The transition to electric vehicles (EVs) has been a significant trend in the automotive industry, and governments worldwide have offered incentives to encourage this shift. One such incentive is the federal tax credit for EVs, which provides a substantial financial benefit to buyers. However, there is growing concern about the potential phase-out of this credit, which could impact the EV market and consumer behavior. This paragraph will explore the implications of a potential phase-out, examining the reasons behind it and the potential consequences for both consumers and the environment.

What You'll Learn

- Eligibility Criteria: Who qualifies for the EV tax credit and when does it end

- Income Limits: Are there income caps for EV credit recipients

- Vehicle Price: How does the EV price affect credit phase-out

- Manufacturing Location: Does the EV's production location impact credit availability

- Timeframe: When does the EV tax credit fully phase out

Eligibility Criteria: Who qualifies for the EV tax credit and when does it end?

The federal tax credit for electric vehicles (EVs) is a significant incentive for consumers to go green and has been a driving force behind the growing popularity of EVs in the United States. However, it's important to understand the eligibility criteria and the phase-out process to ensure you take full advantage of this benefit.

Who Qualifies for the EV Tax Credit?

The EV tax credit is available to individuals and businesses who purchase or lease new qualified electric vehicles. To be eligible, the vehicle must meet specific criteria, including being manufactured or assembled in the U.S. or a qualifying country, and meeting certain battery and emission standards. The Internal Revenue Service (IRS) provides detailed guidelines on what constitutes a qualified vehicle, and these standards are regularly updated. For individuals, the vehicle must be acquired primarily for personal use, and the credit is generally limited to one vehicle per household. Businesses can claim the credit for multiple vehicles, but there are specific rules regarding the types of businesses and the vehicles they can claim.

Income Limits and Phase-Out:

One of the most critical aspects of the EV tax credit is the income limit, which is a phase-out threshold. The credit begins to decrease for individuals with adjusted gross income (AGI) above $150,000 for single filers and $300,000 for joint filers. For married couples filing separately, the threshold is $150,000. For businesses, the phase-out starts at $450,000 in tangible personal property (TPP) expenses for tax years beginning after December 31, 2022. This means that the credit will gradually reduce as your income or business expenses approach these limits.

Timing of the Phase-Out:

The phase-out of the EV tax credit is a gradual process. For individuals, the credit is reduced by 50% for AGI above the threshold up to $200,000 for single filers and $400,000 for joint filers. For businesses, the reduction is more complex and depends on the type of business and the specific rules governing their TPP expenses. It's essential to stay informed about these changes, as they can significantly impact your ability to claim the full credit.

Understanding the eligibility criteria and the phase-out process is crucial for anyone considering purchasing an EV. The credit can be a substantial financial benefit, but it's a limited-time offer, and being aware of the income limits and timing will ensure you make the most of this incentive. Always consult the IRS guidelines and seek professional advice to ensure you meet the requirements and maximize your EV tax credit.

Unleash Your Portfolio's Potential: A Guide to Electric Vehicle Stocks

You may want to see also

Income Limits: Are there income caps for EV credit recipients?

The answer to your question is yes, there are income limits for EV credit recipients. This is a crucial aspect to consider when planning to purchase an electric vehicle (EV) and taking advantage of the available tax credits. The federal tax credit for EVs is a significant incentive for buyers, offering a substantial amount of money back on the purchase price. However, this credit is not available to everyone; it is means-tested, meaning that your income level plays a significant role in determining your eligibility.

The income limits for EV tax credits are set by the Internal Revenue Service (IRS) and are adjusted annually for inflation. For the 2023 tax year, the income thresholds for EV credit eligibility are as follows: For single filers, the maximum modified adjusted gross income (MAGI) is $200,000, and for married filing jointly, it is $400,000. These limits are designed to ensure that the credit benefits those who may need it most, often lower- to middle-income families.

It's important to note that these income limits are not just about the buyer's income but also consider the value of the EV being purchased. The credit amount is generally a percentage of the vehicle's sale price, and there are specific price caps for different types of EVs. For example, the credit for plug-in hybrid EVs is generally a percentage of the vehicle's sale price, not to exceed $7,500. For other EVs, the credit is generally a percentage of the vehicle's sale price, not to exceed $7,500 for vehicles with a base price of $80,000 or less, and $3,750 for vehicles with a base price between $80,001 and $100,000.

Additionally, there are state-level income limits and requirements that may further restrict eligibility. Some states have their own EV incentive programs with different income thresholds and eligibility criteria. Therefore, it is essential to check both federal and state guidelines to understand the full scope of your eligibility.

Understanding these income limits is crucial for anyone considering purchasing an EV and applying for the tax credit. It ensures that the financial assistance is directed towards those who may need it most, promoting a more equitable distribution of the benefits of EV ownership.

Toyota's Electric Vehicle Absence: A Strategic Hold or Missed Opportunity?

You may want to see also

Vehicle Price: How does the EV price affect credit phase-out?

The price of electric vehicles (EVs) is a critical factor when considering the potential phase-out of incentives and credits for EV purchases. The credit phase-out is a mechanism used by governments to encourage the adoption of cleaner and more sustainable transportation options. However, the effectiveness of this strategy is closely tied to the cost of EVs.

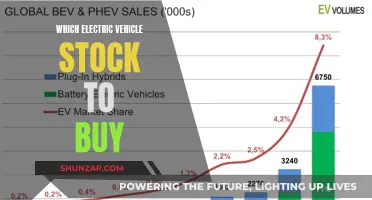

As EV technology advances and production scales, prices have been steadily decreasing, making EVs more affordable for consumers. This trend is particularly notable in the United States, where the average price of new EVs has dropped significantly over the past decade. Lower prices can make it more challenging for governments to justify the phase-out of incentives, as the financial barrier to entry for potential EV buyers is reduced. When the cost of an EV becomes more competitive with traditional gasoline vehicles, the urgency to provide subsidies and credits diminishes.

The impact of EV pricing on credit phase-out is twofold. Firstly, lower prices can lead to a faster depletion of the available credit funds, as more consumers may be eligible to receive the incentives. This could result in a premature end to the credit program, leaving potential buyers without the financial support they need to make the switch to EVs. Secondly, a significant drop in EV prices might indicate that the market is mature enough to sustain itself without government intervention. This could prompt policymakers to reconsider the phase-out strategy, especially if the credit program was intended to stimulate the market during its early stages.

Additionally, the relationship between EV prices and credit phase-out has implications for the overall sustainability of the EV industry. If prices continue to fall, it may encourage more consumers to purchase EVs, potentially leading to a rapid shift in the automotive market. This shift could have a positive environmental impact by reducing greenhouse gas emissions from the transportation sector. However, it also presents challenges for the credit program's design and implementation, requiring careful monitoring and adjustments to ensure the incentives remain effective and sustainable.

In summary, the price of EVs plays a pivotal role in determining the timing and effectiveness of credit phase-out strategies. As EV prices continue to decrease, policymakers must carefully consider the potential consequences for the market and the environment. Balancing the need to support the EV industry with the goal of achieving long-term sustainability is essential to ensure a successful transition to a cleaner transportation system.

Powering the Future: Unveiling the Key Components of Battery Electric Vehicles

You may want to see also

Manufacturing Location: Does the EV's production location impact credit availability?

The production location of electric vehicles (EVs) can indeed influence the availability of financial incentives and credits, which is an important consideration for both manufacturers and potential EV buyers. The concept of 'phase-out' for EV credits often refers to the gradual reduction or expiration of tax credits or incentives as the market matures and production scales. However, the manufacturing location can play a role in how and when these credits are applied, creating a complex dynamic in the EV industry.

In many countries, governments offer financial incentives to encourage the adoption of electric vehicles, aiming to reduce greenhouse gas emissions and promote sustainable transportation. These incentives often take the form of tax credits or rebates, which can significantly lower the cost of purchasing an EV. For instance, in the United States, the federal government provides a tax credit for EV buyers, but this credit has a specific allocation based on the manufacturing location of the vehicle. EVs produced in North America, including the United States, Canada, and Mexico, are eligible for the full credit, while those manufactured elsewhere may receive a reduced or none at all. This policy encourages domestic production and supports local industries.

The impact of manufacturing location becomes even more critical when considering regional variations in credit availability. Some regions or countries might have their own incentives or subsidies in addition to federal programs. For example, California, known for its stringent environmental regulations, offers a separate EV incentive program that provides additional credits or rebates. These regional incentives can further complicate the picture for consumers, as the eligibility and amount of credits may vary depending on where the EV is produced and purchased.

Manufacturers must navigate these complexities to ensure they can take advantage of the most favorable credit options for their products. Producing EVs in a location that aligns with the specific credit criteria can be a strategic decision. For instance, a company might choose to establish a production facility in a region with generous incentives to maximize the benefits for its customers. This approach can also influence the overall cost structure of the vehicle, potentially impacting its competitiveness in the market.

In summary, the manufacturing location of EVs is a critical factor in determining credit availability and eligibility. Consumers and manufacturers alike should be aware of these nuances to make informed decisions. As the EV market continues to evolve, understanding the interplay between production location, government incentives, and credit phase-out policies will be essential for all stakeholders in the industry.

Electric Vehicles: The Dark Side of Green Transportation

You may want to see also

Timeframe: When does the EV tax credit fully phase out?

The federal tax credit for electric vehicles (EVs) is a significant incentive for consumers to purchase these eco-friendly cars. However, it's important to understand that this credit is not permanent and is subject to a phase-out period. The timeframe for the full phase-out of the EV tax credit is a crucial piece of information for anyone considering an EV purchase.

The EV tax credit was introduced as part of the Inflation Reduction Act (IRA) in 2022, replacing the previous credit structure. Under the IRA, the credit is available for a limited time and is gradually reduced as the number of EVs sold increases. This phase-out is designed to encourage the production and sale of EVs in the early stages of the market and to ensure a steady transition to a more sustainable transportation system.

The phase-out begins after a certain number of EVs have been sold, and the credit is reduced in two steps. Initially, the credit is reduced by 20% for each month that the vehicle is sold after the threshold is reached. This reduction continues until the credit is fully phased out. The specific threshold and the exact timing of the phase-out can vary depending on the vehicle type and its manufacturer.

For example, the credit for plug-in hybrid EVs (PHEVs) and all-electric vehicles (AEVs) is available for the first 300,000 units sold. Once this threshold is met, the credit starts to phase out, and the reduction rate is applied. It's essential for potential EV buyers to stay updated on these sales figures to know when the credit might be fully phased out for their desired vehicle.

Understanding the timeframe for the EV tax credit's phase-out is crucial for making informed decisions. It allows consumers to plan their purchases, especially if they are considering an EV as a long-term investment. Additionally, it provides an incentive for manufacturers to continue producing and selling EVs to maintain their eligibility for the credit. As the market for EVs grows, the phase-out period ensures a sustainable and well-managed transition to cleaner transportation options.

Electric Vehicle Fire Risk: Unveiling the Truth Behind the Statistics

You may want to see also

Frequently asked questions

The EV credit phase-out refers to the gradual reduction or elimination of financial incentives provided by governments to encourage the purchase of electric vehicles. This phase-out is often a concern for potential EV buyers as it can impact the overall cost and affordability of EVs.

The phase-out typically occurs over a specific period, during which the credit amount decreases annually until it reaches zero. For example, a government might offer a full credit of $5,000 for the first year of EV sales, then reduce it to $3,000 the following year, and so on, until the credit is fully phased out.

The primary reason is to ensure a sustainable market for EVs and prevent a sudden surge in demand that could strain the automotive industry and infrastructure. By gradually reducing the credit, governments aim to encourage a steady transition to electric mobility and support the long-term growth of the EV market.

Yes, eligibility criteria vary by region and country. Typically, buyers must meet certain requirements, such as purchasing a new EV, meeting income thresholds, or residing in specific areas. Additionally, some governments may have rules regarding the vehicle's battery capacity, range, or manufacturer to qualify for the credit.