1,000.

On the other hand, some states have different tax rules for used EVs, often charging a lower tax rate or no tax at all. This is because the value of a used EV might have depreciated over time, and taxing it at the original rate could be seen as unfair. In these cases, the tax might be applied to the current market value of the vehicle, which can be significantly lower than the original purchase price.

It's important to note that these rules can vary widely, and some states might have specific regulations for used car dealerships or private sellers. For instance, a private sale might be exempt from sales tax, while a dealership might be required to collect and remit the tax. Therefore, it's crucial to understand the local laws and potentially consult a tax professional to ensure you're handling the transaction correctly.

When buying a used EV, it's advisable to research the specific tax laws in your area and consider the vehicle's history and condition. This will help you make an informed decision and ensure that you're aware of all the associated costs. Understanding these nuances can save you from unexpected expenses and ensure a smooth transaction when purchasing a used electric vehicle.

Mastering Short Electrical Wiring: Extending Vehicle Connections Efficiently

You may want to see also

Online Purchases: Out-of-state online purchases may be subject to sales tax

When you buy an electric vehicle online from a retailer based in a different state, the sales tax rules can get a bit tricky. In many cases, the state where the retailer is located will apply sales tax to the purchase, even if the vehicle is being shipped to your state of residence. This is because the retailer is considered to be making a sale in that state, and therefore, they are required to collect and remit the appropriate sales tax.

For example, if you live in State A and purchase an electric vehicle from an online retailer based in State B, the retailer in State B will likely calculate and collect the sales tax based on the laws of State B. This tax may then be remitted to the state government in State B. It's important to note that the sales tax rate and rules can vary significantly between states, so it's crucial to understand the specific regulations in both your state and the state of the retailer.

To avoid any surprises, it's recommended to carefully review the website of the online retailer and look for information about sales tax. Some retailers may provide a clear indication of whether they collect sales tax and, if so, which state's tax laws they follow. Additionally, you can contact the retailer directly to inquire about their sales tax policies and ensure you are aware of any potential additional costs.

In some cases, you may be able to take advantage of tax-free options. For instance, if you are a resident of a state that does not impose sales tax on electric vehicles, you might be able to purchase the vehicle from a retailer in a different state without incurring additional tax. However, this can be a complex process, and it's essential to understand the specific tax laws and any potential restrictions.

Online vehicle purchases can be a convenient way to access a wider range of models and potentially find better deals. However, it's crucial to be aware of the sales tax implications to ensure you are making an informed decision and to avoid any unexpected financial burdens. Always research and understand the tax laws in both your state and the state of the retailer to make the most of your online vehicle-buying experience.

Fund Your Electric Dream: Strategies for EV Funding

You may want to see also

Frequently asked questions

Sales tax rates and regulations vary by state and even by county or city. It's best to check with your local tax authorities or a financial advisor to get accurate information specific to your location. Some states may exempt electric vehicles from sales tax, while others may apply a reduced rate or a standard rate.

The calculation of sales tax depends on the purchase price of the vehicle and the tax rate in your area. You can use online calculators or tax software to estimate the tax amount. These tools often require you to input the vehicle's price and your location to provide an accurate estimate.

When buying a used electric vehicle, the sales tax might be different from new vehicle purchases. Some states may require a used vehicle sales tax based on the vehicle's value or a flat rate. It's essential to research the specific rules for used car sales in your jurisdiction.

Many governments offer incentives to promote the adoption of electric vehicles, which can include tax credits or rebates. These incentives are designed to reduce the overall cost of ownership for electric vehicle owners. The availability and amount of these incentives vary by region and can be found on government websites or by consulting local automotive authorities.