The electric vehicle (EV) tax credit has been a significant incentive for consumers to purchase electric cars, and many have taken advantage of this benefit. The tax credit was introduced to encourage the adoption of electric vehicles and reduce the environmental impact of traditional gasoline-powered cars. It has been a popular program, with numerous eligible vehicles qualifying for the credit. The recipients of this credit vary, as it is available to individual buyers, businesses, and even government entities that purchase electric vehicles for their fleets. This paragraph aims to explore the diverse range of entities that have utilized the EV tax credit, highlighting its impact on the automotive industry and the environment.

What You'll Learn

- Legislative History: The EV tax credit was introduced in the Inflation Reduction Act of 2022

- Eligibility Criteria: Vehicles must be new, manufactured in North America, and meet specific emissions standards

- Consumer Benefits: Tax credits directly reduce the purchase price for eligible EV buyers

- Industry Impact: The credit has boosted EV sales and encouraged innovation in the automotive sector

- Political Support: bipartisan support for the credit has been crucial for its passage and implementation

Legislative History: The EV tax credit was introduced in the Inflation Reduction Act of 2022

The Inflation Reduction Act of 2022, a landmark piece of legislation, played a pivotal role in the advancement of electric vehicles (EVs) in the United States. This act, which was signed into law by President Joe Biden, included a significant provision: a tax credit for EV purchases. The EV tax credit has been a subject of much discussion and analysis, as it aims to incentivize consumers to make the switch to electric transportation.

The legislative journey of this tax credit began with the recognition of the growing importance of EVs in combating climate change and reducing the nation's reliance on fossil fuels. The act's primary goal was to provide financial incentives for consumers to purchase EVs, thereby accelerating the transition to a more sustainable transportation system. This tax credit was designed to be a powerful tool in encouraging the adoption of electric vehicles, especially as the industry was still in its early stages.

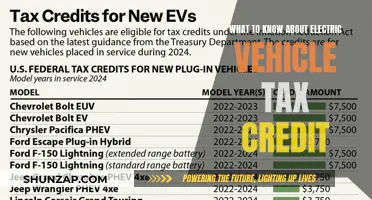

In the Inflation Reduction Act, the EV tax credit was introduced as a means to stimulate the market and make EVs more affordable for American families. The credit amount was set at $7,500 per new EV purchase, with certain conditions and limitations. These conditions included a price cap on the vehicle and a requirement for the EV to be manufactured in North America. The act's authors aimed to ensure that the credit would benefit a wide range of consumers and promote the growth of the domestic EV industry.

The passage of this legislation was a significant milestone in the history of EV adoption. It demonstrated a strong commitment from the U.S. government to support the development of a sustainable transportation sector. The act's impact was immediate, as it provided a much-needed boost to the EV market, attracting more consumers and encouraging manufacturers to invest in electric vehicle production.

Furthermore, the Inflation Reduction Act's EV tax credit has had a lasting effect on the industry. It has not only increased the number of EVs on the road but has also fostered innovation and competition. The credit has encouraged manufacturers to offer a diverse range of electric vehicles, catering to various consumer preferences and needs. As a result, the EV market has become more vibrant and accessible, contributing to a greener and more sustainable future.

Unlocking EV Tax Savings: A Guide to Maximizing Your Credit

You may want to see also

Eligibility Criteria: Vehicles must be new, manufactured in North America, and meet specific emissions standards

The Electric Vehicle Tax Credit, a significant incentive for promoting the adoption of electric vehicles (EVs), has been a topic of interest for many. This credit is a crucial step towards encouraging the use of environmentally friendly transportation options. To be eligible for this credit, vehicles must meet certain criteria, ensuring they are both new and environmentally conscious.

Firstly, the vehicle must be new. This means it has never been registered or used before. The purpose of this criterion is to stimulate the market for new EVs, ensuring that the tax credit supports the purchase of the latest models with the most advanced technology. By encouraging the purchase of new vehicles, the credit aims to drive innovation and provide consumers with the most efficient and sustainable options available.

Secondly, the vehicle's manufacturing location is a critical factor. The tax credit specifically targets EVs manufactured in North America. This requirement supports local industries and promotes the growth of the EV market within the region. By prioritizing North American production, the credit helps create jobs and fosters economic growth, all while reducing the environmental impact associated with long-distance transportation of vehicles.

Emissions standards play a pivotal role in the eligibility process. Vehicles must meet specific emissions standards to qualify for the tax credit. These standards ensure that the EVs are not only new and locally produced but also environmentally friendly. The criteria likely include measures to reduce greenhouse gas emissions, improve air quality, and minimize the overall environmental footprint of the vehicle. By setting these standards, the tax credit encourages manufacturers to produce cleaner, more sustainable vehicles.

In summary, the Electric Vehicle Tax Credit's eligibility criteria are designed to promote new, locally manufactured EVs that adhere to strict emissions standards. This approach not only benefits consumers by providing incentives for purchasing eco-friendly vehicles but also supports the growth of the North American EV market, driving innovation and economic development while contributing to a greener future.

Powering the Engine: The Secret to Vehicle Electricity

You may want to see also

Consumer Benefits: Tax credits directly reduce the purchase price for eligible EV buyers

The electric vehicle (EV) tax credit is a financial incentive designed to encourage consumers to purchase and drive electric cars, which offer a more sustainable and environmentally friendly alternative to traditional gasoline vehicles. This tax credit is a significant benefit for EV buyers, as it directly reduces the overall cost of purchasing an electric vehicle.

When consumers purchase an eligible electric vehicle, they can claim a tax credit, which is a dollar-for-dollar reduction in the amount they owe to the government. This credit is a powerful tool to make EVs more affordable and accessible to a wider range of buyers. The credit amount varies depending on the specific vehicle and its battery capacity, but it can be substantial, often covering a significant portion of the vehicle's price. For instance, in the United States, the Inflation Reduction Act of 2022 introduced a new tax credit of up to $7,500 for qualified EVs, making electric cars more competitive in the market.

The impact of this tax credit is twofold. Firstly, it provides an immediate financial benefit to consumers, allowing them to save money on their vehicle purchase. This is particularly advantageous for those who might otherwise be priced out of the EV market. Secondly, it encourages the adoption of electric vehicles, which is crucial for reducing greenhouse gas emissions and promoting a greener economy. By making EVs more affordable, the tax credit can accelerate the transition to sustainable transportation.

For consumers, the process of claiming the tax credit is relatively straightforward. After purchasing the eligible EV, buyers can file the necessary tax forms to receive the credit. This credit can be used to offset the purchase price or, in some cases, be carried forward to future tax years if the vehicle's price exceeds the credit amount. This flexibility ensures that consumers can take advantage of the credit in a way that best suits their financial situation.

In summary, the electric vehicle tax credit is a consumer-friendly policy that offers a direct financial benefit by reducing the purchase price of eligible EVs. This incentive not only makes electric cars more affordable but also plays a vital role in promoting environmental sustainability by encouraging the widespread adoption of electric transportation. As the world moves towards a greener future, such tax credits are essential in driving consumer interest and demand for electric vehicles.

Electric Vehicles: Projected Global Sales by 2030

You may want to see also

Industry Impact: The credit has boosted EV sales and encouraged innovation in the automotive sector

The introduction of the electric vehicle (EV) tax credit has had a profound impact on the automotive industry, primarily by significantly boosting EV sales and fostering a culture of innovation. This policy, which provides a financial incentive to consumers purchasing EVs, has played a pivotal role in accelerating the industry's transition to sustainable transportation.

One of the most immediate effects has been the surge in EV sales. The tax credit, which offers a substantial amount of money back to buyers, has made EVs more affordable and attractive to a broader market. This has led to a rapid increase in consumer interest and, consequently, a higher volume of EV purchases. As a result, automotive manufacturers have experienced a boost in sales, particularly for their electric vehicle lines. This shift in consumer behavior has also encouraged traditional carmakers to accelerate their EV development and production, ensuring they remain competitive in a rapidly evolving market.

The credit's influence extends beyond sales, significantly impacting the automotive sector's innovation landscape. With the prospect of financial incentives, both startups and established automakers have been spurred to invest in research and development for EV technology. This has led to a wave of new EV models, each aiming to offer improved performance, longer ranges, and enhanced features. The competition among manufacturers has driven the industry to set higher standards for EV quality and reliability, ultimately benefiting consumers. Moreover, the tax credit has encouraged the development of supporting infrastructure, such as charging stations, which are essential for the widespread adoption of EVs.

In the long term, this policy has the potential to reshape the automotive industry's future. As more resources are allocated to EV technology, we can anticipate a continuous stream of innovative solutions, from advanced battery designs to sustainable materials. This not only benefits the environment but also positions the automotive sector as a leader in sustainable innovation, potentially attracting further investment and talent.

The electric vehicle tax credit has, therefore, served as a powerful catalyst for the automotive industry's transformation. By stimulating sales and fostering innovation, it has accelerated the shift towards a more sustainable transportation ecosystem. This impact is likely to have long-lasting effects, shaping the industry's trajectory and contributing to a greener future.

Understanding Electric Auxillary Controls: Powering Vehicle Convenience

You may want to see also

Political Support: bipartisan support for the credit has been crucial for its passage and implementation

The electric vehicle (EV) tax credit has been a significant policy initiative, and its success can be largely attributed to the bipartisan political support it has garnered. This support has been crucial in its passage through Congress and its subsequent implementation, ensuring a consistent and long-lasting impact on the automotive industry and the environment.

In the United States, the EV tax credit has been a bipartisan effort, with support from both major political parties. This is a notable achievement, as environmental and energy policies often face challenges in gaining widespread political agreement. The credit's proponents from both parties recognized the potential benefits of promoting electric vehicles, which include reduced greenhouse gas emissions, improved air quality, and a shift towards a more sustainable transportation system. This shared goal has been a driving force behind the credit's introduction and ongoing support.

The political strategy behind this bipartisan approach was to build a broad coalition of supporters. This involved engaging with various stakeholders, including automotive manufacturers, environmental organizations, and consumer advocacy groups. By presenting the EV tax credit as a non-partisan initiative, supporters aimed to appeal to a wide range of interests and gain momentum for its passage. This inclusive approach helped to secure the necessary votes in Congress, as members from different political backgrounds could find common ground in supporting the credit's goals.

Furthermore, the political support has ensured the credit's longevity. Bipartisan backing has provided a level of stability, allowing for the credit's consistent application over multiple legislative sessions. This has been vital, as the EV market has grown and evolved, and the credit has adapted to meet the changing needs of the industry. The political commitment has also facilitated the credit's expansion and improvement, with periodic reauthorizations and adjustments to address emerging challenges and opportunities.

In summary, the electric vehicle tax credit's success is a testament to the power of bipartisan political support. This support has been instrumental in its passage, ensuring that the credit has become a permanent feature of US environmental policy. The credit's ability to gain and maintain support from both major parties demonstrates its broad appeal and the shared recognition of its importance for a sustainable future. This political alignment has been a key factor in the credit's positive impact on the automotive industry and the environment.

Unveiling the Green Impact: Electric Vehicles and Their Carbon Footprint

You may want to see also

Frequently asked questions

The tax credit is available to individuals and businesses who purchase or lease new electric vehicles (EVs) in the United States. The vehicle must be new and meet specific criteria, such as being produced by an original equipment manufacturer (OEM) that has a binding contract with the Internal Revenue Service (IRS).

The amount of the tax credit varies depending on the vehicle's battery capacity and the manufacturer. For vehicles with a battery capacity of at least 40 kilowatt-hours (kWh), the credit can be up to $7,500. For those with a battery capacity of 50 kWh or more, the credit can reach up to $8,000.

Yes, there are income-based restrictions on the vehicle's price. The tax credit is generally limited to vehicles with a manufacturer's suggested retail price (MSRP) of $80,000 or less for new vehicles and $55,000 or less for used vehicles. These price limits are adjusted for inflation annually.