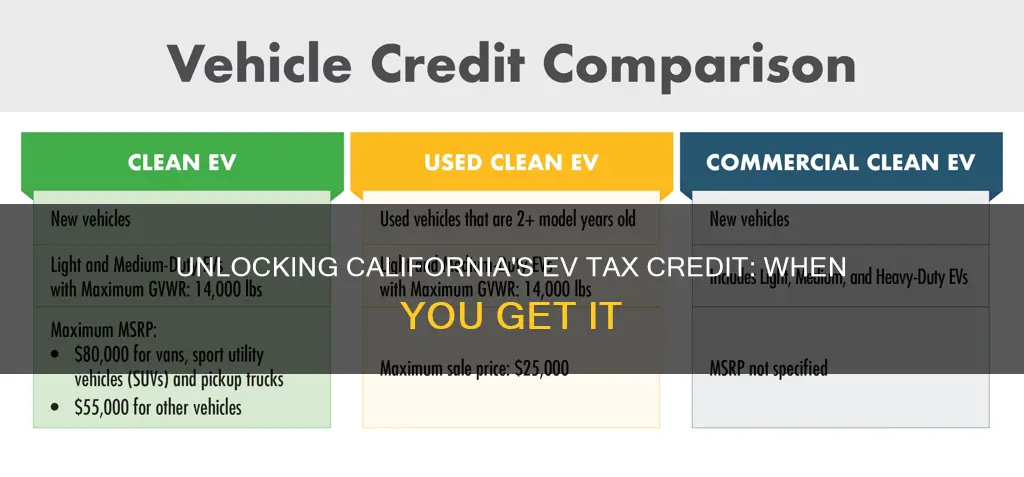

When you purchase or lease an electric vehicle (EV) in California, you may be eligible for a tax credit that can significantly reduce the upfront cost. The California Electric Vehicle (EV) Tax Credit is designed to encourage the adoption of electric vehicles and promote a cleaner, more sustainable transportation system. This credit is available to individuals and businesses who buy or lease new electric vehicles, including cars, trucks, and motorcycles, that meet specific criteria. The amount of the credit varies depending on the vehicle's price and the type of EV, with higher credits for lower-emission models. Understanding the eligibility requirements and application process is essential for maximizing this financial benefit and making an informed decision when investing in an electric vehicle.

| Characteristics | Values |

|---|---|

| Eligibility | Open to California residents who purchase or lease a new electric vehicle (EV) |

| Credit Amount | Up to $7,500 for new EVs and $5,000 for used EVs (with specific requirements) |

| Income Limit | Not specified, but there are income limits for other EV incentives in California |

| Vehicle Type | Includes battery-electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) |

| Timing of Credit | The credit is typically issued as a refund when filing state income tax, but it can also be claimed as a credit on federal tax returns |

| Application Process | Claim the credit on your state income tax return (Form 540) or federal tax return (Form 1040) |

| Resale or Trade-In | The credit can be transferred to a new owner if the vehicle is sold or traded-in |

| Effective Dates | The credit is available for vehicles purchased or leased on or after January 1, 2023, and before January 1, 2025 |

| Additional Requirements | May require proof of residency, vehicle registration, and other documentation |

| State Website | Information and application details can be found on the California Air Resources Board (CARB) website |

What You'll Learn

Eligibility: Who qualifies for the California EV tax credit?

The California Electric Vehicle (EV) Tax Credit is a financial incentive designed to encourage the purchase of electric vehicles in the state. This credit is a valuable benefit for EV buyers, but it's important to understand who qualifies for this credit to ensure you can take full advantage of it.

To be eligible for the California EV tax credit, you must meet specific criteria. Firstly, the vehicle must be new and purchased from a dealership or retailer in California. This includes fully electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) that meet the state's emissions standards. The credit is available for both new and used vehicles, but there are certain restrictions. For used vehicles, the credit is limited to those purchased from a California dealer and must have been previously owned by the seller for at least 90 days.

Individuals and businesses that purchase or lease eligible EVs are eligible for the tax credit. This includes residents of California, as well as businesses operating within the state. The credit is typically calculated as a percentage of the vehicle's price, up to a certain limit. For the 2023 tax year, the credit amount is 30% of the vehicle's price, but this can vary depending on the vehicle type and the state's budget.

It's important to note that there are income limits for individuals. The credit is available to those with adjusted gross income (AGI) below a certain threshold, which is adjusted annually. For the 2023 tax year, the AGI limit is $150,000 for single filers and $300,000 for joint filers. However, this limit is subject to change, and it's recommended to check the latest information on the California Franchise Tax Board's website.

Additionally, there are specific vehicle price limits. The credit is available for vehicles with a base price (before incentives) of $80,000 or less for new vehicles and $60,000 or less for used vehicles. These price limits ensure that the credit is targeted at a wider range of EV models and helps promote more affordable options for consumers.

California's Electric Revolution: A Green Future in Sight?

You may want to see also

Application Process: How to apply for the EV tax credit

The California Electric Vehicle (EV) Tax Credit is a financial incentive designed to encourage residents to purchase and drive electric vehicles, reducing the state's carbon footprint. This credit is a valuable benefit for EV buyers, but understanding the application process is crucial to ensure a smooth and successful claim. Here's a step-by-step guide to help you navigate the application process:

- Determine Your Eligibility: Before initiating the application, ensure you meet the eligibility criteria. The credit is typically available to California residents who purchase or lease a new electric vehicle. Research the specific requirements, as certain conditions may apply, such as vehicle price limits or residency duration.

- Gather Required Documents: Collect all the necessary documents to support your application. This may include proof of residency, such as a driver's license or utility bill, and documentation related to your EV purchase or lease. Keep the original documents or have digital copies ready for submission.

- Complete the Application Form: Visit the official website of the California Energy Commission or the designated agency responsible for EV incentives. Download or access the application form, which can usually be found in PDF format. Carefully fill out the form, providing accurate and detailed information about your EV purchase or lease, including the vehicle's make, model, and purchase date. Double-check all the fields to ensure accuracy.

- Submit the Application: After completing the form, submit it according to the provided instructions. This might involve mailing the application to a specific address or uploading it through an online portal. Ensure you keep a copy of the submitted application for your records.

- Wait for Processing and Approval: The processing time for EV tax credit applications can vary. Once submitted, monitor the status of your application. You may receive a confirmation email or letter notifying you of the processing timeline. If approved, you will be informed of the amount of credit you are eligible to receive.

- Receive the Tax Credit: If your application is approved, the tax credit will typically be issued as a refund or directly applied to your vehicle purchase or lease. The timing of receiving the credit can vary, but it is essential to keep track of the expected payment date. You may also be required to provide additional documentation to finalize the credit disbursement.

Remember, staying organized and providing accurate information is key to a successful application. Keep all relevant documents and records for future reference, as you may need to provide additional details during the verification process.

Powering Your Ride: Understanding Vehicle Electrical Connectors

You may want to see also

Timing: When are the tax credits issued?

The California Clean Vehicle Rebate Project (CVRP) offers tax credits for the purchase or lease of new electric vehicles (EVs) to encourage the adoption of cleaner transportation options. The timing of these tax credits is an important consideration for potential EV buyers.

The tax credits are typically issued in the form of a rebate, and the process usually takes a few months from the date of purchase or lease. Here's a breakdown of the timing:

- Purchase or Lease: The first step is to purchase or lease a new electric vehicle from an authorized dealer or participating dealership. This process involves selecting the EV model, finalizing the purchase or lease agreement, and providing the necessary documentation.

- Application Submission: After the purchase or lease, applicants need to submit a rebate application to the California Air Resources Board (CARB). This can be done online through the CVRP website, and the application requires providing vehicle details, purchase/lease information, and proof of residency in California.

- Processing and Approval: CARB reviews the applications, and the processing time can vary. The agency aims to process applications within 45 days of receipt. Once approved, the rebate amount is calculated based on the vehicle's price and the applicable credit tier.

- Rebate Issuance: The tax credit rebate is issued to the applicant within 10 days of approval. This can be in the form of a direct deposit to the applicant's bank account or a check, depending on the preferred method chosen during the application process.

It's important to note that the CVRP has specific guidelines and eligibility criteria, including vehicle price limits and residency requirements. Applicants should ensure they meet these criteria to avoid delays or rejections. Additionally, the program has a limited budget, and rebates are issued on a first-come, first-served basis until funds are depleted for each credit tier. Therefore, timely submission of applications is crucial to secure the tax credit.

Powering the Future: Understanding Electric Vehicle Controllers

You may want to see also

Amount: What is the maximum tax credit amount?

The California Clean Vehicle Rebate Project (CVRP) offers a tax credit for the purchase or lease of new electric vehicles (EVs) to encourage the adoption of cleaner transportation options. The maximum tax credit amount available through this program is $7,000. This credit is designed to offset a significant portion of the upfront cost of purchasing or leasing an EV, making it more affordable for consumers.

To be eligible for the maximum tax credit, the vehicle must meet specific criteria. Firstly, it should be a new, in-use, or leased electric vehicle, including plug-in hybrid electric vehicles (PHEVs). The vehicle's price, including destination charges, must not exceed $50,000 for new vehicles and $45,000 for used vehicles. Additionally, the vehicle must be purchased or leased from an eligible dealer or manufacturer.

It's important to note that the tax credit is not a direct payment to the consumer but rather a reduction in the vehicle's purchase price. The credit is applied at the time of purchase or lease, and the amount is subtracted from the total vehicle cost. This means that the actual savings for the consumer will depend on the vehicle's price and the credit amount.

The California tax credit for electric vehicles is a valuable incentive for those looking to go green. By offering a substantial credit, the state aims to make EVs more accessible and affordable, ultimately reducing the environmental impact of transportation. This program has been instrumental in promoting the use of electric vehicles and fostering a more sustainable future.

Understanding the maximum tax credit amount is crucial for consumers considering an EV purchase or lease. It allows individuals to plan their budgets effectively and take advantage of this financial incentive. With the potential to save up to $7,000, the California tax credit for electric vehicles can significantly contribute to making eco-friendly transportation choices more feasible and attractive.

Unraveling the Challenges: Electric Vehicles' Hidden Hurdles

You may want to see also

Renewal: Can the EV tax credit be renewed annually?

The California Electric Vehicle (EV) Tax Credit is a valuable incentive for residents looking to purchase electric cars, offering a significant reduction in the state's sales tax. However, understanding the renewal process and its implications is crucial for maximizing this benefit.

One common question among EV buyers is whether the tax credit can be renewed annually. The answer is yes, the EV tax credit can be renewed annually, providing a continuous incentive for consumers to make the switch to electric vehicles. This annual renewal ensures that the credit remains accessible to those who may have missed it in previous years or are considering an upgrade to a newer electric model.

The renewal process typically involves a simple application, often requiring the submission of a few documents, such as proof of vehicle ownership and the completed tax credit form. This streamlined process allows eligible individuals to quickly access the credit and apply it to their recent EV purchase. By renewing annually, the state ensures that the incentive remains relevant and effective in promoting the adoption of electric vehicles.

It is important to note that there may be specific criteria and limitations to consider when renewing the EV tax credit. These could include income limits, vehicle specifications, and residency requirements. Staying informed about these details is essential to ensure eligibility and maximize the benefits of the tax credit.

In summary, the annual renewal of the California EV tax credit is a significant advantage for EV owners, providing an ongoing opportunity to save on vehicle purchases. This process allows individuals to take advantage of the credit multiple times, encouraging the widespread adoption of electric vehicles and contributing to a more sustainable future.

Powering the Future: Understanding EV Voltage and Its Impact

You may want to see also

Frequently asked questions

The California Tax Credit for Electric Vehicles is available to California residents who purchase or lease a new electric vehicle (EV) that meets specific criteria. The vehicle must be new, purchased or leased after December 31, 2021, and be used primarily for personal transportation.

The tax credit amount varies depending on the vehicle's price and the type of EV. For vehicles priced up to $40,000, the credit is 10% of the purchase or lease price, up to a maximum of $5,000. For vehicles priced between $40,001 and $55,000, the credit is 15% of the purchase or lease price, up to $7,500.

No, there is no specific income limit for the California EV tax credit. However, the credit is limited to one per household and is non-transferable.

To claim the credit, you need to file a California state income tax return. You will need to provide documentation, such as the vehicle's purchase or lease agreement, and the dealer's confirmation of the vehicle's eligibility. The credit is typically claimed as a reduction in taxable income.

Yes, there are a few restrictions. The credit cannot be claimed if the vehicle is used for commercial purposes or if it is leased for more than three years. Additionally, the credit is subject to annual adjustments and may change over time as the program evolves.