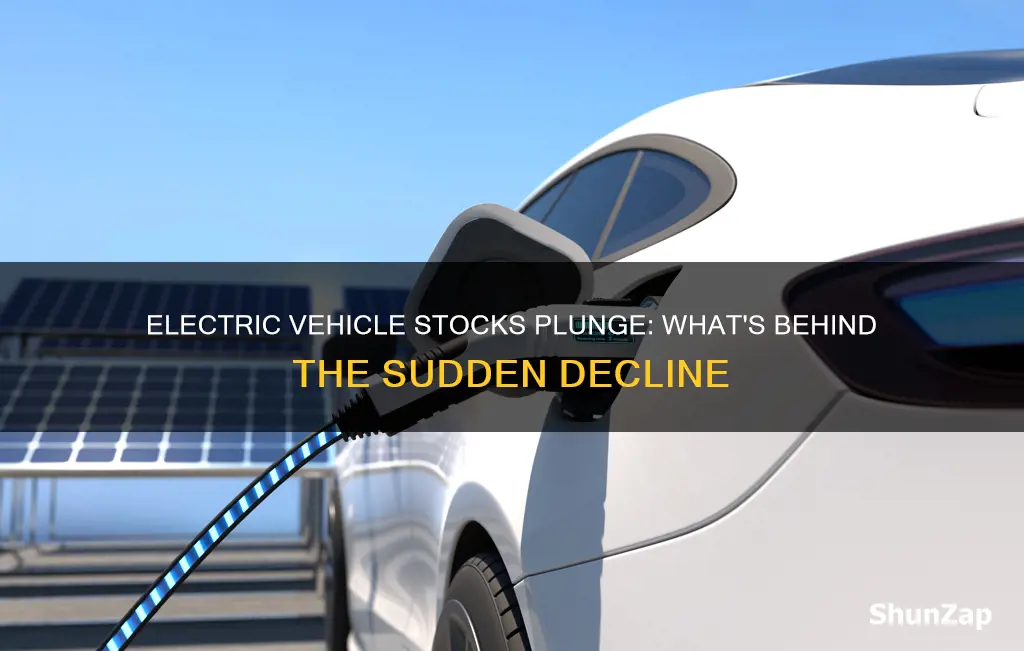

Electric vehicle (EV) stocks have experienced a recent downturn, prompting investors and industry observers to seek explanations. This decline can be attributed to various factors, including supply chain disruptions, rising raw material costs, and concerns about consumer demand in the face of economic uncertainties. Additionally, regulatory changes and the emergence of new competitors in the market have further impacted the sector's performance. Understanding these factors is crucial for investors and stakeholders to navigate the evolving landscape of the EV industry.

What You'll Learn

- Supply Chain Disruptions: Shortages of critical materials like lithium and cobalt impact production and sales

- Battery Technology Challenges: Range anxiety, charging time, and battery degradation concerns hinder widespread adoption

- Regulatory and Policy Changes: Shifts in government incentives, subsidies, and emissions standards affect market dynamics

- Economic Factors: High upfront costs, inflation, and recession fears make EVs less affordable for some consumers

- Competition and Market Saturation: Increased competition from traditional automakers and new entrants dilutes market share

Supply Chain Disruptions: Shortages of critical materials like lithium and cobalt impact production and sales

The recent decline in electric vehicle (EV) stock prices can be attributed to several factors, and one of the most significant is supply chain disruptions, particularly the shortages of essential raw materials. The production and sales of electric vehicles heavily rely on critical materials such as lithium, cobalt, and nickel, which are crucial for battery manufacturing. These materials are in high demand, and their supply chains are complex, often sourced from a limited number of regions.

The global supply chain for these materials is vulnerable to various disruptions. For instance, lithium, a key component in lithium-ion batteries, is primarily extracted from brine pools in South America and hard-rock mines in Australia. Any political instability or natural disasters in these regions can significantly impact production. Similarly, cobalt, another critical material, is mainly mined in the Democratic Republic of Congo, where political unrest and safety concerns have led to supply chain disruptions in the past. These shortages create a ripple effect throughout the EV industry, causing a bottleneck in production and delaying the launch of new models.

The impact of these shortages is twofold. Firstly, it directly affects the production capacity of EV manufacturers, leading to reduced output and delayed deliveries. This, in turn, results in lower sales and revenue, especially for companies with a heavy reliance on these materials. Secondly, the shortages create a sense of uncertainty and risk among investors, who may question the long-term sustainability of the EV market. As a result, stock prices for EV manufacturers and suppliers can experience a downward trend, reflecting the market's concerns about the industry's ability to overcome these supply chain challenges.

To address these issues, EV companies are exploring various strategies. Some are investing in vertical integration, where they control the entire supply chain, from mining to processing and manufacturing. Others are forming partnerships with mining companies to secure long-term supply agreements. Additionally, research and development efforts are focused on finding alternative materials and improving recycling processes to reduce the reliance on critical minerals. These measures aim to ensure a more stable and sustainable supply of materials, which is crucial for the long-term growth and success of the electric vehicle industry.

In summary, supply chain disruptions, particularly the shortages of lithium, cobalt, and other critical materials, have a significant impact on the electric vehicle market. These shortages lead to production delays, reduced sales, and investor uncertainty. To mitigate these challenges, EV manufacturers are adopting various strategies, including supply chain optimization and the development of alternative materials, to ensure a more resilient and sustainable future for the industry.

Green Revolution: Unveiling EV's Environmental Impact

You may want to see also

Battery Technology Challenges: Range anxiety, charging time, and battery degradation concerns hinder widespread adoption

The widespread adoption of electric vehicles (EVs) has been a topic of interest and investment for several years, but recent trends indicate a downward trend in EV stock prices, sparking curiosity and concern among investors and enthusiasts alike. One of the primary reasons behind this phenomenon is the persistent challenges associated with battery technology, which are crucial to the performance and appeal of EVs.

Range anxiety, a term that has gained traction in the automotive industry, refers to the fear or worry that an EV's battery will run out of power before reaching its destination. This anxiety is a significant barrier to the widespread acceptance of electric vehicles. While modern EVs have made remarkable strides in terms of range, with some models now offering over 300 miles on a single charge, the fear of running out of power remains a real concern for many potential buyers. The current battery technology often fails to match the range of traditional gasoline vehicles, and the infrastructure to support long-distance travel is still developing.

Charging time is another critical issue. Unlike the quick and convenient process of refueling a gasoline vehicle, charging an EV can take significantly longer, often requiring hours to fully recharge. This extended charging time is a practical concern for daily commuters and those with busy schedules. The availability of fast-charging stations is improving, but the process still lags behind the speed and convenience of traditional fueling methods, potentially discouraging potential EV owners.

Battery degradation is a third critical challenge. Over time, EV batteries experience a natural decline in performance, which can lead to reduced range and increased charging times. This degradation is a result of various factors, including the chemical processes within the battery, environmental conditions, and the number of charge-discharge cycles. As batteries age, they may not hold their charge as effectively, impacting the overall reliability and appeal of EVs, especially for those who plan to keep their vehicles for an extended period.

Addressing these battery technology challenges is crucial for the successful integration of EVs into the mainstream automotive market. Manufacturers are investing in research and development to improve battery efficiency, reduce charging times, and enhance overall battery life. Additionally, efforts are being made to expand charging infrastructure and develop innovative solutions to alleviate range anxiety. While these advancements are promising, they take time to implement and may not immediately reverse the current downward trend in EV stock prices.

Electric Vehicles: Powering the Future, One Charge at a Time

You may want to see also

Regulatory and Policy Changes: Shifts in government incentives, subsidies, and emissions standards affect market dynamics

The electric vehicle (EV) market has experienced a recent downturn, and one of the primary factors influencing this trend is the evolving regulatory and policy landscape. Governments worldwide are implementing various measures that can significantly impact the EV industry's growth and market dynamics. One of the most notable changes is the shift in incentives and subsidies designed to promote EV adoption. Initially, many countries offered substantial financial incentives to encourage consumers to switch to electric cars, which helped drive sales and establish a market presence. However, as the EV market matures, governments are reassessing these incentives. Some countries are reducing or phasing out subsidies, while others are introducing new policies that may favor other transportation sectors. For instance, a government might decide to allocate more funds to public transportation infrastructure rather than individual EV purchases, potentially leading to a decrease in EV sales.

Emissions standards and regulations also play a pivotal role in shaping the EV market. As environmental concerns take center stage, governments are tightening emissions standards, pushing the industry towards more stringent requirements. While this is beneficial for the environment, it can also impact EV manufacturers. To meet these new standards, companies may need to invest in research and development, redesigning their vehicles to incorporate more advanced technologies. This increased cost could potentially be passed on to consumers, making EVs less affordable and contributing to a temporary decline in sales. Moreover, changes in emissions regulations can affect the entire supply chain, from battery production to vehicle assembly, further influencing the overall market dynamics.

The regulatory environment also encompasses the introduction or modification of policies related to charging infrastructure. Governments are recognizing the importance of a robust charging network to support widespread EV adoption. However, the development of charging stations can be a complex and costly endeavor. If governments fail to provide adequate incentives or support for charging infrastructure, it could hinder the growth of the EV market. This, in turn, may lead to a decrease in EV sales as potential buyers face challenges in finding convenient charging options.

In summary, regulatory and policy changes, particularly those related to incentives, emissions standards, and charging infrastructure, have a direct impact on the electric vehicle market. Governments' decisions to adjust subsidies, tighten emissions regulations, and manage charging infrastructure can either stimulate growth or create temporary setbacks. As the EV industry continues to evolve, staying abreast of these policy shifts is crucial for investors, manufacturers, and consumers alike, as they navigate the complexities of this rapidly changing market.

Unveiling the Average Cost of Neighborhood Electric Vehicles: A Comprehensive Guide

You may want to see also

Economic Factors: High upfront costs, inflation, and recession fears make EVs less affordable for some consumers

The electric vehicle (EV) market has been experiencing a recent downturn, and one of the primary economic factors contributing to this decline is the high upfront cost of EVs. While these vehicles offer long-term savings through reduced fuel and maintenance expenses, the initial purchase price remains a significant barrier for many potential buyers. The cost of EVs has been steadily rising, often surpassing that of their traditional gasoline counterparts, which is a direct result of the increased demand for battery technology and the limited supply of critical raw materials. This surge in prices has made EVs less accessible to price-sensitive consumers, especially those on a tight budget.

Inflation has further exacerbated the financial burden associated with electric vehicles. As the cost of living rises, consumers are more cautious about their spending, and the high prices of EVs become an even more substantial obstacle. The inflationary pressures on the automotive industry have led to increased production costs, which are then passed on to consumers. This situation is particularly challenging for individuals and families who are already struggling with rising living expenses and may not have the financial flexibility to invest in a premium vehicle.

The fear of a recession also plays a role in dampening the demand for electric vehicles. During economic downturns, consumers tend to prioritize essential purchases and often delay non-essential spending. EVs, being a relatively new and luxury item, fall into the latter category. As a result, potential buyers may opt for more affordable options or even consider postponing their purchase plans until the economic outlook improves. This behavior can significantly impact the sales and stock performance of EV manufacturers.

Additionally, the high upfront cost of EVs is not just a financial hurdle for individual consumers but also for fleet operators and businesses. Commercial fleets, which often rely on cost-effective transportation solutions, might find it challenging to justify the investment in electric vehicles due to their higher initial expenditure. This could potentially slow down the adoption of EVs in commercial sectors, further contributing to the overall market downturn.

To address these economic challenges, governments and automotive companies are exploring various strategies. These include offering incentives and subsidies to make EVs more affordable, developing more cost-effective battery technologies, and implementing policies to stimulate demand during economic downturns. By tackling these economic factors, the industry aims to overcome the current hurdles and drive the widespread adoption of electric vehicles.

California's Electric Revolution: A Green Future or a False Promise?

You may want to see also

Competition and Market Saturation: Increased competition from traditional automakers and new entrants dilutes market share

The electric vehicle (EV) market is experiencing a significant downturn, and one of the primary reasons is the intense competition and market saturation. The EV industry has attracted the attention of both established automakers and new startups, leading to a crowded landscape. Traditional automakers, such as General Motors, Ford, and Volkswagen, have been quick to recognize the potential of the EV market and have invested heavily in developing their own electric vehicle lines. This has resulted in a rapid expansion of their product portfolios, with numerous EV models entering the market. As a consequence, consumers now have a wider range of choices, which, while beneficial in many ways, has also led to increased competition and market saturation.

The influx of new entrants into the EV space is another factor contributing to the current situation. Many startups and niche manufacturers have emerged, offering innovative and unique electric vehicles. While these new players bring fresh ideas and designs, they also face the challenge of establishing a strong market presence. As a result, the market becomes more competitive, with established brands and newcomers vying for consumer attention and market share. This competition often leads to price wars, as companies try to outdo each other with discounts and promotions, further impacting stock prices.

Market saturation occurs when the supply of a product exceeds the demand, leading to a decline in prices and potential losses for manufacturers. In the EV industry, the rapid growth in production capacity has outpaced the growth in consumer demand. This imbalance is evident as the market becomes saturated, with an oversupply of electric vehicles. As a result, companies are forced to lower prices to attract buyers, which directly affects their profitability and stock performance. The increased competition and market saturation have created a challenging environment for EV manufacturers, especially those who were early entrants and had higher production costs.

To address this issue, some EV companies are focusing on differentiation and niche markets. They aim to stand out by offering unique features, superior performance, or specialized versions of their vehicles. By targeting specific consumer segments, these companies can maintain a competitive edge and protect their market share. Additionally, strategic partnerships and collaborations between traditional automakers and startups can help streamline production, reduce costs, and bring innovative products to market faster.

In summary, the electric vehicle market's downturn can be attributed to the intense competition and market saturation caused by the entry of traditional automakers and new players. This competition has led to price wars, oversupply, and a decline in stock prices. To navigate this challenging environment, EV manufacturers must focus on innovation, niche markets, and strategic collaborations to maintain their competitiveness and ensure long-term success in the rapidly evolving EV industry.

The Evolution of Electric Vehicles: A Historical Perspective

You may want to see also

Frequently asked questions

The downturn in EV stocks can be attributed to various factors. Firstly, the broader market sentiment plays a significant role, where overall stock market volatility and a shift towards more defensive sectors can impact EV-related investments. Secondly, concerns about supply chain disruptions and component shortages have affected the production and sales of electric vehicles, leading to reduced demand and potential revenue shortfalls for EV manufacturers. Additionally, rising interest rates and inflationary pressures may discourage investors, as these factors can impact consumer spending and the overall economic environment.

Yes, several recent events have contributed to the downward trend. One significant factor is the announcement of new government policies and incentives that favor traditional internal combustion engine (ICE) vehicles over EVs. These policies may have created uncertainty among investors regarding the long-term growth prospects of the EV industry. Moreover, some high-profile companies in the EV space have faced challenges, such as production delays, supply chain issues, or financial performance that fell short of expectations, causing a ripple effect on the entire sector.

The current decline is likely a combination of both temporary market fluctuations and some underlying structural challenges. While the market reaction to recent news and events has been a significant factor, the EV industry is still in its early stages and faces several long-term hurdles. These include the need for extensive charging infrastructure, battery technology advancements, and addressing consumer range anxiety. Additionally, the competition from established automakers and the potential for regulatory changes could impact the industry's growth trajectory. However, many industry experts believe that the long-term prospects for EVs remain positive, and the recent decline may provide an opportunity for investors to re-evaluate their strategies and consider the industry's potential for long-term growth.