When considering the purchase of an electric vehicle, understanding the timing of tax credits is crucial. The federal tax credit for electric vehicles is a significant incentive for buyers, offering a substantial discount on the vehicle's price. However, this credit is subject to specific eligibility criteria and expiration dates. Claiming the tax credit at the right time can maximize savings, and it's essential to be aware of the deadlines to ensure you don't miss out on this valuable financial benefit. This guide will provide an overview of the key considerations and steps to take when claiming the electric vehicle tax credit.

What You'll Learn

- Eligibility Requirements: Determine if you meet the criteria for the tax credit

- Vehicle Type: Understand the specific EV models eligible for the credit

- Purchase Date: Time your purchase to align with tax credit availability

- Residency and Income: Verify your residency and income limits

- Filing and Documentation: Learn the process for claiming the credit on tax returns

Eligibility Requirements: Determine if you meet the criteria for the tax credit

To determine your eligibility for the electric vehicle tax credit, it's essential to understand the specific criteria set by the relevant authorities. Here's a detailed breakdown of the key factors to consider:

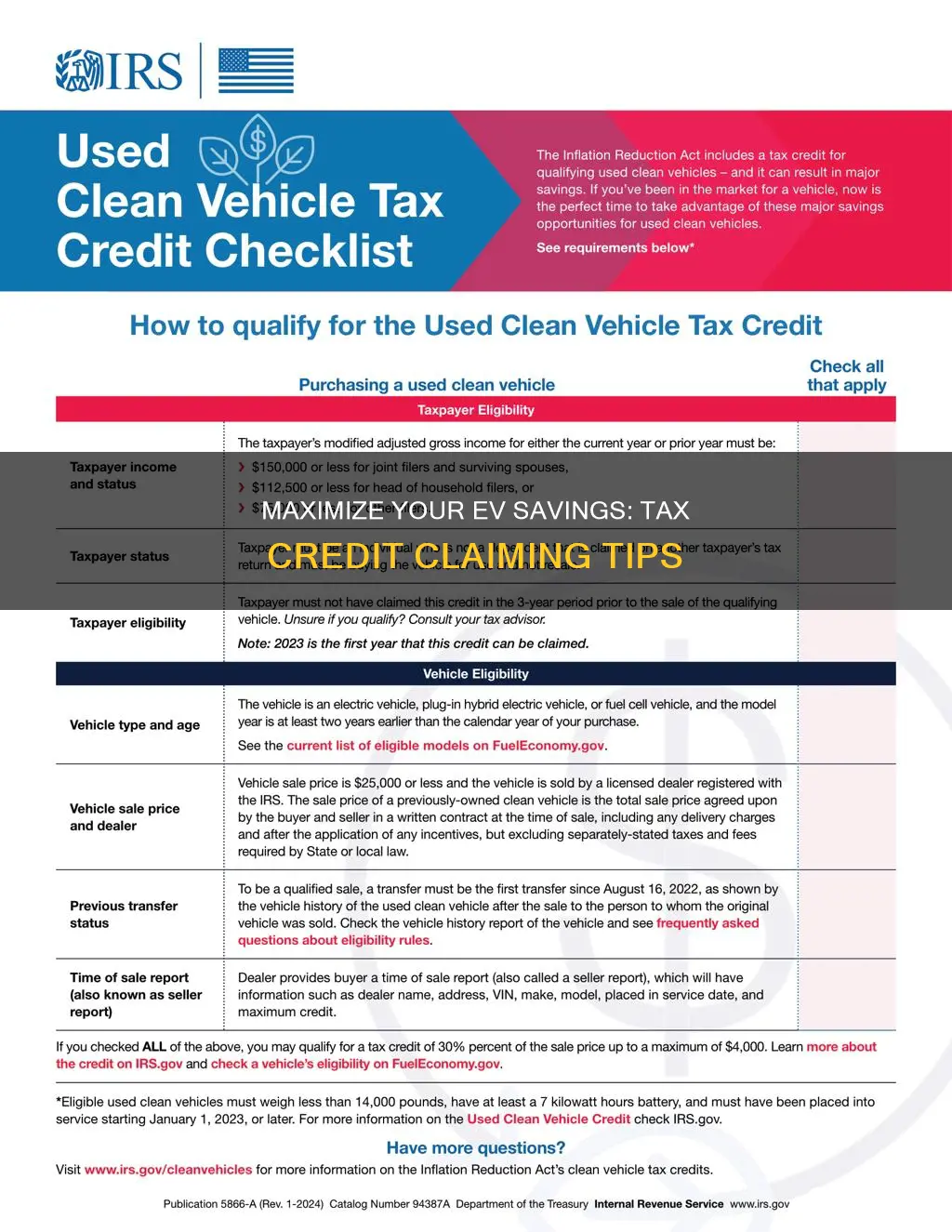

Vehicle Type and Price: The tax credit primarily applies to new electric vehicles, including battery-electric cars and plug-in hybrid electric vehicles. However, there are price limits to ensure the credit supports the purchase of affordable electric cars. As of the latest updates, the vehicle's price, including taxes and delivery charges, must not exceed $80,000 for individuals and $85,000 for married couples filing jointly. This price cap ensures the credit is accessible to a broader range of consumers.

Manufacturer's Rules: Certain manufacturers may impose additional requirements or restrictions on eligibility. These rules could include residency in specific regions, membership in certain organizations, or meeting particular income thresholds. It is crucial to review the guidelines provided by the vehicle manufacturer to ensure compliance with any additional criteria they may have.

Income Limits: There are income-based eligibility requirements for the tax credit. For the 2023 tax year, the modified adjusted gross income (MAGI) limit for individuals is $75,000, and for married couples filing jointly, it is $150,000. If your income exceeds these limits, you may still be eligible if you purchase the vehicle as a second home or for a family member who meets the income criteria.

Timing and Purchase Documentation: The timing of your purchase is also critical. The tax credit is typically available for vehicles purchased after December 31, 2021, and before January 1, 2024. Ensure you have the necessary documentation, such as the vehicle's sales contract, to support your claim. This documentation will be required when filing your tax return to claim the credit.

Resale and Trade-In Considerations: If you are trading in or reselling your vehicle, there are specific rules to follow. The tax credit is generally allowed for the purchase of a new electric vehicle, even if you are trading in or reselling an existing one. However, the credit amount may be reduced based on the fair market value of the traded-in vehicle. It is advisable to consult a tax professional to understand the implications of any trade-in or resale.

By carefully evaluating these eligibility requirements, you can determine if you meet the necessary criteria to claim the electric vehicle tax credit. Staying informed about any updates to the tax credit program and seeking professional advice when needed will ensure a smooth and successful claim process.

Powering the Future: Unlocking Electric Vehicles' Energy Secrets

You may want to see also

Vehicle Type: Understand the specific EV models eligible for the credit

When it comes to claiming the electric vehicle (EV) tax credit, understanding the specific models eligible is crucial. The tax credit is designed to incentivize the purchase of electric vehicles, and it's important to know which models qualify to ensure you can take full advantage of this benefit. The eligibility criteria often focus on the vehicle's battery capacity, range, and other technical specifications.

For instance, many countries and regions have set certain thresholds for battery capacity and range to qualify for the tax credit. In the United States, for example, the Internal Revenue Service (IRS) has defined specific guidelines. Vehicles with a battery capacity of at least 4 kWh and a range of over 100 miles are generally eligible. This means that popular compact EVs like the Tesla Model 3 and the Chevrolet Bolt EV, which meet these criteria, are typically covered. However, it's essential to check the exact specifications as they may vary depending on the year and model.

Additionally, some regions might have their own unique requirements. In certain European countries, there could be specific regulations regarding the vehicle's CO2 emissions or the use of advanced battery technologies. For instance, models with higher efficiency ratings or those utilizing cutting-edge battery systems might be prioritized. It's worth researching the local guidelines to ensure you're aware of any additional criteria that could impact eligibility.

To stay informed, it's advisable to consult official government websites or seek guidance from automotive experts. They can provide the most up-to-date information on eligible EV models, ensuring you make an informed decision when purchasing an electric vehicle. Being aware of these details will enable you to maximize the benefits of the tax credit and contribute to a more sustainable transportation future.

The Evolution of Hybrid and Electric Cars: A Green Revolution

You may want to see also

Purchase Date: Time your purchase to align with tax credit availability

When considering the purchase of an electric vehicle, timing your acquisition to coincide with tax credit availability can significantly impact your overall savings. Many governments offer financial incentives to encourage the adoption of electric vehicles, and understanding the criteria for these credits is essential for maximizing your benefits. The key factor in determining eligibility for these tax credits is often the purchase date, as it dictates when you can claim the credit.

To take advantage of the tax credit, you should aim to purchase your electric vehicle during the period when the credit is actively available. This timing is crucial because the credit is typically provided on a first-come, first-served basis, and there are often specific timeframes during which you can apply for the rebate. For instance, in some countries, the tax credit might be available for a limited period, such as a few months or a specific fiscal year. During this time, you can claim the credit against your federal or state taxes, effectively reducing your taxable income.

The process of claiming the tax credit usually involves submitting an application to the relevant tax authorities, providing proof of purchase, and meeting any additional criteria set by the government. It is essential to research and understand the specific requirements of your region to ensure you qualify for the credit. By aligning your purchase with the available tax credit period, you can ensure that your application is processed smoothly and that you receive the financial incentive without delay.

Additionally, keeping an eye on the release of new electric vehicle models and their associated tax credit offerings can be beneficial. Sometimes, manufacturers or dealerships offer incentives or promotions tied to the launch of new electric vehicle models, providing an extra incentive to make a timely purchase. Being proactive and well-informed about these opportunities can further enhance your savings.

In summary, timing your electric vehicle purchase to align with tax credit availability is a strategic decision that can result in substantial financial savings. By understanding the eligibility criteria, staying informed about tax credit periods, and keeping track of new vehicle releases, you can optimize your experience and potentially save a significant amount of money when acquiring your electric vehicle.

Revolutionizing Transportation: A Journey Through Electric Vehicle History

You may want to see also

Residency and Income: Verify your residency and income limits

When it comes to claiming the electric vehicle (EV) tax credit, understanding the residency and income requirements is crucial. The tax credit is designed to incentivize the purchase of electric vehicles and promote environmental sustainability, but it is not available to everyone. Here's a breakdown of how to verify your eligibility based on residency and income:

Residency:

- You must be a U.S. citizen or resident alien for the entire tax year for which you are claiming the credit. This means that your primary residence and significant ties to the country should be established.

- If you are a non-resident alien, you may still be eligible if you meet specific criteria, such as having a valid visa or work permit. However, the rules can be complex, and it's essential to consult tax professionals for guidance.

- In some cases, states may have their own residency requirements for tax credits, so it's worth checking the specific regulations in your state.

Income Limits:

- The income limits for the EV tax credit are based on your adjusted gross income (AGI). For the 2023 tax year, the AGI limits are as follows: For single filers, the limit is $150,000, and for married filing jointly, it is $300,000.

- If your AGI exceeds these limits, you may still be eligible for a partial credit. The credit gradually phases out for incomes above these thresholds.

- It's important to note that these income limits are adjusted annually, so it's best to check the latest IRS guidelines or consult a tax advisor to ensure you have the most up-to-date information.

To verify your residency, you will typically need to provide proof of address, such as a valid driver's license, state-issued ID, or a recent utility bill. For income verification, you should have access to your tax returns or financial records to determine your AGI. The IRS provides detailed instructions and forms to help taxpayers calculate their AGI.

Additionally, if you are purchasing an EV for personal use, you must ensure that the vehicle meets the IRS's definition of an electric vehicle. This includes specific criteria related to battery capacity and range, which can be found on the IRS website.

Understanding and meeting these residency and income requirements is essential to ensure you can take full advantage of the EV tax credit. It is always recommended to consult a tax professional or accountant who can provide personalized advice based on your unique circumstances.

Toyota's Electric Future: Rumors of EV Production Halt

You may want to see also

Filing and Documentation: Learn the process for claiming the credit on tax returns

When it comes to claiming the tax credit for electric vehicles, understanding the filing and documentation process is crucial to ensure you receive the benefits you're entitled to. Here's a step-by-step guide to help you navigate the process:

- Determine Your Eligibility: Before diving into the paperwork, confirm your eligibility for the tax credit. Typically, this credit is available to individuals who purchase or lease new electric vehicles. Research the specific requirements and guidelines provided by your country or region's tax authorities. These criteria may include factors such as vehicle type, purchase date, and income limits.

- Gather Required Documents: Collecting the necessary documents is essential for a smooth filing process. Here's a list of documents you'll likely need:

- Sales or Lease Agreement: Obtain a copy of the original purchase or lease agreement for your electric vehicle. This document should include details such as the vehicle's make, model, year, and purchase/lease date.

- Vehicle Identification Number (VIN): The VIN is a unique identifier for your vehicle. You can find it on the vehicle's title, registration, or a sticker inside the car.

- Proof of Ownership: Provide evidence of your ownership, such as a vehicle registration or a certificate of title.

- Income Verification: In some cases, you might need to submit proof of income to ensure you meet the eligibility criteria. This could include tax returns, pay stubs, or bank statements.

- Understand Filing Options: The tax credit can typically be claimed on your annual tax return. Familiarize yourself with the tax forms relevant to your jurisdiction. For example, in the United States, Form 8936, "Expanded Assets for Individuals with Unconventional Energy Property," is used to claim the credit. Ensure you have a clear understanding of the instructions and requirements for this form.

- Complete and Submit the Tax Return: When filing your tax return, carefully follow the instructions provided by your tax authority. Here's a general outline:

- Claim the Credit: On the appropriate tax form, locate the section related to tax credits. Select the 'Electric Vehicle Credit' and provide the necessary details from your documentation.

- Provide Vehicle Information: Include the vehicle's VIN and relevant specifications as requested.

- Attach Supporting Documents: Gather all the required documents and attach them to your tax return. This ensures that your claim is properly backed up and can be verified if needed.

- Submit Timely: Be mindful of tax filing deadlines to avoid penalties. Submit your tax return and any additional forms or schedules as required by your tax jurisdiction.

Keep Records: Maintain a record of your filings and the documents you've submitted. This is essential for future reference and in case of any audits or inquiries. Store these records securely and consider creating a digital backup for easy access.

Remember, the specific steps and requirements may vary depending on your location and the tax laws in effect. Always consult official government resources or seek professional advice to ensure you comply with the latest regulations when claiming your electric vehicle tax credit.

NMC vs. NCA: Unlocking EV Battery Potential

You may want to see also

Frequently asked questions

The tax credit is available for purchases made after December 31, 2020, and before January 1, 2027. This credit is designed to incentivize the adoption of electric vehicles and is available to individuals who buy or lease new electric vehicles.

Yes, there are income limits to ensure the credit benefits those who may need it most. The credit phases out for individuals with adjusted gross income (AGI) above $100,000 ($150,000 for married filing jointly) and $150,000 ($200,000 for married filing jointly) for joint filers.

To claim the credit, you'll need to file Form 3466, Credit for New Electric Vehicles, with your tax return. You'll also need to provide documentation proving your vehicle's electric motor and battery capacity. The credit is generally claimed as a reduction in your tax liability, and any excess can be carried forward to future years.