The Electric Vehicle Index (EVI) is a comprehensive tool designed to track and analyze the performance and growth of the electric vehicle (EV) market. It provides valuable insights into the adoption and sales trends of electric cars, buses, and other commercial vehicles, offering a detailed picture of the industry's evolution. This index is an essential resource for investors, policymakers, and industry professionals, as it helps identify market opportunities, assess the impact of regulatory changes, and understand consumer preferences in the rapidly expanding EV sector. By monitoring key metrics such as sales volume, market share, and technological advancements, the EVI offers a dynamic and informative perspective on the global shift towards sustainable transportation.

What You'll Learn

- Definition: Electric Vehicle Index measures the performance of EV-related stocks

- Composition: Index includes companies in battery tech, charging infrastructure, and EV manufacturers

- Performance: Tracks the market's overall growth and volatility in the EV sector

- Impact: Economic and environmental effects of the EV industry on global markets

- Future Trends: Forecasts and predictions for the EV market's evolution and sustainability

Definition: Electric Vehicle Index measures the performance of EV-related stocks

The Electric Vehicle Index is a specialized financial metric designed to track and quantify the performance of a specific group of stocks within the broader electric vehicle (EV) industry. This index serves as a comprehensive gauge of the market's sentiment and overall health of EV-related companies, providing investors with valuable insights into the sector's dynamics. By focusing on a carefully curated selection of stocks, the index offers a more nuanced perspective compared to broader market indices, allowing investors to make informed decisions about the EV industry's performance.

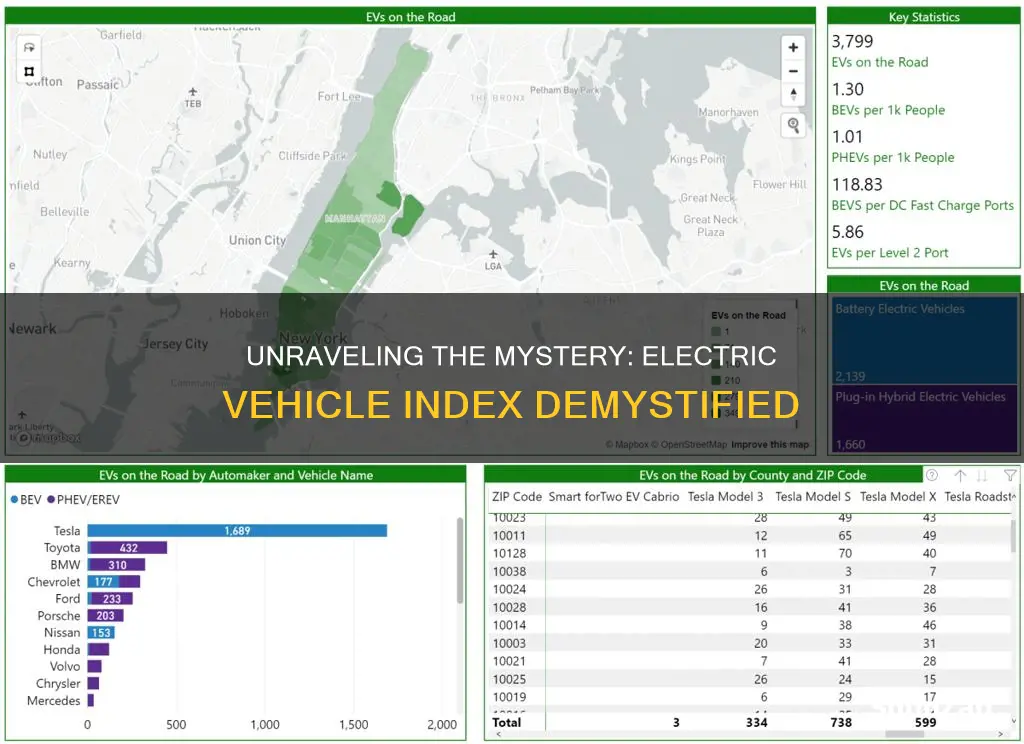

This index typically includes a diverse range of companies involved in the electric vehicle ecosystem, encompassing various stages of the value chain. It may comprise manufacturers of electric cars, buses, and motorcycles, as well as suppliers of critical components such as batteries, motors, and charging infrastructure. Additionally, it might include companies providing services related to EV adoption, such as charging network operators, battery recycling specialists, and software developers catering to the EV market. The inclusion of these diverse segments ensures that the index reflects the multifaceted nature of the electric vehicle industry.

The primary objective of the Electric Vehicle Index is to provide a clear and accurate representation of the market's performance in the EV sector. It does so by aggregating the financial data of the included stocks, calculating weighted averages, and monitoring price movements over time. This index is designed to be a reliable tool for investors, analysts, and policymakers, enabling them to assess the overall health and growth potential of the electric vehicle industry. By tracking the index, stakeholders can identify trends, make investment decisions, and develop strategies aligned with the evolving EV market.

One of the key advantages of the Electric Vehicle Index is its ability to provide a focused and specialized view of the market. Unlike broader market indices, it allows investors to pinpoint the specific areas of the EV industry that are performing well or facing challenges. This level of detail is particularly valuable for those seeking to capitalize on the opportunities presented by the rapid transition to electric mobility. Furthermore, the index can serve as a benchmark for evaluating the performance of individual EV-related companies, helping investors compare their investment returns against the overall sector performance.

In summary, the Electric Vehicle Index is a powerful financial tool that measures the performance of stocks related to the electric vehicle industry. It provides a comprehensive and focused assessment of the market's health, enabling investors to make informed decisions. By tracking the index, stakeholders can gain valuable insights into the EV sector's growth, identify investment opportunities, and contribute to the broader transition towards sustainable transportation. This index is a testament to the importance of specialized financial metrics in understanding and navigating the complexities of emerging industries.

Electric Vehicles in Colorado: Worth the Switch?

You may want to see also

Composition: Index includes companies in battery tech, charging infrastructure, and EV manufacturers

The Electric Vehicle (EV) Index is a carefully curated benchmark designed to track the performance of companies involved in the EV ecosystem. This index is a comprehensive tool that provides investors and analysts with a clear view of the market's health and growth potential in the electric vehicle sector. The composition of this index is strategically designed to encompass the entire value chain of the EV industry, ensuring a holistic representation of the market.

At its core, the index includes companies that are at the forefront of battery technology. These firms are responsible for developing and manufacturing advanced lithium-ion batteries, which are essential for powering electric vehicles. The battery tech segment is a critical component, as it directly impacts the performance, range, and overall appeal of EVs. Companies in this sector are constantly pushing the boundaries of energy density, charging speed, and battery lifespan, making them key players in the EV revolution.

In addition to battery manufacturers, the index also features companies focused on charging infrastructure. These businesses are instrumental in establishing the necessary charging networks to support the widespread adoption of electric vehicles. The charging infrastructure segment includes developers of fast-charging stations, home charging solutions, and innovative technologies that optimize charging efficiency. By including these companies, the index highlights the importance of a robust charging ecosystem, which is vital for addressing range anxiety and ensuring a seamless user experience.

Furthermore, the Electric Vehicle Index encompasses EV manufacturers, who are the primary producers of electric cars, trucks, and motorcycles. These companies design and assemble vehicles powered by electric motors and advanced battery systems. The index tracks the performance of various EV manufacturers, considering factors such as vehicle sales, market share, and product innovation. By including this segment, the benchmark provides insights into the competitive landscape and the overall demand for electric transportation.

The composition of the index is carefully selected to ensure a balanced representation of the market. It aims to capture the diverse range of companies that contribute to the EV industry's growth. By including battery tech firms, charging infrastructure providers, and EV manufacturers, the index offers a comprehensive view of the entire EV ecosystem. This holistic approach allows investors to make informed decisions, identify emerging trends, and assess the potential for long-term growth in the electric vehicle sector.

Ford's Future: Electric Vehicles in Transition

You may want to see also

Performance: Tracks the market's overall growth and volatility in the EV sector

The Electric Vehicle (EV) sector is a rapidly growing industry, and tracking its performance is crucial for investors and stakeholders. The concept of an 'Electric Vehicle Index' is a powerful tool to measure and analyze the overall health and volatility of this market. This index provides a comprehensive view of the EV sector's performance, allowing investors to make informed decisions.

Performance tracking in the EV market involves monitoring various factors that influence the sector's growth and volatility. One key aspect is the overall market capitalization of EV companies. This includes tracking the total value of publicly traded EV manufacturers, suppliers, and related businesses. By analyzing market cap trends, investors can identify periods of growth or decline, helping them understand the market's sentiment and potential future directions. For instance, a steady increase in market cap could indicate rising investor confidence in the EV sector, while a sharp decline might suggest external factors impacting the industry.

Volatility is another critical component of performance tracking. The EV sector, like any other market, experiences price fluctuations, which can be influenced by various factors such as technological advancements, regulatory changes, and consumer trends. Investors often use volatility indicators to gauge the market's short-term price movements and potential risks. These indicators can help identify periods of high uncertainty, allowing investors to adjust their strategies accordingly. For example, a sudden spike in volatility might prompt investors to reevaluate their positions and consider risk management techniques.

Additionally, tracking the performance of specific EV sub-sectors is essential. The EV industry encompasses various segments, including automotive, energy storage, charging infrastructure, and battery technology. Each sub-sector may exhibit unique growth patterns and sensitivities to market changes. By analyzing these sub-sectors' performances, investors can identify areas of strength and weakness within the EV market. This detailed analysis enables a more nuanced understanding of the industry, helping investors make strategic decisions based on specific sectoral trends.

In summary, performance tracking in the EV sector involves a comprehensive approach, considering market capitalization, volatility, and sector-specific trends. This analysis provides valuable insights for investors, enabling them to navigate the dynamic EV market effectively. It allows for better risk management, strategic decision-making, and a deeper understanding of the industry's overall growth and potential challenges.

Hybrid Electric Vehicles: Unveiling the Hidden Drawbacks

You may want to see also

Impact: Economic and environmental effects of the EV industry on global markets

The rise of the electric vehicle (EV) industry has had a profound impact on global markets, reshaping economic landscapes and driving significant environmental changes. This shift towards electric mobility is not just a trend but a necessary evolution in the automotive sector, aimed at reducing carbon footprints and combating climate change. The economic implications are far-reaching, affecting various sectors and industries worldwide.

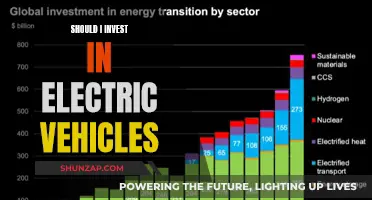

From an economic perspective, the EV industry has stimulated innovation and investment, fostering a new wave of technological advancements. The development and manufacturing of electric vehicles require specialized skills and knowledge, leading to the creation of new job opportunities in research, design, and production. This has resulted in a surge of employment in the automotive sector, particularly in regions that have embraced EV manufacturing. Additionally, the rise of EV startups and tech companies has contributed to a dynamic and competitive market, challenging traditional automotive giants. This increased competition drives innovation, improves product quality, and potentially lowers prices, benefiting consumers.

However, the economic impact also extends to the broader supply chain and infrastructure. The production of electric vehicles relies on a complex network of suppliers for batteries, motors, and other critical components. This has led to the growth of secondary industries, including battery manufacturing hubs and the development of charging infrastructure. As a result, local and regional economies benefit from increased investment, job creation, and the establishment of new business ventures. The shift towards EVs also influences the energy sector, as the demand for electricity to power these vehicles rises, potentially impacting energy prices and distribution networks.

Environmental benefits are a significant driving force behind the EV industry's growth. Electric vehicles produce zero tailpipe emissions, significantly reducing air pollution and greenhouse gas emissions. This shift contributes to improved air quality in urban areas and helps countries meet their emissions reduction targets, which is crucial in the fight against climate change. The environmental impact is further amplified by the potential for renewable energy sources to power EVs, creating a sustainable energy loop. As more EVs hit the roads, the collective reduction in emissions can lead to a substantial decrease in carbon footprints on a global scale.

In summary, the EV industry's economic and environmental effects are interconnected and far-reaching. Economically, it fosters innovation, creates jobs, and stimulates new business opportunities. Environmentally, it plays a pivotal role in reducing pollution and combating climate change. The global market's response to this industry transformation is evident in the increasing demand for electric vehicles, the growth of supporting industries, and the potential for a more sustainable future. As the world embraces the EV revolution, the long-term benefits for both the economy and the environment are likely to be substantial.

Boosting EV Speed: Tips for Faster, More Efficient Driving

You may want to see also

Future Trends: Forecasts and predictions for the EV market's evolution and sustainability

The electric vehicle (EV) market is experiencing rapid growth and transformation, driven by technological advancements, environmental concerns, and government incentives. As the world shifts towards more sustainable transportation, the EV industry is poised for significant evolution, with several key trends and predictions shaping its future.

One of the most prominent trends is the continuous improvement in battery technology. The development of more efficient, powerful, and longer-lasting batteries is a critical factor in the widespread adoption of EVs. Researchers and manufacturers are investing heavily in solid-state batteries, which promise higher energy density and faster charging times compared to traditional lithium-ion batteries. This innovation will not only enhance the range of EVs but also reduce the overall cost, making electric vehicles more accessible to a broader consumer base. By 2030, it is predicted that solid-state battery technology will be commercialized, revolutionizing the EV industry.

Another significant trend is the expansion of charging infrastructure. As the number of EVs on the road increases, so does the demand for convenient and efficient charging solutions. Governments and private companies are investing in the development of fast-charging stations, aiming to reduce charging times significantly. The implementation of wireless charging technology, which allows EVs to charge without physical connections, is also gaining traction. This trend will not only improve the user experience but also encourage the adoption of EVs in remote areas where traditional charging infrastructure may be limited.

The future of the EV market also lies in the integration of smart technologies and connectivity. Electric vehicles are becoming increasingly intelligent, with advanced driver-assistance systems (ADAS) and autonomous driving capabilities. These features enhance safety, improve driving efficiency, and provide a more personalized experience for users. Additionally, the integration of IoT (Internet of Things) devices in EVs will enable real-time data collection and analysis, allowing for predictive maintenance and optimized energy management. This connectivity will further drive the market's growth and create new opportunities for EV manufacturers and service providers.

In terms of sustainability, the EV industry is expected to play a crucial role in reducing greenhouse gas emissions and combating climate change. As more countries and cities implement stricter emission regulations, the demand for zero-emission vehicles will continue to rise. Governments are likely to offer further incentives and subsidies to promote EV adoption, making it an increasingly attractive option for consumers. The shift towards a more sustainable transportation ecosystem will also drive innovation in recycling and waste management, ensuring that the EV market's growth is environmentally responsible.

Looking ahead, the EV market's evolution will be characterized by a combination of technological advancements, infrastructure development, and a strong focus on sustainability. With ongoing research and development, the industry is set to deliver more efficient, affordable, and environmentally friendly electric vehicles. The predictions indicate a bright future for the EV market, with a potential global shift towards sustainable transportation, reducing our reliance on fossil fuels and contributing to a greener planet.

Transform Your Ride: A Comprehensive Guide to Electric Vehicle Conversion

You may want to see also

Frequently asked questions

The Electric Vehicle Index (EVI) is a performance metric and ranking system designed to evaluate and categorize electric vehicles (EVs) based on their overall efficiency, sustainability, and technological advancements. It provides a comprehensive overview of the EV market, helping consumers, investors, and policymakers make informed decisions.

The EVI is calculated using a proprietary algorithm that considers various factors, including vehicle range, battery efficiency, charging speed, environmental impact, safety features, and technological innovations. It assigns a score to each EV, with higher scores indicating superior performance and sustainability. The index is regularly updated to reflect the latest market trends and technological advancements.

The EVI is a valuable resource for a wide range of stakeholders. Consumers can use it to compare different EV models and make informed purchasing decisions based on their specific needs and preferences. Investors can analyze the market trends and identify opportunities in the EV industry. Policymakers can utilize the index to develop strategies and incentives to promote sustainable transportation.

The Electric Vehicle Index is updated periodically to ensure its accuracy and relevance. Updates may occur annually or more frequently, depending on significant market developments, technological breakthroughs, or changes in consumer preferences. Regular updates help maintain the index's reliability and provide the most current information for users.