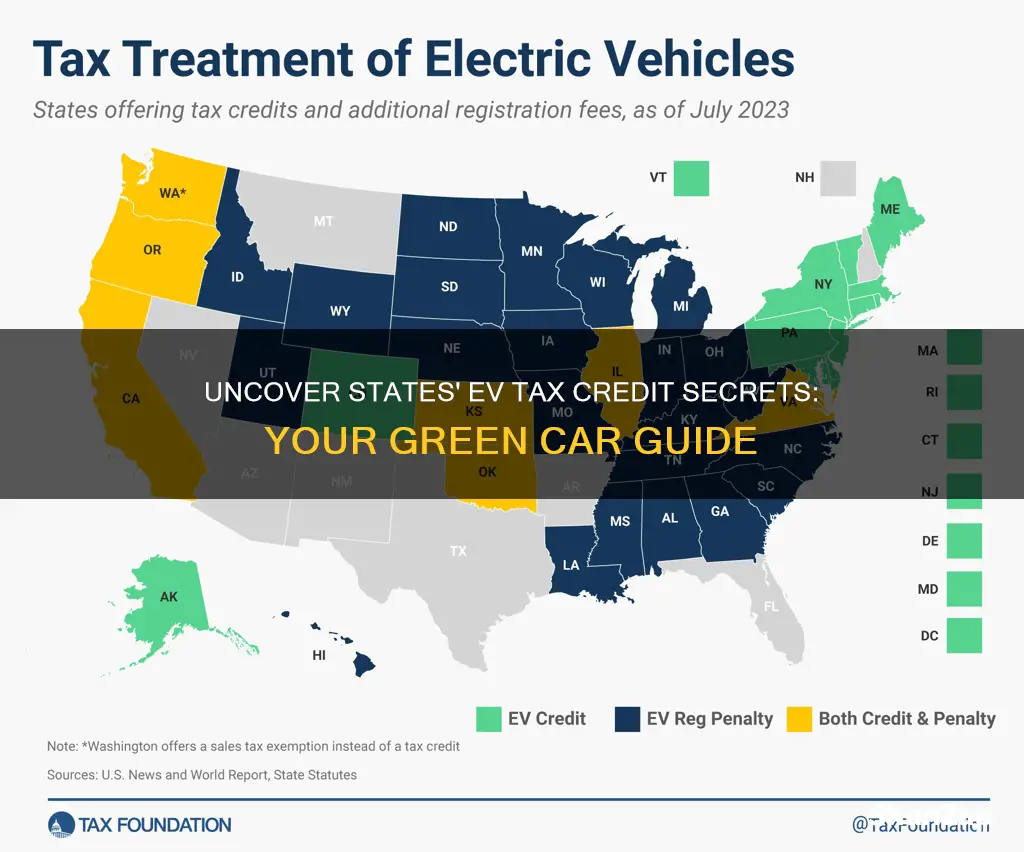

Electric vehicles (EVs) are becoming increasingly popular, and many states are offering incentives to encourage their adoption. One such incentive is the electric vehicle tax credit, which provides financial benefits to EV buyers. This paragraph will explore the states that offer this tax credit, highlighting the benefits and potential savings for EV owners. It will also discuss the criteria for eligibility and the process of claiming the credit.

What You'll Learn

- Eligibility Criteria: States define who qualifies for EV tax credits, often based on vehicle type and income

- Credit Amounts: Tax credit amounts vary by state, ranging from a few hundred to several thousand dollars

- Income Limits: Many states impose income caps to ensure credits benefit lower- to middle-income residents

- Vehicle Requirements: States specify EV types, battery sizes, and other technical criteria for eligible vehicles

- Application Process: Taxpayers must follow specific procedures to claim credits, often involving forms and documentation

Eligibility Criteria: States define who qualifies for EV tax credits, often based on vehicle type and income

The criteria for qualifying for electric vehicle (EV) tax credits vary significantly across different states, and understanding these eligibility requirements is crucial for EV buyers. Many states have implemented tax incentives to encourage the adoption of electric cars, trucks, and motorcycles, but each state has its own unique rules. These rules often consider factors such as the type of vehicle, its price, and the buyer's income.

One common eligibility criterion is the vehicle type. Some states offer tax credits exclusively for electric cars, while others provide incentives for a broader range of EVs, including electric trucks and motorcycles. For instance, California's Clean Vehicle Rebate Project provides rebates for electric cars, plug-in hybrids, and fuel cell vehicles, but not for traditional hybrid vehicles. In contrast, New York's EV Tax Credit Program includes a broader range of vehicles, such as electric buses and delivery vehicles, in addition to cars and trucks.

Income limits are another critical factor in determining eligibility. Many states cap the income of eligible buyers to ensure that tax credits are directed towards lower- to middle-income households. For example, the Massachusetts EV Tax Credit Program has a maximum household income of $150,000 for individuals and $250,000 for joint filers. Similarly, the Oregon Clean Vehicle Rebate Program has a maximum income limit of $150,000 for individuals and $225,000 for joint filers. These income thresholds ensure that the tax credits benefit those who may need financial assistance the most.

In addition to vehicle type and income, some states also consider the price of the EV. Certain states offer tax credits based on the vehicle's price, ensuring that incentives are provided to those purchasing more affordable EVs. For instance, the New York EV Tax Credit Program provides a credit of up to $2,000 for vehicles priced below $35,000 and up to $4,000 for vehicles priced below $50,000. This pricing-based eligibility ensures that a wider range of consumers can benefit from the tax credits.

It is essential for EV buyers to research and understand the specific eligibility criteria of their state to maximize their chances of receiving the tax credit. States often provide detailed information on their websites, outlining the requirements and application processes. Staying informed about these criteria can help buyers make more informed decisions and potentially save a significant amount on their EV purchase.

Understanding the Basics: Vehicle Electrical Architecture Explained

You may want to see also

Credit Amounts: Tax credit amounts vary by state, ranging from a few hundred to several thousand dollars

The financial incentives for electric vehicle (EV) buyers vary significantly across different states in the United States. These incentives, often in the form of tax credits, play a crucial role in promoting the adoption of electric cars and reducing the overall cost for consumers. Tax credit amounts can range from a modest few hundred dollars to several thousand dollars, depending on the state and specific vehicle criteria.

For instance, California, a state known for its aggressive environmental policies, offers a substantial tax credit of up to $7,000 for the purchase of new electric vehicles. This credit is designed to encourage residents to make the switch from traditional gasoline-powered cars to electric ones, contributing to the state's goal of reducing greenhouse gas emissions. Similarly, New York provides a tax credit of up to $2,000, while New Jersey offers a credit of up to $1,500. These credits can significantly impact the upfront cost of an EV, making it more affordable for potential buyers.

On the other hand, some states offer lower tax credits, which can still provide valuable savings. For example, Connecticut provides a tax credit of up to $3,000, and Massachusetts offers a credit of up to $2,500. These credits, while lower than some states, can still contribute to the overall cost reduction, making electric vehicles more accessible to a wider range of consumers.

It's important to note that the availability and amount of these tax credits are subject to change and may be influenced by various factors, including state legislation, budget constraints, and the specific vehicle models eligible for the credit. Therefore, prospective EV buyers should research the most up-to-date information for their respective states to understand the current tax credit offerings and their potential savings.

In summary, the tax credit amounts for electric vehicles vary widely by state, providing a range of financial incentives for consumers. From substantial credits of several thousand dollars to more modest savings, these incentives aim to make electric vehicles more affordable and accessible, ultimately contributing to a greener and more sustainable transportation future.

Anne Heche's Electric Vehicle: A Green Choice or a Misstep?

You may want to see also

Income Limits: Many states impose income caps to ensure credits benefit lower- to middle-income residents

Many states have implemented income limits for their electric vehicle (EV) tax credits to ensure that these financial incentives primarily benefit lower- to middle-income residents. This strategy aims to promote EV adoption among those who might otherwise struggle to afford the higher upfront costs of electric cars. By setting income thresholds, states can target their resources towards individuals and families who may have limited financial means but still desire to make the switch to electric vehicles.

For instance, California, one of the leading states in EV incentives, offers the Clean Vehicle Rebate Project (CVRP). This program provides rebates of up to $7,000 for new electric cars and $4,500 for used electric vehicles, but with specific income guidelines. The income limits for the CVRP are set at $100,000 for individuals and $150,000 for households, ensuring that the credits are accessible to a broader range of residents. Similarly, New York's EV tax credit program has an income cap of $150,000 for individuals and $200,000 for joint filers, further emphasizing the focus on lower- to middle-income earners.

These income limits are designed to prevent the tax credits from disproportionately benefiting higher-income individuals who may already have the financial flexibility to purchase electric vehicles. By doing so, states aim to create a more equitable environment where the benefits of EV ownership are accessible to a diverse range of residents. This approach not only supports the environmental goals of reducing greenhouse gas emissions but also contributes to social equity by ensuring that the financial incentives are directed towards those who need them most.

It is important for potential EV buyers to be aware of these income restrictions when considering purchasing an electric vehicle. Many states provide clear guidelines on their official websites, outlining the specific income thresholds and the corresponding tax credit amounts. Prospective buyers should review these details to understand whether they qualify for the incentives and to make informed decisions about their vehicle purchases.

In summary, income limits are a crucial aspect of state-level EV tax credit programs, ensuring that the financial benefits reach lower- to middle-income residents. This strategy not only promotes EV adoption among those who need it most but also contributes to a more sustainable and equitable transportation system. As the popularity of electric vehicles continues to grow, understanding these income-based requirements will be essential for consumers to maximize the potential savings.

Electric Vehicle Fun: A Smooth, Eco-Friendly Ride

You may want to see also

Vehicle Requirements: States specify EV types, battery sizes, and other technical criteria for eligible vehicles

When it comes to electric vehicle (EV) tax credits, the specific requirements can vary widely from state to state. Each state has its own criteria for determining which EVs qualify for the credit, and these criteria can be quite detailed and technical. Understanding these requirements is essential for EV owners and potential buyers to ensure they can take full advantage of the financial incentives available.

One of the primary considerations is the type of electric vehicle. States often differentiate between various EV categories, such as all-electric cars, plug-in hybrid electric vehicles (PHEVs), and fuel cell vehicles. For instance, California's Clean Vehicle Rebate Project (CVRP) provides rebates for new and in-use all-electric cars and PHEVs, but it does not include fuel cell vehicles. Similarly, New York's EV Tax Credit Program offers incentives for new and used all-electric cars and PHEVs, with specific limitations on vehicle age and mileage.

Battery size and capacity are another set of technical criteria that states may use to define eligible vehicles. Many states require EVs to have a minimum battery capacity or range to qualify for the tax credit. For example, the Massachusetts EV Tax Credit Program provides a credit of up to $2,500 for new EVs with a battery range of at least 100 miles, while the New Jersey EV Tax Credit Program offers a maximum credit of $7,500 for new EVs with a battery range of 100 miles or more. These range requirements ensure that the vehicles are capable of providing a practical driving experience without frequent charging.

In addition to battery specifications, states may also consider other technical aspects such as vehicle weight, horsepower, and emissions. Some states might have specific weight requirements to ensure the vehicle's structural integrity and safety. For instance, the Oregon EV Tax Credit Program provides a credit of up to $2,000 for new EVs with a combined weight of 4,500 pounds or less. Horsepower limits are also common, with states like New York capping the credit at vehicles with a horsepower rating of 150 or less.

Furthermore, states may impose restrictions on the age and mileage of eligible vehicles. For used EVs, states might require a minimum battery health percentage or a specific age limit. For example, the Connecticut EV Tax Credit Program offers a credit of up to $3,000 for used EVs with a battery health of at least 70%, while the Maryland EV Tax Credit Program provides incentives for used EVs that are less than 5 years old. These criteria ensure that the vehicles are in good condition and have a reasonable lifespan remaining.

It is important for EV owners and prospective buyers to carefully review the specific requirements set by their state to ensure their vehicle meets all the necessary criteria. Staying informed about these vehicle requirements can help individuals take advantage of the available tax credits and make more sustainable transportation choices.

Lubricants for Electric Vehicles: Enhancing Efficiency and Longevity

You may want to see also

Application Process: Taxpayers must follow specific procedures to claim credits, often involving forms and documentation

The process of claiming electric vehicle (EV) tax credits can vary depending on the state, and it's important for taxpayers to understand the specific procedures to ensure they receive the benefits they are entitled to. Here's an overview of the application process:

Research and Eligibility: Begin by researching your state's EV tax credit program. Each state has its own criteria for eligibility, which may include factors such as vehicle purchase date, residency, and income limits. For instance, some states offer credits for the purchase of new EVs, while others provide incentives for used vehicles. It's crucial to verify your eligibility to avoid any issues during the application.

Gather Required Documents: The application process typically requires taxpayers to submit various documents to support their claim. These documents may include proof of residency, such as a driver's license or state ID, and evidence of the EV purchase, such as a sales contract or invoice. Additionally, you might need to provide financial information, such as income verification, to meet the state's eligibility requirements.

Complete and Submit the Application: Taxpayers are usually required to fill out a specific form provided by the state's tax authority or relevant department. This form may be available online or can be requested from the appropriate government office. Carefully review the instructions and ensure that all required fields are completed accurately. Inaccurate or incomplete information can lead to delays or rejection of the application. After filling out the form, submit it along with the supporting documents to the designated authority.

Follow Up and Stay Informed: After submitting the application, it's essential to follow up to ensure its processing. Each state may have different timelines for processing tax credit claims, and some may require additional information or documentation. Stay informed about the status of your application by checking the relevant state agency's website or contacting their customer service for updates.

Keep Records: Maintain a record of your application, including the submitted documents and any correspondence with the tax authority. This documentation can be useful if there are any disputes or if you need to provide additional information in the future. Proper record-keeping ensures a smoother process and helps taxpayers stay organized.

Remember, the application process for EV tax credits can vary, so it's crucial to consult your state's official resources for the most accurate and up-to-date information. By following the specific procedures and providing the necessary documentation, taxpayers can successfully claim their eligible credits.

Electric Vehicles: Green Revolution or Environmental Trade-Off?

You may want to see also

Frequently asked questions

Several states in the United States offer tax incentives to promote the adoption of electric vehicles (EVs). These credits can significantly reduce the cost of purchasing an EV, making it more affordable for consumers. Some of the notable states that provide EV tax credits include California, New York, New Jersey, Massachusetts, and Oregon. Each state has its own eligibility criteria and credit amounts, so it's essential to check the specific details for your state.

The tax credit amount varies depending on the state and the specific EV model. For instance, in California, the Clean Vehicle Rebate Project offers a rebate of up to $7,000 for new electric cars and $3,000 for used EVs. New York provides a tax credit of up to $2,000 for electric vehicles, while New Jersey's credit can reach up to $5,000. It's advisable to research the latest information from your state's revenue department to determine the exact credit amount you may qualify for.

Income limits are a common consideration for tax credits, and they can vary across states. For example, in California, the Clean Vehicle Rebate Project has an income limit of $100,000 for individuals and $150,000 for joint filers. In New York, the tax credit is available to residents with an adjusted gross income (AGI) below $150,000 for single filers and $200,000 for joint filers. These limits ensure that the credits benefit a broader range of taxpayers.

Tax credits for EVs are typically available for purchases, not leases. When you lease a vehicle, you don't own it, and the lease agreement often includes restrictions on modifying or selling the vehicle. Therefore, leasing an EV might not qualify you for the tax credit. However, it's best to consult with a tax professional or review the specific regulations in your state to understand the eligibility criteria.

The process for claiming the tax credit varies by state. In some states, you may need to submit an application or provide documentation to the state's revenue department. This could include proof of residency, vehicle purchase or lease agreement, and income verification. For instance, in California, you must apply through the Clean Vehicle Rebate Project website. In other states, the credit might be automatically applied to your state tax return. It's crucial to follow the instructions provided by your state's tax authority to ensure a smooth claiming process.