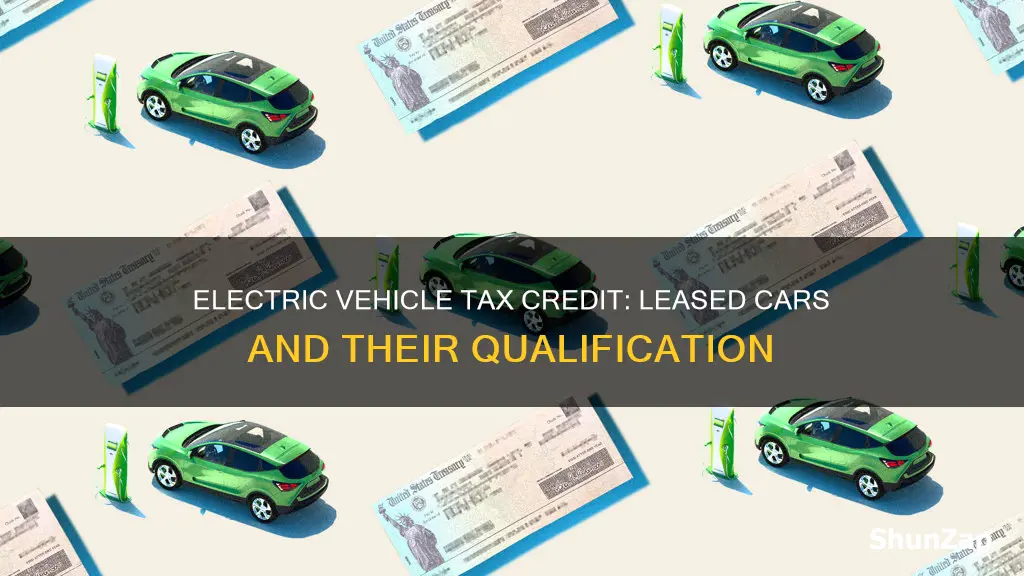

Many electric vehicle (EV) enthusiasts are curious about the tax benefits associated with leasing an EV. The question of whether leased electric vehicles qualify for tax credits is an important consideration for those looking to make an environmentally friendly purchase. This paragraph will explore the tax implications of leasing an electric vehicle and provide insights into the potential financial advantages for EV owners.

What You'll Learn

- Eligibility Criteria: Leased EVs must meet specific requirements to qualify for tax credits

- Lease Duration: Longer lease terms may increase the chances of qualifying

- EV Type: Certain EV models and manufacturers are eligible

- Tax Credit Amount: The credit varies based on vehicle type and lease terms

- Lease Agreement: Details in the lease contract must align with tax regulations

Eligibility Criteria: Leased EVs must meet specific requirements to qualify for tax credits

Leased electric vehicles (EVs) can indeed qualify for tax credits, but there are specific eligibility criteria that must be met. These requirements are in place to ensure that the tax incentives are directed towards individuals and businesses that are making a long-term commitment to purchasing and using electric vehicles. Here are the key factors that determine whether a leased EV qualifies for tax credits:

Lease Duration and Ownership: One of the primary considerations is the lease term. Tax credits are typically available for leased EVs that are part of a longer-term lease agreement. The longer the lease period, the higher the chances of qualifying for the tax benefit. Additionally, the lease should clearly outline the terms of ownership at the end of the lease period. If the lease includes an option to purchase the vehicle, it strengthens the case for eligibility.

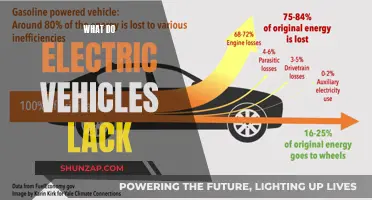

Vehicle Type and Performance: The type of electric vehicle and its performance characteristics play a crucial role. Tax credits often favor EVs that meet certain efficiency and range standards. For instance, vehicles with a higher EPA-estimated range and lower greenhouse gas emissions scores may be more attractive to tax authorities. It is essential to check the specific guidelines provided by the relevant tax authorities or consult with a tax professional to understand the exact requirements for your leased EV.

Lease Agreement Details: The lease agreement should be scrutinized to ensure it complies with tax regulations. This includes verifying that the lease contract includes all the necessary provisions, such as the lease term, payment structure, and any restrictions on mileage or usage. Additionally, the lease should specify the vehicle's make, model, and year to ensure it aligns with the tax credit program's criteria.

Income and Residency: Tax credits for leased EVs may also be subject to income limits and residency requirements. These criteria ensure that the tax benefits are targeted towards individuals or businesses with a specific financial profile. It is important to review the tax credit program's guidelines to understand if your income level and residency status meet the necessary thresholds.

Meeting these eligibility criteria is essential for leased EV owners to claim the available tax credits. It is recommended to consult with tax experts or refer to official government resources to ensure compliance with the specific requirements of the tax credit program in your region.

The Pioneers of Electric Vehicles: A Historical Journey

You may want to see also

Lease Duration: Longer lease terms may increase the chances of qualifying

The duration of your lease plays a significant role in determining your eligibility for tax credits when it comes to leased electric vehicles. Longer lease terms can indeed increase your chances of qualifying for these incentives. Here's why:

Firstly, tax credits for electric vehicles are often designed to encourage long-term adoption. By extending the lease period, you demonstrate a more serious commitment to the vehicle's ownership, which aligns with the government's goal of promoting sustainable transportation. Longer leases also provide a more substantial period for the vehicle's environmental benefits to be realized, such as reduced carbon emissions. This extended timeframe allows for a more comprehensive assessment of the vehicle's performance and its positive impact on the environment.

Additionally, longer lease terms can provide a more stable and predictable financial situation for both the leaseholder and the lessor. This stability is crucial for qualifying for tax credits, as it indicates a lower risk of default or early termination. With a longer lease, the financial commitment is spread out over a more extended period, making it easier to meet the eligibility criteria for tax incentives.

When negotiating your lease agreement, consider the following: Aim for a lease term that is at least 36 months (3 years) to maximize your chances. Some lease programs may have specific requirements or preferences for lease durations, so it's essential to review the terms and conditions carefully. Longer leases might also offer more flexibility in terms of mileage limits and other lease-specific clauses, ensuring that you can take full advantage of the tax benefits.

In summary, longer lease durations are generally more favorable when it comes to qualifying for tax credits on leased electric vehicles. It demonstrates a genuine interest in the vehicle's long-term use, provides a more stable financial situation, and aligns with the environmental goals of promoting electric vehicle adoption. Always review the specific requirements of the tax credit program you are interested in to ensure your lease duration meets or exceeds their criteria.

Electric Vehicle Fires: The Challenge of Extinguishing Burning Batteries

You may want to see also

EV Type: Certain EV models and manufacturers are eligible

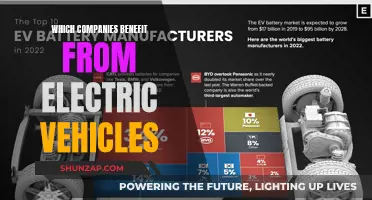

When it comes to leased electric vehicles and their eligibility for tax credits, it's important to understand that not all EVs are created equal in this context. The key factor here is the type of EV and the specific manufacturer.

Firstly, leased electric vehicles may not always qualify for the tax credit, especially if they are not part of a specific program or initiative. Many governments and organizations have introduced incentives to promote the adoption of electric vehicles, and these often come with certain criteria. For instance, the United States' federal tax credit for electric vehicles is available for new purchases, not leased vehicles. However, some states or local governments might offer tax incentives for leased EVs under specific conditions.

The eligibility of EV models and manufacturers is a crucial aspect. Certain EV manufacturers and their models are specifically targeted by these tax credit programs. For example, the federal tax credit in the US is available for qualified plug-in electric vehicles (PEVs) that meet specific criteria, including battery capacity and manufacturing requirements. These criteria ensure that the vehicles are indeed electric and meet certain performance standards. Additionally, some programs might favor vehicles produced by domestic manufacturers, further narrowing down the eligible models.

It's essential to check the specific guidelines and regulations set by the relevant authorities. These guidelines will outline the exact requirements for EV models and manufacturers to be considered eligible for the tax credit. This information is typically available on government websites or through official resources. By understanding these criteria, you can determine whether your leased EV, or any EV you are considering, qualifies for the tax benefit.

In summary, while leased electric vehicles may not always be eligible for tax credits, certain EV models and manufacturers can qualify under specific programs. These programs often have detailed criteria, including vehicle type, battery capacity, and manufacturing origin. Staying informed about these requirements is crucial for anyone looking to take advantage of tax incentives for electric vehicles.

Elevate Your EV: Upfit Solutions for Electric Vehicles

You may want to see also

Tax Credit Amount: The credit varies based on vehicle type and lease terms

The tax credit for leased electric vehicles can be a significant financial benefit for individuals and businesses looking to make the switch to electric mobility. However, it's important to understand that the amount of tax credit one can claim depends on several factors, primarily the type of vehicle and the lease terms.

For leased electric vehicles, the tax credit amount can vary based on the specific vehicle model and its classification under the Internal Revenue Code (IRC). The IRC categorizes vehicles into different tiers based on their battery capacity and other factors. Each tier has a corresponding tax credit amount. For instance, vehicles with a battery capacity of 40 kWh or more typically qualify for a higher tax credit compared to those with lower battery capacities.

Lease terms also play a crucial role in determining the tax credit. The credit is generally available for leased vehicles, but the duration of the lease can impact the total credit amount. Longer lease terms often result in a higher cumulative tax credit. This is because the credit is typically calculated on a per-mile or per-year basis, and longer leases provide more mileage or years for which the credit can be claimed.

It's worth noting that the tax credit for leased electric vehicles is often a percentage of the vehicle's base price. This base price is determined by the manufacturer's suggested retail price (MSRP) minus any applicable discounts or incentives. The specific percentage can vary, but it is generally a fixed rate for each vehicle type.

Understanding these variations in tax credit amounts is essential for anyone considering leasing an electric vehicle. It allows individuals and businesses to make informed decisions about their vehicle choices and lease durations, maximizing the potential financial benefits through tax credits.

Transform Your Ride: A Guide to Electric Brakes Conversion

You may want to see also

Lease Agreement: Details in the lease contract must align with tax regulations

When leasing an electric vehicle, it's crucial to understand the tax implications and how they are structured in the lease agreement. The lease contract should clearly outline the terms related to tax credits and deductions to ensure compliance with tax regulations. Here are some key points to consider:

Lease Term and Tax Credit Eligibility: The lease term is a critical factor. Tax credits for electric vehicles are often available for a limited period, typically a few years. The lease agreement must specify the lease duration and ensure it aligns with the tax credit eligibility criteria. For instance, if the lease is for 36 months, it should cover the entire period during which the tax credit is available. This ensures that the lessee can take advantage of the tax benefits throughout the lease term.

Lease Payments and Deductions: The lease contract should detail how lease payments are structured regarding tax deductions. In many cases, lease payments include both the vehicle's cost and associated expenses. The agreement should clarify which portion of the payment is allocated to the vehicle's cost and which can be deducted for tax purposes. This is essential for accurately calculating the tax benefits and ensuring the lessee can claim the appropriate deductions.

Lease End Options and Tax Implications: At the end of the lease, the contract should outline the options available to the lessee. This includes the possibility of purchasing the vehicle, returning it, or extending the lease. If the lessee has the option to buy the electric vehicle, the lease agreement must specify the tax consequences of this decision. Understanding the tax implications of lease-end options is vital to ensure the lessee can make informed choices regarding their tax liability.

Documentation and Record-Keeping: Proper documentation is essential to support tax claims. The lease agreement should emphasize the importance of maintaining records and providing necessary documentation to the tax authorities. This includes lease contracts, payment receipts, and any other relevant paperwork. Accurate record-keeping ensures that the lessee can claim the tax credits and deductions as per the lease agreement's terms.

In summary, the lease contract for an electric vehicle should be meticulously reviewed to ensure it aligns with tax regulations regarding tax credits and deductions. By paying attention to the lease term, payment structure, end-of-lease options, and documentation, lessees can navigate the tax implications effectively and take full advantage of the available tax benefits.

Electric Vehicle Lease: Is It Worth It?

You may want to see also

Frequently asked questions

Yes, leased electric vehicles are eligible for tax credits under the Internal Revenue Code (IRC) Section 30D, which provides a credit for qualified plug-in electric vehicles. This credit is available to both individuals and businesses, and it applies to both new and used vehicles, including those leased. The amount of the credit depends on the vehicle's battery capacity and the lease term.

The tax credit for leased electric vehicles is calculated based on the vehicle's battery capacity and the lease term. For a leased vehicle, the credit is typically calculated as a percentage of the lease payments made by the lessee. The credit amount is generally limited to the lease payments up to a certain threshold, which is adjusted annually for inflation. The formula considers the vehicle's battery range and the lease duration, ensuring that the credit reflects the environmental benefits of the leased vehicle.

Yes, there are certain restrictions and limitations to consider. The tax credit is generally limited to vehicles with a battery range of at least 40 miles (64 kilometers) and a manufacturer's suggested retail price (MSRP) of $85,000 or less. For leased vehicles, the credit may be reduced or phased out if the lease term is less than three years or if the vehicle is used for business purposes more than 15% of the time. Additionally, the credit is subject to annual inflation adjustments and may have other specific criteria that need to be met.