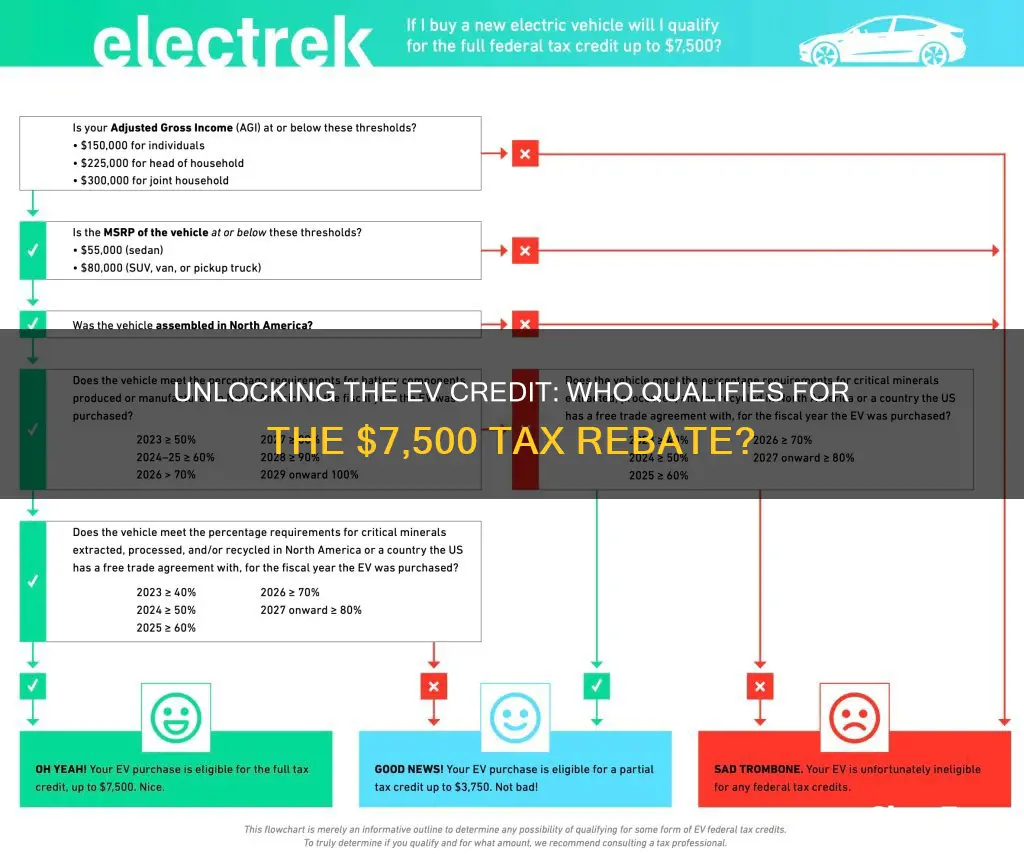

The 7500 electric vehicle (EV) credit is a significant incentive for individuals and businesses looking to purchase electric cars, trucks, and motorcycles. This credit is part of the Inflation Reduction Act (IRA) in the United States, designed to boost the production and sale of EVs and reduce greenhouse gas emissions. To qualify for this credit, applicants must meet specific criteria, including purchasing or leasing a new EV from a dealership or manufacturer that complies with the IRS's regulations. Additionally, the vehicle must be new, produced in the United States or a qualifying foreign country, and meet certain environmental and safety standards. This credit is a valuable opportunity for EV buyers, offering substantial savings and encouraging the adoption of cleaner transportation options.

| Characteristics | Values |

|---|---|

| Income Level | Households with modified adjusted gross income (MAGI) of $150,000 or less for single filers and $300,000 or less for joint filers. |

| Employment Status | Must be a U.S. citizen or resident alien. |

| Vehicle Type | New electric vehicles, including plug-in hybrids, that are purchased or leased. |

| Manufacturing Location | Vehicles must be assembled in North America (Canada, Mexico, or the United States). |

| Sales or Lease Period | The vehicle must be sold or leased on or after March 1, 2023, and before January 1, 2024. |

| Credit Limit | The credit is limited to the first 200,000 vehicles sold or leased. |

| Eligible States | The credit is available in all states, but some states may have additional requirements or restrictions. |

| Taxable Income | The credit is generally not taxable, but it may be subject to certain income limits. |

| Transferability | The credit can be transferred to a dealer or manufacturer if the vehicle is not purchased directly. |

What You'll Learn

- Income Limits: Household income under $300,000 for individuals or $450,000 for joint filers

- Vehicle Price: New electric vehicles under $80,000, used under $55,000

- Manufacturer's Rules: Each car maker has its own eligibility criteria and limits

- State Incentives: Additional state-specific credits may apply, varying by location

- Trade-In Value: Older vehicles can increase credit eligibility, up to $7,500

Income Limits: Household income under $300,000 for individuals or $450,000 for joint filers

The 7500 electric vehicle (EV) tax credit is a significant incentive for individuals and families looking to purchase an electric car. This credit can cover up to 30% of the vehicle's sale price, making it an attractive option for those seeking an eco-friendly mode of transportation. However, it's important to understand the qualification criteria to ensure you meet the necessary requirements.

One of the primary factors in qualifying for this credit is your household income. The Internal Revenue Service (IRS) has set income limits to ensure that the credit benefits those who may need it most. For individuals, the household income must be under $300,000, while for joint filers, the limit is set at $450,000. These income thresholds are adjusted annually, so it's essential to check the current year's limits to ensure accuracy.

To determine your eligibility, you need to consider your total household income, including wages, salaries, bonuses, and other forms of earnings. Income from investments, rental properties, or business ventures may also be taken into account. It's crucial to have accurate financial records and documentation to support your income level. If your income exceeds these limits, you may still be eligible for a partial credit, but the amount will be reduced proportionally.

For those who are self-employed or have varying income sources, it's advisable to consult a tax professional to ensure compliance with the income requirements. They can provide guidance on how to accurately report your income and navigate any complexities that may arise. Additionally, if you are purchasing an EV for a business, the income limits may differ, so it's essential to understand the specific rules for business-related purchases.

In summary, the 7500 electric vehicle tax credit is a valuable incentive, but it's crucial to be aware of the income limits set by the IRS. Individuals and joint filers must ensure their household income remains under the specified thresholds to qualify for the full credit. Staying informed about these requirements will help you make an informed decision when purchasing an electric car and take advantage of this financial incentive.

Unraveling the Mystery: Why Some Animals Chew on Car Wires

You may want to see also

Vehicle Price: New electric vehicles under $80,000, used under $55,000

The 7500-dollar electric vehicle tax credit is a significant incentive for consumers looking to purchase an electric car, and understanding the qualifications is crucial for anyone interested in taking advantage of this benefit. When it comes to vehicle price, the criteria are clear: new electric vehicles must cost under $80,000, while used electric vehicles should be valued at $55,000 or less. This price cap ensures that the credit is accessible to a wide range of consumers, promoting the adoption of electric vehicles across various market segments.

For new electric vehicles, this means that buyers can explore a variety of models from different manufacturers, ensuring a diverse selection of options. The $80,000 threshold is a reasonable limit, allowing for competitive pricing and a healthy market for electric cars. This price range encourages manufacturers to offer competitive deals, making electric vehicles more affordable and attractive to potential buyers.

Used electric vehicles, on the other hand, provide an opportunity for those who prefer a pre-owned option. The $55,000 price cap for used vehicles is a significant advantage, as it opens up the market to a broader audience. This includes individuals who may not have the budget for a new car but still desire the benefits of electric mobility. By qualifying for the credit on used vehicles, buyers can potentially save a substantial amount, making the transition to electric more accessible.

It's important to note that these price limits are designed to encourage the purchase of electric vehicles and support the growth of the industry. By setting these thresholds, governments aim to stimulate the market and reduce the financial burden on consumers, making electric cars more attainable for a diverse range of buyers. This approach not only benefits individual consumers but also contributes to the overall sustainability and environmental goals associated with electric vehicle adoption.

In summary, the 7500-dollar electric vehicle tax credit has specific vehicle price qualifications, ensuring that the incentive reaches a broad audience. New electric vehicles under $80,000 and used electric vehicles under $55,000 are eligible, providing opportunities for buyers to save on their electric car purchases. Understanding these criteria is essential for anyone considering the tax credit, as it allows for informed decision-making and the potential to take advantage of this substantial financial incentive.

Unleash the Power: Understanding the EV HomeCharge Scheme

You may want to see also

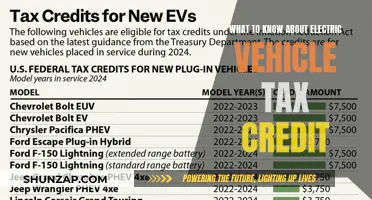

Manufacturer's Rules: Each car maker has its own eligibility criteria and limits

The 7500 electric vehicle (EV) tax credit is a significant incentive for consumers to purchase electric cars, but it's important to understand that this benefit is not universally available. Each car manufacturer has its own set of rules and criteria that determine eligibility for this credit. These rules can vary widely, making it crucial for potential EV buyers to research and understand the specific requirements of the manufacturer they are interested in.

For instance, some manufacturers may offer the full $7,500 credit, while others might provide a partial amount or even none at all. The credit amount can depend on various factors, including the vehicle's price, its battery capacity, and the manufacturer's specific policies. For example, a luxury car brand might have a higher price threshold for eligibility, while a more affordable EV manufacturer may have different criteria.

Additionally, some car makers may impose restrictions on the types of vehicles that qualify. This could include limitations on vehicle size, weight, or even specific models within a brand. For instance, a manufacturer might only offer the credit for their compact electric SUVs but not for their larger luxury sedans. Understanding these manufacturer-specific rules is essential to ensure that a potential buyer's vehicle of choice qualifies for the credit.

Furthermore, the credit often comes with certain limitations and conditions. Some manufacturers may require buyers to meet specific income thresholds or provide proof of residency in certain regions. These criteria can vary, and it's important to check the manufacturer's guidelines to ensure compliance. Moreover, the credit might be subject to annual caps, meaning that once a certain number of vehicles are sold, the credit for that year becomes unavailable.

To navigate these manufacturer rules effectively, potential EV buyers should start by researching the specific manufacturer's website and contacting their sales team. Many car makers provide detailed information about their EV credit programs, including eligibility criteria and any additional requirements. This proactive approach ensures that buyers can make informed decisions and potentially save a significant amount on their electric vehicle purchase.

South Carolina's EV Tax Exemption: A Green Car Owner's Guide

You may want to see also

State Incentives: Additional state-specific credits may apply, varying by location

The federal government's $7,500 tax credit for electric vehicles (EVs) is a significant incentive for buyers, but it's important to note that this credit is not the only financial benefit available. Many states also offer their own incentives, which can vary widely depending on the location. These state-specific credits can provide additional savings or benefits to EV buyers, making the transition to electric more affordable and attractive.

For instance, California, a state known for its environmental initiatives, offers the California Clean Vehicle Rebate Project. This program provides rebates of up to $7,000 for the purchase or lease of new electric vehicles. The amount of the rebate depends on the vehicle's battery capacity and the dealer's participation in the program. Similarly, New York State offers the NY Zero-Emission Vehicle (ZEV) Program, which provides incentives for the purchase or lease of new electric vehicles, with a maximum rebate of $2,000. These state-based programs often have their own eligibility criteria, such as residency requirements or specific vehicle models that qualify.

In addition to direct rebates, some states provide tax credits or exemptions. For example, Oregon offers a tax credit of up to $5,000 for the purchase of electric vehicles, and this credit can be used in place of the federal tax credit. This means that EV buyers in Oregon might receive a total credit of $12,500 ($7,500 federal + $5,000 state) if they meet the state's eligibility criteria. Similarly, Hawaii provides a tax exemption on the first $15,000 of the vehicle's sales price for electric vehicles, which can be a substantial benefit for buyers.

It's crucial for potential EV buyers to research their state's specific incentives, as these programs often have limited funding and may have application deadlines. Some states might also have income limits or other restrictions on who can qualify. For instance, Massachusetts offers the Massachusetts Electric Vehicle Incentive Program, but with a cap of $3,000 per vehicle and a total program budget of $10 million. This highlights the importance of checking the latest information and guidelines provided by your state's environmental or financial authorities.

Understanding these state-specific incentives is essential for maximizing the benefits of purchasing an electric vehicle. It can significantly impact the overall cost and, consequently, the accessibility of EVs. Therefore, staying informed about your state's offerings is a crucial step in the process of going electric.

Battling EV Fires: Rapid Response Strategies for Safety

You may want to see also

Trade-In Value: Older vehicles can increase credit eligibility, up to $7,500

The federal government's $7,500 tax credit for electric vehicles (EVs) is a significant incentive for consumers to make the switch to electric. One often overlooked aspect of this credit is how the trade-in value of your current vehicle can impact your eligibility. Older vehicles, in particular, can play a crucial role in maximizing this credit.

When you trade in an older car, you're essentially providing a down payment on your new EV. This is a strategic move because it can increase your overall credit amount. The credit is designed to encourage the purchase of new EVs, and by trading in a vehicle, you're demonstrating a willingness to part with a current asset, which can be seen as a commitment to the EV market. This commitment can result in a higher credit amount, potentially reaching the full $7,500.

The age of your vehicle is a critical factor. Older cars, especially those that are no longer in production, can have a higher trade-in value. This is because they are considered unique and may have a dedicated following among collectors or enthusiasts. By trading in such a vehicle, you're not only contributing to a higher trade-in value but also potentially attracting attention from buyers who appreciate the car's rarity. This can significantly boost your credit eligibility.

Additionally, the condition of your older vehicle matters. A well-maintained car, even if it's an older model, can fetch a higher price. Regular servicing, proper care, and a clean history can make your trade-in more attractive to dealers or buyers. This, in turn, can lead to a more substantial credit amount. It's a good idea to have your vehicle inspected and valued by a professional before trading it in to ensure you get the best possible deal.

In summary, trading in an older vehicle can be a powerful strategy to maximize your $7,500 electric vehicle tax credit. The age and condition of your car can significantly impact its trade-in value, which directly influences your credit eligibility. By understanding these factors and taking the necessary steps to prepare your vehicle, you can make the most of this government incentive and potentially save a substantial amount on your new electric car purchase.

Unleashing the Power of EVs: Strategies to Boost Demand and Revolutionize Transportation

You may want to see also

Frequently asked questions

The $7,500 tax credit is available to individuals who purchase or lease a new qualified electric vehicle. This includes battery-electric vehicles and fuel cell electric vehicles, but not plug-in hybrid electric vehicles.

Yes, there are income limits. The credit is generally available to taxpayers with modified adjusted gross income (AGI) of $150,000 or less for individuals or $300,000 or less for married filing jointly. However, the credit begins to phase out at $200,000 ($100,000 for single filers) and is completely eliminated at $200,000 ($150,000 for joint filers).

Yes, you can claim the credit if you lease a qualified electric vehicle. However, the rules for leasing are more complex, and you may need to consider the lease term, lease payments, and the vehicle's value at the end of the lease.

The Internal Revenue Service (IRS) provides a list of qualified electric vehicles on its website. You can also check with the vehicle manufacturer or dealer to ensure your specific model meets the criteria. The vehicle must be new, acquired and used primarily for personal use, and meet certain performance and efficiency standards.