Are you considering buying an electric vehicle but are unsure about the financial incentives available? Many governments worldwide offer special financing incentives to encourage the adoption of electric vehicles, which can significantly reduce the upfront cost of purchasing these eco-friendly cars. These incentives often include tax credits, rebates, and low-interest loans, making electric vehicles more affordable and accessible to consumers. In this article, we will explore the various financing incentives available for electric vehicle buyers, helping you make an informed decision about your next green purchase.

| Characteristics | Values |

|---|---|

| Federal Tax Credit | Up to $7,500 per vehicle (as of 2023) |

| State-Level Incentives | Varies by state; some offer tax credits, rebates, or grants |

| Local Government Programs | Cities and counties may provide additional incentives, such as reduced registration fees or property tax exemptions |

| Manufacturer Incentives | Many EV manufacturers offer special financing deals, lease offers, or cashback programs |

| Green Vehicle Schemes | Some countries have specific schemes to promote EV adoption, like the UK's Plug-in Car Grant |

| Low-Interest Loans | Financial institutions often provide loans with lower interest rates for electric vehicles |

| Lease Options | Leasing an EV can be more affordable, with some manufacturers offering lease-to-own programs |

| Zero-Emission Vehicle (ZEV) Status | In some regions, EVs are exempt from certain fees, like HOV lane restrictions or congestion charges |

| Environmental Benefits | While not a financing incentive, the environmental impact of EVs is a significant advantage |

| Long-Term Cost Savings | EVs have lower running costs due to reduced maintenance and cheaper electricity compared to gasoline |

What You'll Learn

- Tax Credits: Federal and state tax incentives for electric vehicle buyers

- Rebates: Local and regional rebates to reduce EV purchase costs

- Low-Interest Loans: Special financing options with low interest rates for EVs

- Grant Programs: Government grants to support EV adoption and infrastructure

- Lease Incentives: Lease deals with reduced monthly payments for electric cars

Tax Credits: Federal and state tax incentives for electric vehicle buyers

The United States offers a range of tax incentives to encourage the adoption of electric vehicles (EVs), which can significantly reduce the overall cost of purchasing an EV. These incentives are designed to make EVs more affordable and attractive to consumers, thereby promoting a cleaner and more sustainable transportation system. Here's an overview of the federal and state tax credits available to electric vehicle buyers:

Federal Tax Credits:

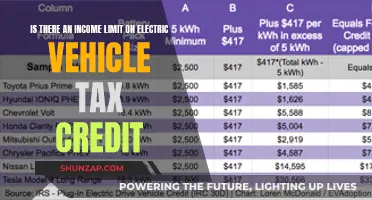

The federal government provides a valuable tax credit for EV purchases, which has been a significant driver of EV sales in the US. As of 2023, the federal tax credit for electric vehicles is available to buyers of new EVs, including plug-in hybrids and fuel cell vehicles. The credit amount varies depending on the vehicle's price and the manufacturer's compliance with certain production requirements. Initially, the credit was set at $7,500 per vehicle, but it was temporarily reduced to $3,750 due to high demand and to encourage the domestic production of EVs. This credit is a direct refund to the buyer and can be claimed when filing taxes. It applies to vehicles with a base price below a certain threshold, ensuring that the incentive supports a wide range of EV models.

State-Level Incentives:

In addition to federal tax credits, many states offer their own incentives to further reduce the cost of electric vehicles for their residents. These state-level programs can include tax credits, rebates, or even special license plate fees that provide additional savings. For instance, California, a leader in EV adoption, offers the Clean Vehicle Rebate Project, which provides rebates of up to $7,000 for the purchase or lease of new electric cars and $2,500 for plug-in hybrids. Similarly, New York State offers a rebate program with varying amounts based on the vehicle's battery capacity and the dealer's location. These state-specific incentives can vary widely in terms of eligibility criteria, vehicle types covered, and the amount of savings offered, so it's essential for buyers to research their state's specific programs.

When considering the purchase of an electric vehicle, it is crucial to understand the tax credits and incentives available, as they can significantly impact the overall cost. Buyers should also be aware that some of these incentives may have expiration dates or specific requirements, such as minimum battery capacity or a cap on the number of vehicles eligible for the credit. Staying informed about these details can help potential EV buyers make more informed decisions and take full advantage of the financial incentives available to them.

Global Shift: Countries Leading the EV Revolution

You may want to see also

Rebates: Local and regional rebates to reduce EV purchase costs

Local and regional rebates are an essential aspect of the financial incentives available to consumers looking to purchase electric vehicles (EVs). These rebates can significantly reduce the upfront cost of buying an EV, making it more affordable and accessible to a wider range of buyers. The amount of the rebate can vary depending on the location and the specific program, but they generally aim to lower the barrier to entry for EV ownership.

Many governments, at both the local and regional levels, offer financial incentives to encourage the adoption of electric vehicles. These rebates are designed to offset the higher initial cost of EVs compared to traditional gasoline vehicles. The primary goal is to accelerate the transition to a more sustainable transportation system by making EVs more economically viable for the general public.

The process of claiming these rebates typically involves a few key steps. Firstly, potential EV buyers need to research and identify the available rebate programs in their area. This information can usually be found on government websites or through local automotive associations. Each program will have its own set of criteria and requirements, such as income limits or specific vehicle models eligible for the rebate. Once the buyer has identified the relevant programs, they can then proceed with the purchase, ensuring that they meet all the necessary conditions.

After purchasing the EV, the next step is to submit the required documentation to the respective authorities. This may include proof of residency, vehicle purchase documents, and sometimes even proof of income to ensure eligibility. The rebate amount can then be calculated based on the specific program's guidelines, and the buyer will receive the financial assistance directly.

It is important to note that the availability and specifics of these rebates can vary widely, so staying informed and keeping track of the latest programs is crucial. Many regions have dedicated websites or resources to provide updates on EV incentives, ensuring that potential buyers are aware of the opportunities available to them. By taking advantage of these local and regional rebates, individuals can make a significant financial impact on their EV purchase, making it a more attractive and feasible option for those looking to go green with their transportation choices.

The Future is Electric: A World Without Gasoline

You may want to see also

Low-Interest Loans: Special financing options with low interest rates for EVs

Many governments and financial institutions worldwide are promoting the adoption of electric vehicles (EVs) to reduce carbon emissions and encourage sustainable transportation. As a result, various special financing incentives have been introduced to make EV purchases more affordable and attractive to consumers. One such incentive is the availability of low-interest loans specifically tailored for EV buyers.

Low-interest loans for electric vehicles offer a unique opportunity for individuals to finance their EV purchase at a reduced cost. These loans typically have interest rates lower than those of traditional car loans, making the overall cost of ownership more manageable. By securing a low-interest loan, EV buyers can save a significant amount of money over the life of the loan compared to higher-interest financing options. This financial incentive not only reduces the upfront cost of the vehicle but also makes the transition to electric mobility more financially viable for a broader range of consumers.

Financial institutions and automotive lenders often provide these low-interest loans as part of their commitment to supporting sustainable practices. They recognize the environmental benefits of EVs and aim to encourage their adoption. As a result, they offer competitive interest rates to attract EV buyers and facilitate the sale of these vehicles. The terms and conditions of these loans may vary, including factors such as loan duration, down payment requirements, and eligibility criteria.

To take advantage of these special financing options, potential EV buyers should research and compare different lenders and their offerings. Many online platforms and automotive websites provide tools to calculate loan payments and compare interest rates, helping consumers make informed decisions. Additionally, staying updated on the latest financing incentives and loan programs offered by local governments or automotive manufacturers can further enhance the benefits of purchasing an electric vehicle.

In summary, low-interest loans are a significant financing incentive for those looking to buy electric vehicles. These loans enable consumers to secure affordable financing, making EV ownership more accessible and environmentally friendly. By exploring various financing options and staying informed about available incentives, individuals can make a well-informed decision when purchasing an electric vehicle, contributing to a greener and more sustainable future.

Exploring the Range of Electric Conveyance Vehicle Sizes

You may want to see also

Grant Programs: Government grants to support EV adoption and infrastructure

Government grant programs play a crucial role in encouraging the adoption of electric vehicles (EVs) and the development of necessary infrastructure. These grants are designed to provide financial assistance to individuals, businesses, and organizations, making it more affordable and accessible to transition to electric transportation. Here's an overview of how these grant initiatives work and their impact:

Grant Types and Eligibility:

Government grants for EV adoption and infrastructure can vary widely in terms of eligibility criteria and the scope of support. Some grants are targeted at specific groups, such as low-income families or public transportation authorities, while others are open to the general public. For instance, the federal government in the United States offers the Clean Vehicle Rebate Project, which provides rebates to individuals purchasing or leasing new electric cars, plug-in hybrids, or fuel cell vehicles. Similarly, many states have their own rebate programs, often with additional criteria like vehicle price caps or residency requirements. These grants aim to accelerate the shift towards cleaner transportation by making EVs more affordable and attractive to consumers.

Infrastructure Development Grants:

In addition to consumer incentives, governments also allocate funds to support the expansion of EV charging infrastructure. This includes grants for installing public charging stations, especially in areas with limited access to charging facilities. Many countries and regions offer grants to businesses and organizations willing to invest in EV charging networks, ensuring a more comprehensive and convenient charging experience for EV owners. These infrastructure grants are vital to addressing range anxiety and encouraging widespread EV adoption.

Benefits and Impact:

Grant programs have a significant impact on the EV market and the environment. By providing financial assistance, governments can reduce the upfront cost barrier associated with purchasing EVs, making them more affordable and appealing to a broader audience. This, in turn, leads to increased sales and a faster transition to a more sustainable transportation system. Moreover, infrastructure grants enable the development of a robust charging network, addressing a critical concern for potential EV buyers. As a result, these grants contribute to a more efficient and environmentally friendly transportation ecosystem.

Application and Access:

The application process for government grants varies, with some requiring detailed proposals and business plans, while others may be more straightforward. Many governments provide clear guidelines and resources to assist applicants in navigating the grant application process. It is essential for individuals and organizations to stay informed about available grants and their respective eligibility criteria to maximize the chances of receiving financial support.

In summary, government grant programs are a powerful tool to incentivize EV adoption and infrastructure development. These grants not only make EVs more affordable but also contribute to the creation of a robust charging network, addressing key barriers to widespread EV ownership. As the world moves towards more sustainable transportation, such grant initiatives will continue to play a vital role in driving this transition.

EVs' Size and Color Constraints: A Technical Deep Dive

You may want to see also

Lease Incentives: Lease deals with reduced monthly payments for electric cars

Many car manufacturers and dealerships offer lease incentives specifically tailored to electric vehicles (EVs), which can significantly reduce the monthly cost of owning an EV. These incentives are designed to make electric cars more affordable and attractive to potential buyers, especially those who prefer the flexibility of a lease over a traditional purchase. Here's a detailed look at how these lease incentives work and what they entail:

Reduced Monthly Payments: One of the most common lease incentives for electric cars is the reduction in monthly lease payments. This is often achieved by offering lower interest rates or extended lease terms. For instance, a dealership might provide a 0% interest rate lease for a specific EV model, meaning the monthly payment will be lower compared to a lease with a higher interest rate. Alternatively, they might extend the lease term from the standard 24 or 36 months to 48 or 60 months, further reducing the monthly payment. This strategy allows more people to enter the EV market without a substantial upfront cost.

Lease-to-Own Options: Some lease programs also include a lease-to-own option, which can be particularly appealing to those who want the possibility of owning the vehicle at the end of the lease period. With this incentive, the lease agreement might include a purchase option at a predetermined price, often lower than the vehicle's market value. This encourages lessees to consider the long-term ownership of the EV, providing an incentive to maintain the vehicle's health and ensure it remains in good condition.

Incentivized Mileage Allowance: Lease deals for electric cars often come with higher mileage allowances compared to traditional gasoline vehicles. This is because EVs tend to have lower maintenance costs due to fewer moving parts and reduced fuel expenses. As a result, lessees can drive more miles without incurring additional charges. This incentive is especially beneficial for those who frequently drive long distances or need a vehicle for business purposes.

Additional Benefits: Lease incentives for electric cars may also include other perks such as free or discounted charging at public stations, access to car-sharing services, or even a home charging station installation. These additional benefits can further enhance the overall ownership experience and provide long-term savings for EV owners.

When considering lease incentives for electric cars, it's essential to review the terms and conditions carefully. These may vary widely between manufacturers, dealerships, and lease providers. Understanding the lease-end options, any potential penalties for early termination, and the overall cost of the lease over its term is crucial to making an informed decision.

Electric Vehicles: A Sustainable Revolution or a Passing Trend?

You may want to see also

Frequently asked questions

Yes, many financial institutions and car manufacturers offer specific incentives and financing programs to promote the adoption of electric vehicles. These can include low-interest loans, extended warranties, and even manufacturer-specific grants or rebates. It's advisable to research and compare different lenders to find the best rates and terms tailored to your EV purchase.

To access these incentives, you typically need to meet certain criteria, such as being a new EV buyer or meeting specific income thresholds. Many manufacturers provide online tools or calculators to estimate the potential savings and financing options available to you. Additionally, government-backed programs and subsidies might be available in your region, offering further financial benefits for EV purchases.

Electric vehicle financing rates can vary widely, and they often depend on factors like the make and model of the EV, your credit history, and the financing institution. Some lenders offer competitive rates specifically for EVs, sometimes even lower than those for conventional vehicles. It's essential to shop around and negotiate to ensure you get the best financing deal for your electric car purchase.