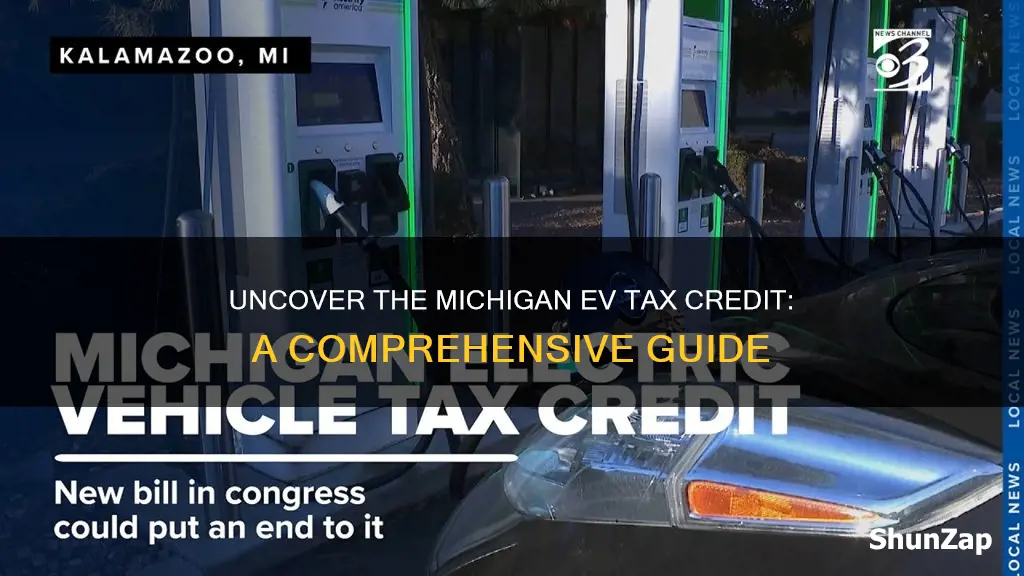

The rise of electric vehicles (EVs) has sparked a new wave of interest in sustainable transportation, and many states are offering incentives to encourage their adoption. One such incentive is the Michigan Electric Vehicle Credit, a financial benefit designed to promote the use of clean energy vehicles in the state. This credit is a significant step towards reducing Michigan's carbon footprint and fostering a greener future. It provides an opportunity for residents to save money while contributing to a more environmentally friendly transportation system. The following paragraphs will delve into the details of this credit, its eligibility criteria, and the potential impact it could have on Michigan's EV market.

| Characteristics | Values |

|---|---|

| Program Type | Tax Credit |

| State | Michigan |

| Eligible Vehicles | New and used electric vehicles, including plug-in hybrids |

| Credit Amount | Up to $7,500 per vehicle |

| Income Limit | Not specified, but typically, the credit is available to all residents |

| Residency Requirement | Must be a resident of Michigan |

| Vehicle Price Cap | Not mentioned, but generally, the vehicle's price should not exceed a certain threshold |

| Application Process | Claimable through the state's tax return or by filing a separate form |

| Effective Dates | The program has been active since 2016, with potential changes each year |

| Additional Information | The credit is part of Michigan's efforts to promote the adoption of electric vehicles and reduce emissions. |

What You'll Learn

Eligibility: Who qualifies for the Michigan EV credit?

The Michigan Electric Vehicle (EV) Credit is a financial incentive program designed to encourage the adoption of electric vehicles in the state. This credit is a valuable resource for residents looking to make an environmentally friendly choice while also saving money. Here's an overview of who qualifies for this credit:

Residency and Vehicle Ownership: To be eligible for the Michigan EV credit, you must be a resident of Michigan. This credit is specifically targeted at state residents, ensuring that the benefits go to those who contribute to the local economy. Additionally, you need to be the owner of the electric vehicle. The credit is not transferable, and it must be claimed by the vehicle's registered owner.

Vehicle Type and Purchase Date: The credit applies to the purchase or lease of new electric vehicles. This includes battery-electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). It's important to note that the purchase or lease must have occurred after a specific date. The Michigan EV credit program typically has a timeline, and only vehicles purchased or leased within this period are eligible. For instance, the credit might be available for vehicles purchased in the current year, with a deadline for the previous year's purchases.

Income and Vehicle Value Restrictions: There are income-based restrictions for this credit. The program often has a cap on the income of eligible individuals or households. This ensures that the credit benefits those who may need it most. For example, the credit might be available to individuals with an annual income below a certain threshold or households with a combined income below a specified amount. Additionally, there may be limits on the value of the electric vehicle. The credit could be limited to vehicles with a sticker price below a certain value, ensuring that the incentive is targeted at a range of affordable EV options.

Application Process: To claim the credit, eligible individuals or their authorized representatives must complete an application. This process typically involves providing personal and vehicle-related information. The application might require details such as your name, address, vehicle specifications, purchase or lease agreement, and proof of residency. It is essential to stay updated with the Michigan Department of Treasury's guidelines, as the application process and required documents may be subject to change.

Understanding these eligibility criteria is crucial for Michigan residents interested in taking advantage of the EV credit. By meeting the residency, vehicle ownership, and income requirements, as well as adhering to the specified purchase or lease timelines, individuals can potentially save a significant amount on their electric vehicle purchase or lease.

Sustainable Power: Recycling EV Batteries for a Greener Future

You may want to see also

Amount: How much is the credit?

The Michigan Electric Vehicle Credit is a financial incentive designed to encourage the adoption of electric vehicles (EVs) in the state. This credit is a form of tax credit, which means it directly reduces the amount of tax owed by individuals and businesses who purchase or lease eligible EVs. The credit amount is significant, providing a substantial financial benefit to EV buyers.

The credit amount varies depending on the type of vehicle and its price. For new electric vehicles, the credit is typically $7,500 per vehicle. This credit is available for a wide range of EVs, including battery-electric cars, plug-in hybrid electric vehicles, and fuel cell electric vehicles. The credit is not limited to a specific manufacturer or model, allowing consumers to choose from various options in the market.

It's important to note that this credit is not a one-time benefit. The Michigan Electric Vehicle Credit can be claimed for multiple vehicles purchased or leased by the same individual or business. This feature ensures that the incentive has a more significant impact on the market, encouraging a broader adoption of electric vehicles.

Additionally, the credit has a price cap, which means the total credit an individual or business can claim is limited. For new electric vehicles, the price cap is set at $80,000. This cap ensures that the credit remains financially sustainable and does not disproportionately benefit high-end vehicle purchases.

To be eligible for this credit, the vehicle must be new and purchased or leased in Michigan. The credit is also subject to certain income limits, ensuring that the incentive reaches a wider range of consumers. These eligibility criteria ensure that the credit is targeted at those who can benefit the most from the financial incentive.

General Motors' Electric Revolution: A Green Future?

You may want to see also

Application Process: Steps to claim the credit

The Michigan Electric Vehicle Credit is a financial incentive designed to encourage residents to purchase or lease new electric vehicles (EVs) in the state. This credit can significantly reduce the cost of going electric, making it an attractive option for those looking to make an environmentally friendly choice. Here's a step-by-step guide on how to apply for and claim this credit:

- Determine Your Eligibility: Before initiating the application process, ensure you meet the eligibility criteria. The credit is typically available to individuals and businesses purchasing or leasing new electric vehicles in Michigan. Check if you fall under this category and if there are any specific requirements or restrictions based on your residency or vehicle type.

- Gather Required Documents: Collect all the necessary documents to support your application. This may include proof of residency in Michigan, a valid driver's license or state ID, and documentation related to the vehicle purchase or lease agreement. For businesses, additional paperwork might be required, such as business registration and tax documents.

- Complete the Application Form: Obtain the application form for the Michigan Electric Vehicle Credit. This form can usually be found on the official website of the Michigan Department of Treasury or the relevant government agency responsible for managing the credit. Carefully fill out the form, providing accurate and detailed information about your vehicle purchase or lease, including the make, model, and purchase price.

- Submit the Application: After completing the form, submit it along with the required supporting documents. You can typically submit your application online, by mail, or in person at the designated government office. Ensure that you follow the submission guidelines and deadlines to avoid any delays or rejections.

- Wait for Processing and Approval: Once your application is received, it will be processed by the relevant authorities. This process may take some time, and you will be notified if any additional information or documentation is required. If your application is approved, you will receive the credit amount, which can be used to reduce the cost of your electric vehicle purchase or lease.

- Claim the Credit: After approval, you can claim the credit by providing the necessary documentation to the seller or lessor of the electric vehicle. They will then process the credit and adjust the final price of the vehicle accordingly. Keep all records and receipts for your records and future reference.

Remember, the application process may vary slightly depending on the specific regulations and guidelines set by the Michigan government. It is essential to stay updated with the latest information and requirements to ensure a smooth and successful application for the Michigan Electric Vehicle Credit.

India's Electric Vehicle Revolution: Ready for the Future?

You may want to see also

Eligibility Criteria: Income limits and vehicle requirements

The Michigan Electric Vehicle Credit is a financial incentive designed to encourage residents to purchase or lease electric vehicles (EVs) in the state. To be eligible for this credit, individuals and businesses must meet specific criteria, including income limits and vehicle requirements. Understanding these requirements is crucial for those looking to take advantage of this incentive.

Income Limits:

One of the primary eligibility criteria is income-based. The Michigan Electric Vehicle Credit is typically available to individuals and households with moderate to low incomes. The exact income limits can vary, but generally, applicants must fall within a certain income range to qualify. For instance, in 2023, the income limits for the federal EV tax credit were set at $300,000 for joint returns and $150,000 for single filers. These limits ensure that the credit benefits those who may need it most, promoting a more equitable distribution of resources. It's important to note that these income thresholds may be adjusted periodically, so staying updated with the latest guidelines is essential.

Vehicle Requirements:

In addition to income considerations, there are specific vehicle criteria that applicants must meet. The vehicle must be new and purchased or leased from a dealership or authorized seller in Michigan. The credit is generally applicable to electric cars, trucks, and motorcycles, but certain restrictions may apply. For example, the vehicle's price, including taxes and fees, should not exceed a certain amount. In the case of the federal EV tax credit, the vehicle's price must not be more than $80,000 for cars and $85,000 for trucks. Moreover, the vehicle should be designed and manufactured primarily for personal use, and it must be powered by a battery or fuel cell.

It is worth mentioning that the credit amount can vary depending on the vehicle's price and the applicant's income. Higher-income individuals may receive a reduced credit amount or none at all. On the other hand, those with lower incomes might be eligible for a more substantial credit. This progressive approach ensures that the incentive is accessible to a broader range of consumers.

In summary, the Michigan Electric Vehicle Credit has clear eligibility criteria, focusing on income limits and vehicle specifications. By adhering to these requirements, residents can take advantage of this financial incentive, making the transition to electric vehicles more affordable and environmentally friendly.

Unveiling the Green Myth: Is the Toyota Prius an Electric Car?

You may want to see also

Tax Year: When can you claim the credit?

The Michigan Electric Vehicle Credit is a financial incentive offered by the state to encourage the adoption of electric vehicles. This credit is available to individuals and businesses who purchase or lease a new electric vehicle, and it can significantly reduce the overall cost of ownership. To claim this credit, it's essential to understand the tax year implications and the specific timing requirements.

Tax Year for Claiming the Credit:

The Michigan Electric Vehicle Credit is typically available for the tax year in which the eligible vehicle is purchased or leased. This means that if you buy or lease an electric vehicle in 2023, you can claim the credit on your 2023 tax return, which is filed in 2024. It's crucial to note that the credit is generally not retroactive, and you must meet the eligibility criteria at the time of purchase or lease.

Eligibility and Timing:

To claim the credit, you must have a valid Michigan state income tax return for the tax year in question. The credit is generally available for the first $7,500 of the vehicle's purchase or lease price, and it can be claimed in the same tax year as the purchase. However, if the credit exceeds the purchase price, the excess can be carried forward to future tax years until fully utilized. It's recommended to consult a tax professional to ensure you meet all the requirements and can claim the credit accurately.

Filing and Documentation:

When filing your tax return, you will need to provide documentation supporting the purchase or lease of the electric vehicle. This may include a sales receipt, lease agreement, or a letter from the dealership confirming the purchase. The credit is typically claimed as a credit against your state income tax liability, reducing the amount of tax you owe. If the credit exceeds your liability, you may receive a refund for the difference.

It's important to stay updated on the specific rules and regulations regarding the Michigan Electric Vehicle Credit, as they may change over time. The state's tax authorities provide detailed guidelines and instructions on their official website, ensuring that taxpayers can navigate the credit claim process smoothly. Understanding the tax year implications and eligibility criteria is crucial to maximizing the benefits of this incentive.

Mastering the Art of Electric Driving: A Beginner's Guide

You may want to see also

Frequently asked questions

The Michigan Electric Vehicle Credit is a financial incentive program designed to encourage the adoption of electric vehicles (EVs) in the state of Michigan. It provides a tax credit to Michigan residents who purchase or lease new electric vehicles.

The credit amount varies depending on the vehicle's price and the type of EV. For electric vehicles priced up to $35,000, the credit is $1,500. For vehicles priced between $35,001 and $45,000, the credit is $2,500. Vehicles over $45,000 are not eligible for this credit.

Michigan residents who are individuals, estates, or trusts are eligible to claim the credit. This includes those who purchase or lease new electric vehicles for personal use.

The credit is claimed on your state tax return. You will need to provide documentation, such as the vehicle's purchase or lease agreement, to verify your eligibility. The Michigan Department of Treasury provides guidelines and forms to help with the application process.

The Michigan Electric Vehicle Credit is available to all Michigan residents, regardless of income. However, there are some restrictions on vehicle types and models. The credit applies to new, in-use electric vehicles, and certain luxury vehicles are excluded. It's best to review the official guidelines for the most up-to-date information.